1 Background

The draft of the Council Directive as regards VAT rules for the digital age (ViDA Directive) contains proposals for the VAT treatment of the platform economy. These regulations are intended to combat VAT fraud and also to ensure equal treatment of the platform economy with traditional suppliers. The ViDA Directive proposes to extend the existing deemed reseller model for online marketplaces. Moreover, deemed reseller models shall apply to digital platforms which facilitate short-term accommodation rental or passenger transport.

2 Extension of the deemed reseller model for online marketplaces

Through Art. 14a of the VAT Directive (sec. 3 para. 3a of the German VAT), a chain transaction between an online trader, an online marketplace and a customer is, in certain cases, already fictitious when a third country connection is involved (namely: an online trader established in a third country or importation of goods with a maximal value of EUR 150). This model has proven itself in practice. Therefore, according to Art. 14a (2) of the ViDA Directive, the deemed reseller model is to be applied from 1 January 2027 for all supplies of goods within the EU (B2C and B2B) that online traders established in a third country render via online marketplaces. The online marketplace’s supply of goods to the customer is subject to regular taxation. The online trader’s supply of goods to the online marketplace is VAT exempt (Art. 136a of the ViDA Directive).

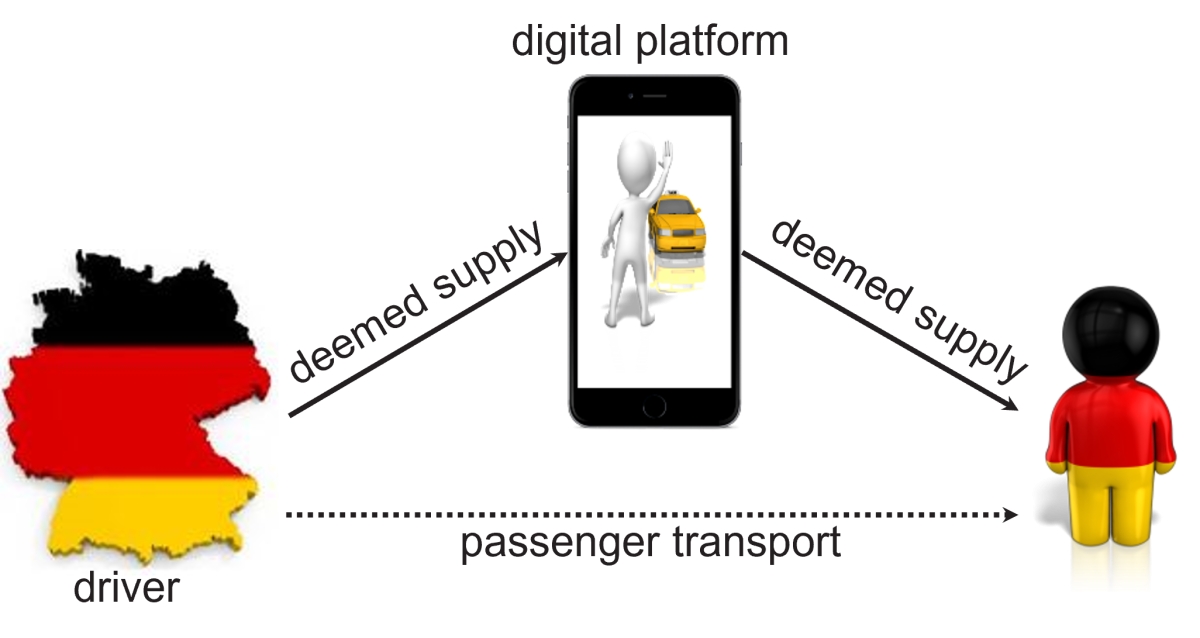

3 Deemed reseller model for short-term accommodation rental and passenger transport

Due to their enormous reach, accommodation platforms compete with the hotel industry, while passenger transport platforms compete with taxi companies. In contrast to traditional providers, private individuals and small businesses can currently offer their rental or passenger transport services via digital platforms, without incurring VAT. Deemed reseller models are intended to counteract this.

Digital platforms, which facilitate the short-term rental of accommodation / passenger transport, are treated as if they had themselves received and supplies these services (Art. 28a of the ViDA Directive). “Short-term rental of accommodation" is defined as the uninterrupted rental for a maximum of 30 days. The deemed supply of the digital platform to the customer is subject to regular taxation. The margin scheme cannot be applied to short-term accommodation rental (Art. 306 (3) of the ViDA Directive). The supply of the lessor / driver to the digital platform is VAT exempt (Art. 136b of the ViDA Directive).

However, there are exceptions that are linked to the to the capacity of the lessor / driver. Thus, the deemed reseller model does not apply if the lessor / driver provides the digital platform with their VAT-ID and declares to the digital platform that he will charge any VAT due (Art. 28a (1) lit. a-b of the ViDA Directive). In addition, Member States can opt out of the regulation for small businesses (Art. 28a (4) of the ViDA Directive).

Member States must apply the deemed reseller model from1 January 2030. However, they may already implement it voluntarily from 1 July 2028.

4 Consequences for the practice

Through the deemed reseller model, the rental of accommodation and passenger transport services, which were previously not taxed with VAT, will now become subject to VAT. This is politically motivated and will damage the business model. Naturally, VAT will be passed on to the customer, thus making the supplies more expensive for customers. It is thanks to Estonia's objection that Member States can opt to exclude small businesses from the deemed reseller model. Affected platforms must verify the capacity of the lessor / driver and answer the question of whether "facilitating" takes place. Art. 9b-9d of the draft Council Implementing Regulation 282/2011 provides important information on this. However, questions concerning delimitation are pre-programmed. As the platforms become the tax debtor, adjustments in tax determination and in the accounting / ERP system, are required.

In contrast, the ViDA Directive does not result in a major need for online marketplaces to adapt. This is because they have already converted their systems to the deemed reseller model for B2C cases by 1 July 2021. Online marketplaces must continue to determine precisely whether the deemed reseller model applies or whether the online trader is liable for VAT, which can result in marketplace liability under sec. 22f para. 1 and sec. 25e of the German VAT Act.

Contact:

Dr. Matthias Oldiges

Lawyer

Phone: +49 211 54 095 366

matthias.oldiges@kmlz.de

As per: 06.11.2024