1 Background

On 8 July 2021, the German Federal Constitutional Court declared the interest rate of 0.5% per month for late assessed taxes, in accordance with secs. 233a and 238 of the German Fiscal Code (AO), to be unconstitutional (KMLZ VAT Newsletter 29 | 2021). At the same time, however, it has allowed the tax authorities to continue applying the unconstitutional interest rate to interest periods from 01.01.2014 to 31.12.2018. Insofar as taxable persons have filed appeals against interest assessments for these periods due to the interest rate or have filed applications for amendment, these have now been rejected as being unfounded. This is the result of a letter dated 29.11.2021 issued by the German tax authorities. This letter constitutes a general ruling, i.e., an administrative act. The general ruling replaces individual decisions on appeals, which the tax offices typically issue separately for each taxable person. The general ruling’s publication on 08.12.2021 in the Federal Tax Gazette replaces the notification of the individual taxable person.

2 Content of the general ruling of 29 November 2021

Appeals against interest assessments, in accordance with sec. 233a AO, for interest periods prior to 01.01.2019 that were pending on 29.11.2021 due to constitutional doubts about the amount of interest, were rejected as unfounded. The interest period prior to 01.01.2019 only includes full interest months ending, at the latest, on 31.12.2018. The same applies to applications to amend the interest assessment beyond appeal proceedings that were pending on 29.11.2021. If both the appeal and amendment application also concern interest assessments for interest periods after 31.12.2018, those are not included by the general ruling. The general ruling therefore contains a partial decision on appeal. Only once the legislator has newly regulated the interest rate for interest periods after 31.12.2018 (which is to take place by 31.07.2022), will the tax offices continue the corresponding procedures concerning the appeals or amendments.

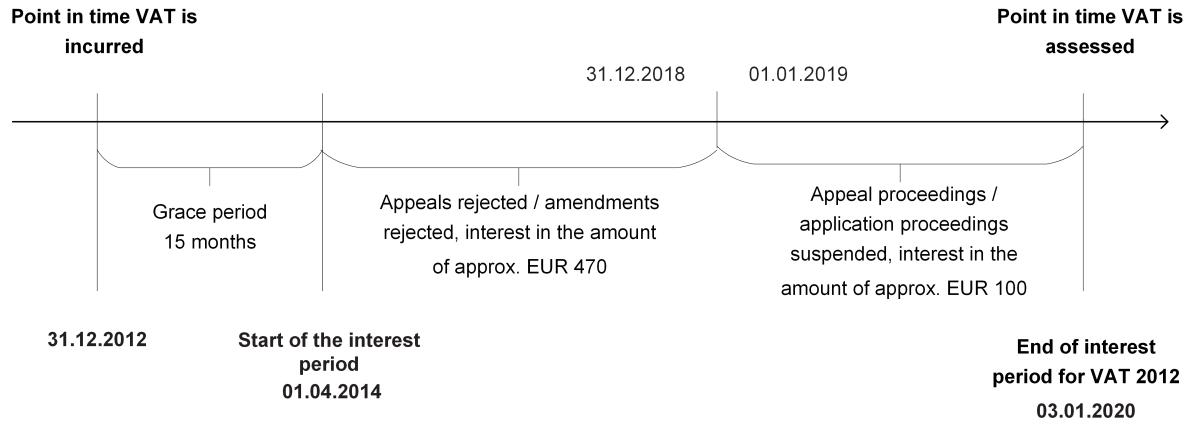

An example to illustrate the situation: A tax office additionally claims VAT in the amount of EUR 1,680 for the taxable period 2012. In January 2020, a VAT and interest assessment is issued. The interest assessment (fictitious amounts) charges interest of EUR 570. EUR 470 of this interest relates to interest periods up until the end of 2018. EUR 100 of interest relates to the interest period 2019. The interest assessment is subject to appeal. The general ruling dismisses the appeal regarding the interest up to the end of 2018 in the amount of EUR 470 as being unfounded.

The taxable person may file a legal action against this general ruling with the Fiscal Court within one year. The general ruling was published in the Federal Tax Gazette on 08.12.2021. The time limit for lodging an appeal starts to run on the following day, i.e., on 09.12.2021.

3 Consequences for the practice and recommendation for action

Affected taxable persons who wish to continue their proceedings against interest pursuant to sec. 233a AO should now act: In the case of interest on VAT arrears, doubts could be raised as to their conformity with EU law. Even if interest is a matter of national law, it must be measured against the principles of proportionality and neutrality (see, for example, ECJ, judgment of 15.09.2016 - C-518/14 - Senatex). Since sec. 233a AO sets out the accrual of interest irrespective of fault and even in the absence of any damage having been suffered by the tax authorities, it is doubtful as to whether the regulation is in conformity with EU law.

In cases where the tax office has previously granted suspension of execution for the interest assessed, this will now end. If the suspension of execution was granted up until one month after the decision on appeal was taken, the suspension of execution will automatically conclude in January 2022. In all other cases, the tax office is expected to shortly revoke the suspensions of execution. Taxable persons must then either pay the interest amounts to the tax office in full or ensure that the decision on appeal does not become final and file a new application for suspension of execution. They should therefore not fail to take legal action in the Fiscal Court within one year. In accordance with sec. 367 para. 2b sentence 4 AO, the decision in the general ruling is deemed to have been taken on 09.12.2021. The time limit for filing an action ends after the expiry of one year following this date (sec. 367 para. 2b sentence 5 AO).

If the tax authorities issue new interest assessments for interest periods prior to 01.01.2019 taxable persons may file an appeal and argue with doubts on the conformity with EU law.

Contact:

Dr. Thomas Streit, LL.M. Eur.

Lawyer

Phone: +49 89 217501275

thomas.streit@kmlz.de

As per: 22.12.2021