1 Background

The VAT treatment of administrative services for dependent foundations has not yet been clarified by the supreme courts. In particular, it was disputed whether the trustees of such foundations provide supplies subject to VAT and whether the special assets play a role in this context. The German Federal Fiscal Court (BFH) has now provided clarity and specified the criteria for the VAT assessment of such activities. The case is interesting because it ultimately concerns the question of whether a trustee can provide supplies subject to VAT to itself (because the trust assets are attributable to it under civil law) or whether it provides supplies to the original founder (trustor). Following the BFH's ruling, trustees (but also other taxable persons who have formed a special fund) must now examine their settlement practices.

2 Facts of the case (judgment of 5 December 2024 – V R 13/22)

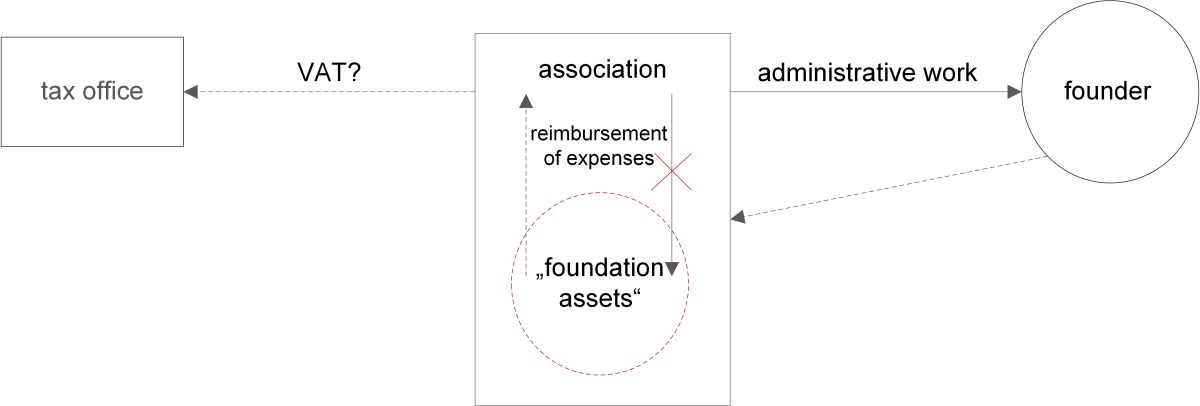

The plaintiff, a registered association (hereinafter referred to as “e.V.”), managed assets as a trustee in the years in dispute from 2014 to 2018, which had been transferred to it by founders under “trust agreements” or “donations with conditions”. These so-called ‘foundation assets’ were each managed as special assets, separately from the association's other assets and in accordance with the charitable purposes specified by the respective founder. In addition to individually managed foundations, the e.V. also set up so-called ‘T-foundations’ together with other founders. Furthermore, the association maintained ‘umbrella foundations’ through which individuals, communities and institutions could realise charitable purposes by means of donations with conditions or endowments. In return for its administrative and advisory services, the association withdrew an annual foundation contribution based on the amount of the foundation's assets in accordance with the contract and the articles of association and reimbursed itself for material and personnel costs from the assets of the T-foundations.

3 Decision of the BFH

The preceding Fiscal Court had assumed that the administrative services were not subject to VAT. The Fiscal Court did not recognise any supply by the registered association to the special fund, as this was purely an internal transaction. This was confirmed by the BFH. However, the BFH stated that, contrary to the opinion of the Fiscal Court, the administration of the foundation's assets could potentially constitute a supply to the founder. A taxable administrative service may exist in relation to assets that are owned by the administrator under civil law. The prerequisite is that the assets (1) are subject to special restrictions as special assets, (2) are kept separate from the administrator's other assets in this respect, and (3) the administrator receives consideration for his service. The crucial factor in this case is that, as the BFH demonstrated using the example of a specific foundation, the parties concluded an independent agency agreement for services for consideration in addition to the non-taxable donation with conditions. The asset management carried out exclusively in the founder's interest is the consumable benefit agreed upon therein for the founder. The economic benefit and the position of the founder as the recipient of the management service are also evident from the fact that asset management for dependent foundations is also offered on the market by banks and savings banks.

4 Consequences for the practice

Anyone who thinks that all trustees now know exactly whether their fees payable from the foundation's assets are subject to VAT will, unfortunately, be disappointed. Although we now, for the first time, have a ruling on how to deal with so-called dependent foundations (known as trust foundations), we still don't have any legal certainty in practice. This is because, although the BFH has set a groundbreaking precedent, it has referred the matter back to the Fiscal Court with many questions. Practitioners will therefore first have to carefully examine the facts of each case:

- Is there any consideration at all (commonly in the manner of reimbursement of personnel and material costs)?

- Are there written agency agreements or other arrangements with the founders regarding consideration? Or is the withdrawal from the foundation's assets based on a de facto practice or even unjustifiably?

- In other special asset constellations, it must be considered whether the ‘administrative services’ may be part of a VAT-exempt supply or whether, for example, the reduced VAT rate applies in the area of charitable activities.

- If no consideration is charged, the question arises as to whether a supply carried out free of charge is subject to VAT or whether the input VAT deduction must be restricted.

It is therefore recommended to take a closer look at the entire topic of ‘dependent assets’.

Contact:

Lawyer, Certified Tax Consultant,

Certified Public Accountant

Tel.: +49 89 217501230

As per: 19.05.2025