1 Background

In the case of a consignment stock, the parties usually agree that the supplier stores the goods at the customer’s premises or close to them; that the supplier remains the owner of the stored goods until the recipient of the goods pulls the goods from the stock, whereupon he becomes the owner. The replenishment of the stock then basically constitutes a transfer of own goods where there is no transfer of title and, as yet, no supply of goods. The transfer of own goods between EU Member States is deemed to be an intra-Community transfer of goods by the supplier according to Art. 17 EU-VAT-Directive. Only the pull of the goods from the warehouse constitutes a supply to the recipient, which is taxable where the stock is located.

In some EU Member States – unlike in Germany – simplification rules are in place, according to which a direct intra-Community supply to the recipient is assumed upon the pull from the stock and the intra-Community transfer of own goods is disregarded. However, not all of the EU Member States have such a rule and furthermore, the conditions to be met, differ. Thus, an EU-wide simplification rule will be implemented.

However, the most recent Federal Fiscal Court case law as regards warehouse constellations (see KMLZ Newsletter 03/2017 and 10/2017) is, in no way, obsolete and therefore must still be taken into consideration. If the acquirer is already known prior to the transport to the stock, e.g. due to a binding purchase agreement, the supply to the acquirer cannot be carried out subsequent to arrival and Art. 17a of the EU-VAT-Directive therefore does not apply. The supply is then deemed to be rendered where the transport commences and not with the pull from the stock. The only question remaining is if the other EU member states take the same view.

3 Further requirements

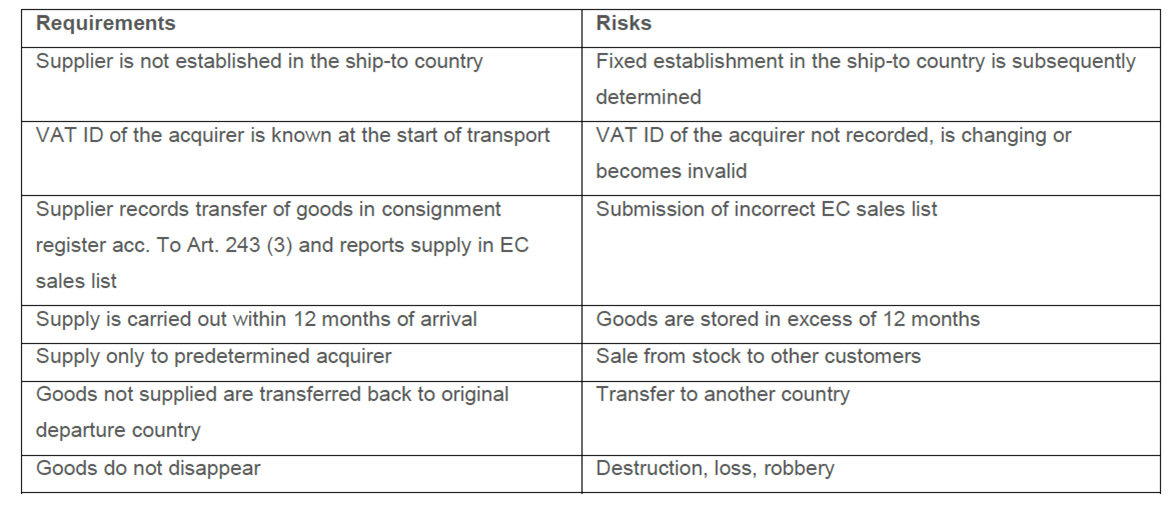

Whether or not the simplification rule is applicable, also depends on other requirements. Insofar, a certain degree of risk exists that the supplies will be deemed to be taxable domestic supplies from the stock if the requirements have not been met. The following further requirements – and thus also related risks – arise from Art. 17a EU-VAT-Directive:

It should be noted that the intra-Community transfers of goods, which have subsequently occurred by not meeting the requirements, are subject to VAT if, at this time, the supplier does not have a VAT ID of another EU Member State. In such a situation, no VAT deduction would be possible and the supplier would ultimately be charged with VAT (see KMLZ Newsletter 01/2019).

In order to avoid these risks, entrepreneurs may waive the application of the simplification rule. Since the rule is not optional, but mandatory, one can only deselect it by deliberately not fulfilling certain of the requirements mentioned above. This should be considered if it is clear, from the outset, that certain requirements cannot always be met.

If companies wish to make use of the simplification rule, they should make appropriate preparations in order to be able to fulfil the requirements on a permanent, ongoing basis. It may be possible to guarantee meeting the time limit by a contractually agreed pull fiction before the end of the 12 months. The remaining requirements would actually have to be fulfilled and therefore have to be secured by implementing supporting processes. It remains to be seen to what extent the formal requirements, such as the reporting in the EC Sales List and registering in the Consignment Register, can be subsequently fulfilled by correcting an initially incorrect EC Sales List or by supplementing the Consignment Register.

Contact:

Ronny Langer

Certified tax consultant, Dipl.-Finanzwirt (FH)

Phone: +49 89 217501250

ronny.langer@kmlz.de

As per: 21.01.2019