1. The concept of evidence for intra-Community supplies

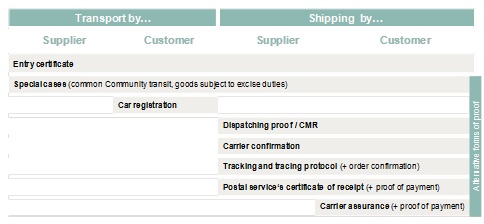

According to the new regulation in Sec. 17a para 2 of the German VAT Implementation Code, the following evidence will be required for zero-rated intra-Community supplies:

- duplicate of the invoice

- entry certificate or one out of seven alternative forms of proof

It should be noted that not every type of alternative proof is permissible for every kind of supply. The purpose of a entry certificate is to prove the physical arrival of a supply’s item in another member state. This basic idea served as the model for almost every kind of alternative proof. Therefore, proof can regularly only be provided after the completion of the transport. This leads to a significant tracking burden being placed upon the supply companies. In order to keep abreast of tracking, personnel capacity is required.

2. The new entry certificate

2.1 Place and month of arrival

The new entry certificate needs to include, in particular, the place and month of the completion of the supply. It is insufficient to only mention the country of destination. The specific city or municipality needs to be stated.

According to the Federal Ministry of Finance, the same applies for chain transactions. Therefore, intermediaries cannot argue that they have an economic interest not to disclose the final recipient.

2.2 Signature of the customer and electronic transmission

The entry certificate always needs to be signed by either the customer or his representative (i.e. employee or warehouse keeper), whose power of representation can be verified in the case of doubt. According to the Federal Ministry of Finance’s draft, it should be sufficient if the power of representation can be verified by an overall assessment (i.e. using a company stamp). It is pleasing that the signature is unnecessary if the entry certificate is transmitted electronically, provided that the transmission recognizably begins in the customer’s or representative’s sphere. According to the Federal Ministry of Finance’s draft, this can be assured in the following three cases:

- using an electronic process that was agreed upon beforehand (i.e. Double-Opt-In process)

- using an e-mail address that was used in connection with the contract negotiation

- information in the header section of the e-mail

Please note, however, with respect to the third bullet point, that it is doubtful that the tax courts would accept this as e-mail headers can easily be forged.

The general accounting principles need to be observed regarding the readability and storage of electronic transmissions. The entry certificate can also be stored as a print. If the transmission is made via e-mail, the e-mail itself needs to be stored. Therefore, it is useful to create an individual e-mail address purely for this purpose (i.e. gelangensbestaetigung@...). It would appear to be useful to agree on an electronic transmission with the customer. In our opinion, the electronically transmitted (collected) entry certificates will be the easiest way for companies to provide proof.

2.3 Layout and language

There is no special layout required for the entry certificate. The Federal Ministry of Finance will ultimately publish model entry certificates in German, English and French. However, it is not mandatory to make use of them. The necessary information can be gained from several documents. In practice, one should stay on the safe side by using a bilingual version.

2.4 Entry certificates and summary certificates

It is also positive that the provision of an entry certificate for every single supply is not required. Supplies from a quarter period can be summarized in one certificate. However, the Federal Ministry of Finance’s draft only allows for this

handling in cases of permanent supply relationships.

Overview of the newest types of proof:

Conatct:

Dr. Stefan Maunz

Lawyer, Certified tax consultant

Phone: +49 (0)89 / 217 50 12 - 40

stefan.maunz@kmlz.de

As per: 02.07.2013