Both the tax authorities and jurisprudence now consider compliance measures as being established grounds for minimisation of legal liability risks. Errors occur in everyday business life - despite the exercise of maximum care. In order for a company and its bodies to avoid liability, implementation of a tax compliance management system (Tax CMS) is both essential and crucial. In the long term, no company will be in a position to simply ignore the need for a Tax CMS.

The prerequisite for a functioning Tax CMS is an internal control system (ICS) to control and monitor the proper fulfilment of all tax law requirements. No specific legal requirements exist as to what such an ICS or Tax CMS should look like and, in all likelihood, no requirements will be introduced in the future. However, in its draft of an IDW Praxishinweis 1/2016, as regards the structuring and examination of a Tax CMS in accordance with IDW PS 980, the Institut der Wirtschaftsprüfer - Institute of Public Auditors in Germany - (IDW) published details of how such a system should be structured.

Taxable persons are often faced with a major challenge when it comes to introducing a Tax CMS and do not know exactly where and how to start. From our perspective, the most important thing is: to simply make a start!

KMLZ's approach to tax compliance takes into account the following points:

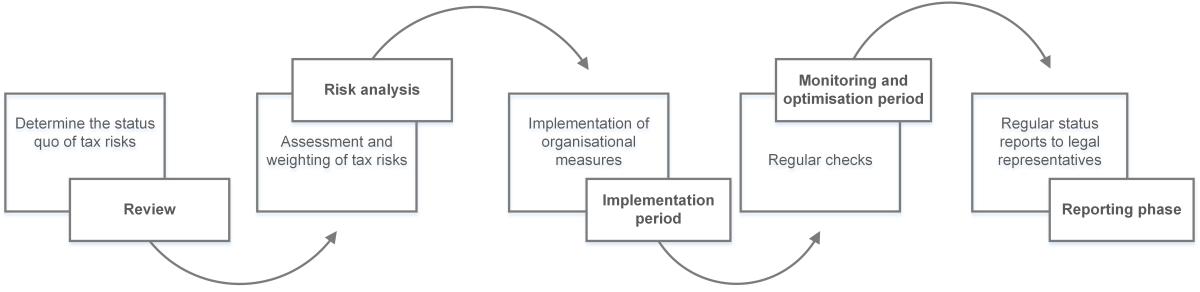

KMLZ follows the steps outlined below when designing and implementing a Tax CMS:

We have a permanent project team that handles all tasks involved in the design and implementation of a Tax CMS in a structured and efficient manner. Our team consists of VAT, criminal law and IT experts. Prof. Dr. Thomas Küffner, a very experienced certified public accountant, heads the team. We will not impose a standard Tax CMS on your company, but instead we will develop a customised Tax CMS in consultation with you according to professional standards.

To ensure that the implementation of the Tax CMS is completed on time and on budget, our work on such projects is performed according to a fixed project management plan. This involves the use of project management software with fixed milestones and reporting obligations to the relevant steering group.

Our firm is certified in the tax consultant sector according to DIN EN ISO 9001. We know what we are talking about.