1 Background

After many twists and turns, the German Federal Fiscal Court has finally ended the proceedings in the case Finanzamt T, which it had referred to the ECJ on two occasions (Finanzamt T I and Finanzamt T II). Now we have clarity: the German VAT group is here to stay. Intra-group supplies between the controlling company and the controlled company are still not subject to VAT. This is particularly important if a part of the group is not entitled to deduct input VAT, for example because it provides VAT exempt supplies or the part of the group in question is partly considered non-taxable. The latter is always the case with VAT ‘hybrids’, i.e. legal entities that engage in both economic and non-economic activities in the narrow sense. These include, for example, legal entities under public law in the case of sovereign activities or non-profit organisations that work on an idealistic basis.

2 Judgment of the German Federal Fiscal Court of 29 August 2024

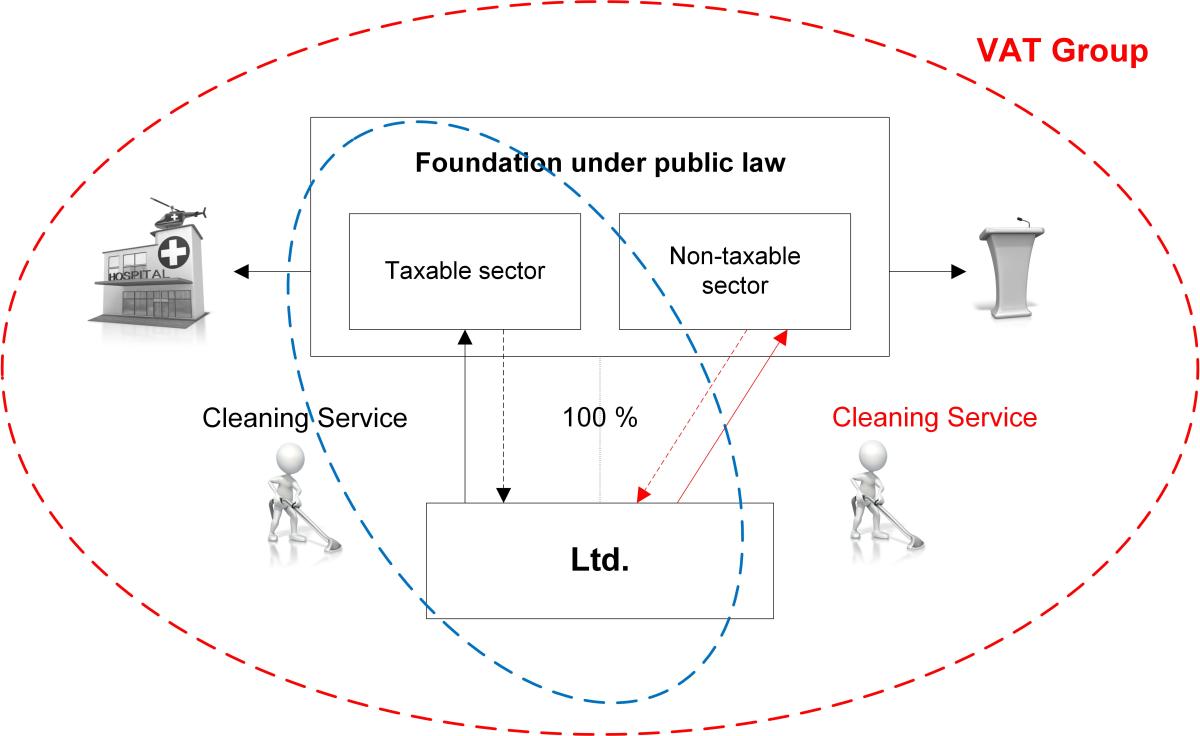

In the proceedings that have now been decided (V R 14/24), a public corporation held 51% of the shares in a limited liability company. It was established that the public corporation and the limited liability company together formed a VAT group. The limited liability company provided cleaning services to the shareholder for a building that the shareholder used for both business and sovereign purposes. The proceedings raised several questions for the German Federal Fiscal Court and the ECJ, which have now been conclusively clarified as follows:

- The controlling company's liability for VAT is, in principle, in line with EU law.

- Intra-group supplies are not subject to VAT, even if one of the parties is subject to restrictions on the deduction of input VAT.

- The VAT group also includes the non-economic sector of the controlling company (in the diagram below, the red circle will replace the blue one).

- Supplies by the controlled company to the non-economic sector of the controlling company are not subject to VAT.

3 Consequences for the practice

For legal entities under public law and non-profit organisations, this jurisprudence opens up considerable new scope for VAT optimisation. By forming a VAT group, supplies to the non-economic sector can be invoiced without incurring a VAT charge. The tax authorities have viewed this differently in the past. According to sec. 2.8 para. 2 sentence 2 of the German Administrative VAT Guidelines, legal entities under public law can (so far!) only be controlling companies ‘if and insofar as’ they engage in economic activities. Following the recent ruling, this latter restriction should now be obsolete.

This means that, in future, (non-input-VAT-burdened) labour costs and also any ‘administrative cost surcharge’ can be passed on to the controlling company, which acts in a sovereign capacity, without VAT. This makes outsourcing to subsidiaries highly interesting again, since VAT no longer acts as a cost driver for supplies to the non-economic sector.

This result is correct and corresponds to the principle of neutrality with regard to the legal form. The purpose of the VAT group is precisely to enable companies to choose the organisational form that is best suited to them. VAT should not and must not have any concentration-promoting effect. Including the non-economic sector in the VAT group contributes to fiscal neutrality. This is because the VAT group allows supplies of goods and services for consideration within a corporate structure without triggering a VAT liability.

The situation is, of course, different for the procurement of goods and services from third parties by the VAT group. In this case, the question arises at the point of procurement of the goods or services as to whether input VAT deduction should be refused because the procurement of the goods or services ultimately serves the non-economic sector.

Contact:

Lawyer, Certified Tax Consultant,

Certified Public Accountant

Tel.: +49 89 217501230

As per: 16.12.2024