1 Facts

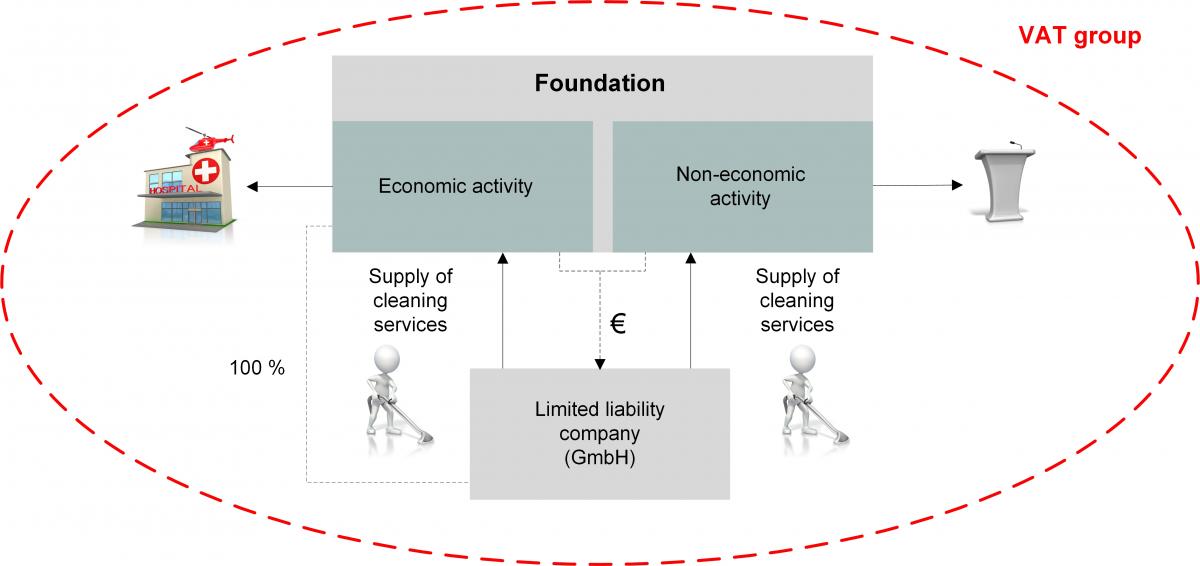

The Plaintiff is a public law foundation, which operates a university. The university's tasks range from the provision of healthcare to teaching in lecture halls and laboratories. In addition, the Plaintiff holds a 100% stake in a limited liability company (GmbH), which renders various supplies including cleaning services. The foundation uses these supplies in one of its building complexes. This building complex contains both facilities for the care of patients and, to a lesser extent, premises for teaching purposes (lecture theatres, laboratories, etc.). Thus the cleaning is carried out partly in pursuit of the foundation’s economic activity and partly for its sovereign field of activity. According to a binding ruling, a VAT group exists between the foundation and the GmbH. For the supply of cleaning services, the foundation paid a total of EUR 76,085.48 to its subsidiary (GmbH) in the year with regard to which the dispute arose. The Plaintiff treated the GmbH’s transactions as non-taxable internal transactions within the VAT group.

2 Content of the complaint

The tax office classified the GmbH's cleaning services as supplies carried out free of charge that are deemed to be subject to VAT to the extent that these services benefited the foundation’s sovereign activity. The tax office justified the classification as supplies rendered free of charge, despite the payments having been made by the foundation, within the VAT group relationship. Based on this relationship, the payment flow took place within one and the same taxable person, such that these payments could not constitute remuneration for VAT purposes. Since the supply of cleaning services for sovereign purposes constituted an activity for purposes of its non-taxable area, the requirements for a taxable supply free of charge, according to sec. 3 para. 9a no. 2 of the German VAT Act, were fulfilled. The foundation, as the controlling company, objected to the tax office’s decision and filed a complaint.

3 Reasons for the judgment

The Tax Court of Lower Saxony came to the conclusion in its judgement of 16.10.2019 (5 K 309/17) that there was no doubt that a VAT group existed. In the opinion of the Tax Court, the supplies rendered by the GmbH to the foundation were therefore to be qualified as non-taxable internal transactions, in their entirety. The fact that the controlled company had also rendered supplies for the sovereign area of the controlling company was irrelevant. The controlled company was to be treated, in its entirety, as non-independent, as otherwise there would be a partial VAT group, which was not provided for by law and which was contrary to the VAT system. The non-taxability of the controlled company’s transactions covered the supplies procured by it for both the economic and non-economic activities of the controlling company.

In the tax court’s view, there was no necessity for a correction of this result by classifying the transactions as supplies free of charge. The non-taxable internal transactions rendered to the sovereign area of the foundation were found not to represent supplies free of charge in accordance with sec. 3 para. 9a no. 2 of the German VAT Act. On the one hand, there was a uniform payment of remuneration for a single supply of services and on the other hand, this payment did not serve any purposes other than those of the taxable person. Although the supply of services was also used for the foundation’s sovereign area of activity, this however was not part of the non-taxable area, but rather only part of the non-economic area of activity. This area of activity, in turn, was not used to pursue any purposes outside the taxable person.

4 Consequences for the practice

The Tax Court’s decision finally serves to build a bridge to the ECJ case law on supplies rendered free of charge. In the case Landkreis Potsdam-Mittelmark, the ECJ came to the conclusion that, under Article 6 para. 2(a) of the Sixth Directive (which corresponds to the current Article 26 of the VAT Directive), a use for purposes of the non-taxable area may be subject to VAT. However, non-economic activities, in the full sense of that term, do not fall within the scope of VAT.

However, these proceedings are not only important for the public sector, but also for charitable institutions and mixed holdings: Also in these cases, the question repeatedly arises as to whether supplies of other services against remuneration to the area of non-economic activity of the controlling company are subject to VAT. We have always been of the opinion that this cannot be correct for the reasons mentioned above. In addition, taxation contradicts the principle of neutrality of legal form. This is because VAT groups are intended to enable companies to organise themselves in the way that best suits them. VAT must not become a hindrance. With this understanding, the tax authorities need not fear any disadvantages arising in terms of the deduction of input VAT. This is because, if the controlled company purchases assets subject to VAT, which it passes on to the non-economic activity area of the controlling company against remuneration, the input VAT deduction must of course be reduced at the point in time the supply is procured. However, in the case of personnel costs or supplies of other services not subject to VAT, there is no need for correction. Whether the Federal Fiscal Court sees this in the same way will become apparent in the upcoming appeal proceedings (Ref. V R 40/19).

Contact:

Prof. Dr. Thomas Küffner

Lawyer, Certified tax consultant,

Certified public accountant

Phone: +49 89 217501230

thomas.kueffner@kmlz.de

As per: 03.04.2020