1 German Federal Fiscal Court: Mere non-payment of VAT is not fraud

The first criteria for a refusal of input VAT deduction or zero-rating of cross-border supplies on the basis of the “abuse“ ruling is the finding that actual VAT fraud has been committed somewhere in the supply chain. In recent decisions, the Federal Fiscal Court has clarified that the mere non-payment of VAT at any point in the supply chain is not sufficient to assume fraud (German Federal Fiscal Court, judgement of 03.07.2019 - XI B 17/19). Instead, VAT fraud implies that incorrect or incomplete information has been given to the tax office. Therefore, in order for a taxable person to be accused of fraud he must normally fail to declare sales or seek to deceive the tax authorities in other ways. The tax office bears the burden of proof (German Federal Fiscal Court, judgement of 11.03.2020 – XI R 38/18).

2 Fiscal Court of Berlin-Brandenburg: ECJ draft on the concept of a supply chain

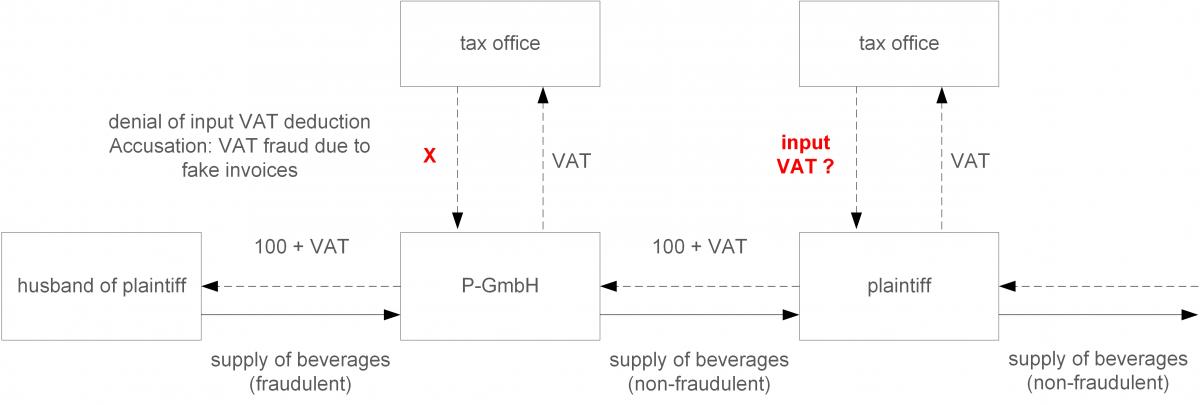

The plaintiff in the case before the Fiscal Court of Berlin-Brandenburg (decision of 5 February 2020 – 5 K 5311/16) purchased beverages from P-GmbH, with the assistance of her husband. P-GmbH supplied the beverages to the plaintiff, issued proper invoices and also correctly taxed the sale to the plaintiff. The plaintiff subsequently deducted the input VAT shown in these invoices. However, P-GmbH had committed VAT fraud when purchasing the beverages. It had purchased them from the plaintiff's husband, who had not paid VAT on the supply to P-GmbH and had not issued any invoices. Instead, an employee of P-GmbH issued fake invoices for the purchase and deducted the input VAT shown in these fake invoices. The tax office of P-GmbH refused to allow the deduction of input VAT. The plaintiff's tax office also refused to allow the plaintiff to deduct input VAT.

The fiscal court referred the matter to the ECJ. According to ECJ and Federal Court of Finance case law, the deduction of input VAT can also be refused by the tax authorities when the taxable person should have known that tax evasion was taking place within the supply chain, in terms of a previous or subsequent transaction. The Fiscal Court has now asked the ECJ for a definition of the term "supply chain". From the perspective of the Fiscal Court, it is conceivable that it is sufficient for the assumption of the existence of a supply chain that the same goods are sold in the chain, without it making any difference whether the (questioned purchase) transaction promotes or supports tax evasion. However, this broad understanding could be contrary to the principles of neutrality and rationality. Accordingly, a separate contribution to the commission of an act of tax evasion could be required, at least in the sense of encouraging or favouring it. Pure bad faith, as a subjective element, might not be sufficient. The plaintiff would lack such a promotion or beneficiary. The previous tax evasion had already been completed. The plaintiff had not been part of an overall plan to commit fraud and she had not concealed supply routes. Nor did the plaintiff's actual transactions give rise to any tax advantage or disadvantage. The case is pending before the ECJ under case number C-108/20.

3 Fiscal Court of Hessian: Disbursement of input VAT by interim order

By decision of 13.03.2020 (1 V 276/20), the Fiscal Court of Hessian ordered a tax office to pay out input VAT credits pursuant to a temporary injunction issued under § 114 Fiscal Court Code of Procedure. The tax office refused to approve the VAT return and wanted to withhold the input VAT credit until a special VAT audit had been completed. The tax office suspected that the taxable person was involved in a VAT fraud. However, the Fiscal Court considered the taxpayer's interest in receiving immediate payment to prevail over the interest of the tax office in securing tax revenue. The tax office had not submitted any evidence of tax evasion to the Court. The fact that the supplier of the goods had been set up by means of a shelf company and had been able to achieve high sales very quickly was not sufficient, in the overall assessment, to establish that the taxable person was acting in bad faith. The taxable person had inspected the supplier, had obtained a tax clearance certificate and had not paid in advance. Moreover, the taxable person had provided sufficient credible evidence that, without immediate payment of the input VAT credit, he would no longer be in a position to continue his business operations and that he would be threatened with insolvency proceedings as a result.

4 Conclusion

The above list of decisions shows that, by no means, have all legal questions been clarified when it comes to the allegation that a taxpayer "should have known". Even if cases of this nature are strongly influenced by the concrete circumstances of the individual case, these decisions sometimes result in good defence possibilities – both in terms of VAT and criminal law.

Contact:

Dr. Thomas Streit, LL.M. Eur.

Lawyer

Phone: +49 89 217501275

thomas.streit@kmlz.de

As per: 09.09.2020