1 Background

The operational planning of a power plant (“dispatch”) may have to be adjusted in order to avoid grid congestion (“redispatch”). If part of the grid is at risk of regional congestion, certain power plants may be instructed to decrease their output, while others are directed to increase theirs. The feed-in management for renewable energy facilities and combined heat and power plants (previously regulated under the Renewable Energy Sources Act and the Combined Heat and Power Act) and Redispatch 1.0 for conventional plants were unified back in 2019 under the umbrella term “Redispatch 2.0” (sections 13, 13a and 14 of the Energy Industry Act). Grid operators were required to implement this new approach by 1 October 2021. Until now, Redispatch 1.0 measures were managed exclusively by transmission system operators (TSOs). Redispatch 2.0 now also extends participation to distribution system operators (DSOs). Previously, these measures only applied to operators (OPs) of conventional power plants with more than 10 MW. Redispatch 2.0 measures, however, may also be imposed on OPs of conventional facilities between 100 kW and 10 MW, as well as renewable energy facilities starting at 100 kW. In response to an inquiry from the German Association of Energy and Water Industries, the Federal Ministry of Finance (BMF) issued a statement on 26 August 2024, regarding the VAT treatment of Redispatch 2.0 measures.

2 Conventional Facilities

For conventional facilities, the supply relationships among the parties are assessed as follows: In the case of positive redispatch (where the OP increases output), the OP provides an electricity supply to the grid operator subject to VAT, whereas in the case of negative redispatch (where the OP reduces output), both the financial compensation and the balance sheet adjustments are considered non-taxable indemnification. No VAT related supply relationships exist between the redispatch balancing group of the grid operator and the balancing group of the balancing group manager (BGM).

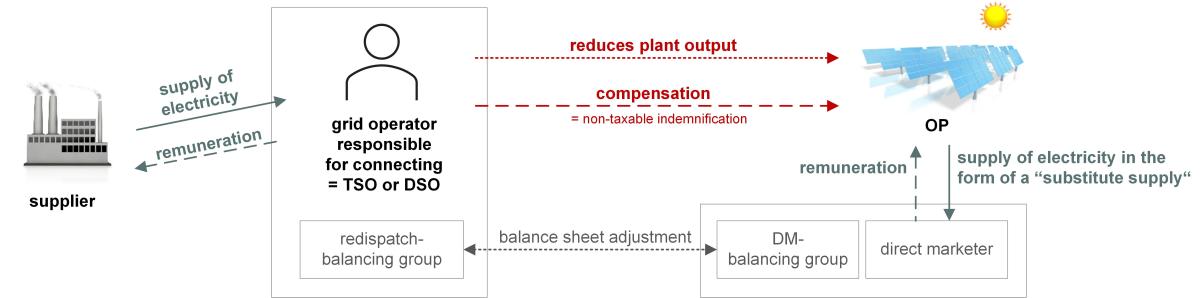

3 Renewable Energy/Combined Heat and Power Facilities

Direct Marketing: For Redispatch 2.0 measures under direct marketing, financial compensation paid by the grid operator to the OP is considered to be non-taxable indemnification. The simultaneous balance sheet adjustment has no VAT implications. The OP continues to meet its electricity supply obligations to the direct marketer, meaning that this is a supply subject to VAT. A different legal assessment may be warranted in individual cases involving private contractual agreements.

Feed-In: If the OP feeds electricity directly into the grid operator’s network, only the relationship between the grid operator and the OP needs to be qualified from a VAT perspective. In the case of a reduction in plant output, any compensation paid in this supply relationship is likewise considered to be non-taxable indemnification.

4 Additional Service Relationships

To implement Redispatch 2.0 measures, multiple grid operators may collaborate. This includes cascading measures, as well as joint redispatch measures. In the case of the former, an instructing grid operator (which directs the measure) provides a service to the requesting grid operator (which identifies the congestion and requests the measure). When multiple grid operators request a measure (joint redispatch measure), the first requesting grid operator is deemed to provide services (management of affairs) to the other requesting gird-operators.

5 Grace Period

As the grace period granted by the BMF for payments made until 31 October 2024 is set to expire, affected parties should now ensure that transactions deemed non-taxable are invoiced without VAT, and that no input VAT deduction is claimed for these transactions.

Contact:

Dr. Thomas Streit, LL.M. Eur.

Lawyer

Phone: +49 89 217501275

thomas.streit@kmlz.de

As per: 04.11.2024