1 Background

Sec. 4 no. 14 lit. a of the German VAT Act provides an exemption from VAT for medical treatment provided by medical professionals. There is a recurring dispute as to whether and under what conditions the supply of medical services or the provision of medical staff can be considered VAT exempt medical treatment.

2 Facts

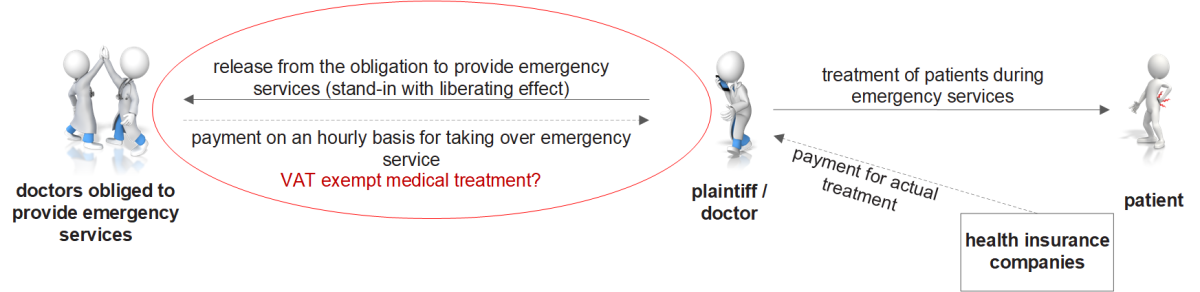

Contract doctors are obliged to provide emergency services (medical care outside of regular consultation hours). The plaintiff is a self-employed doctor and took over emergency services from other doctors. He received two payments: (1) from the private patients or from the relevant health insurance funds – for the medical treatment provided to patients during emergency services, and (2) from the doctors primarily responsible – for each “emergency service hour”, which he had taken over. The dispute concerned the question of whether the remuneration the plaintiff received from the primarily obliged doctors for taking over the emergency service duties, was (also) VAT exempt as medical treatment.

3 Decision of the Federal Fiscal Court

The German Federal Fiscal Court (BFH) ruled – contrary to the previous (lower) court (Fiscal Court of Münster, judgment of 9 May 2023 – 15 K 1953/20 U) – , that the taking over of responsibility for the provision of emergency services, in return for remuneration on an hourly basis, is also deemed to be a VAT exempt supply of medical treatment (BFH, judgment of 14 May 2025 – XI R 24/23). In doing so, the BFH first reiterates two principles:

- The concept of therapeutic purpose – which medical treatment has to serve – must not be interpreted too narrowly.

- Medical treatment must be considered in terms of the supply provided. The crucial factor is that the medical treatment is performed by a person who is a qualified participant in a medical or paramedical profession. The recipient of the services is not relevant as regards the VAT exemption.

The BFH then states that the plaintiff’s supply of services was not limited to relieving the doctors originally obliged to provide emergency services. Rather, the plaintiff provided emergency medical services in a specific area and during a specified period of time. The plaintiff had to be present and ready to provide patient care outside of regular consultation hours. The willingness to do so alone serves a therapeutic purpose. It ensures the prompt treatment of emergency patients and the best possible chance of success of the medical treatment. The BFH distinguishes between the obligation to provide medical treatment and the mere provision of material resources and premises, which is subject to VAT (BFH, judgment of 18 March 2015 – XI R 15/11). In contrast, doctors working in emergency services not only create the appropriate conditions for medical treatment, but also carry out the medical treatment themselves (if necessary).

4 Practical consequences

The VAT implications of the judgment could extend far beyond this individual case. On the one hand, the BFH has provided welcome clarification on the VAT treatment of emergency medical services. On the other hand, the judgment could also have implications for comparable cases. The following principle can be derived from the decision: Even the (assured) willingness to provide medical treatment can potentially constitute a VAT exempt medical treatment.

The judgment is likely to exert particular influence on the VAT treatment of the provision of staff in the medical sector. To date, the tax authorities have taken the view that the provision of staff by a doctor to other doctors does not constitute medical treatment (sec.4.14.1 para. 5 no. 12 of the German Administrative VAT Guidelines). According to the tax authorities, VAT exemption for the provision of medical staff is only possible if it is carried out by and to institutions within the meaning of sec. 4 no. 14 lit. b of the German VAT Act – in particular hospitals – and does not essentially serve to generate additional, competition-relevant income (sec. 4.14.6 para. 2 no. 5, no. 7 of the German Administrative VAT Guidelines). It seems questionable as to whether the tax authorities can maintain their restrictive view, at least in this general form.

Taking into account this new judgment, it will have to be examined, in each individual case, as to whether the provision of staff could, in itself, constitute medical treatment. The requirement for this is that (1) the person/institution providing the staff belongs to the group of beneficiaries within the meaning of sec. 4 no. 14 lit. a and lit. b of the German VAT Act, (2) they undertake to provide medical treatment and (3) the medical staff provided have sufficient medical qualifications (see sec. 4.14.7 para. 1 sentence 4 of the German Administrative VAT Guidelines).

Contact:

Lawyer, Certified Tax Consultant,

Certified Public Accountant

Tel.: +49 89 217501230

As per: 07.08.2025