1 Background

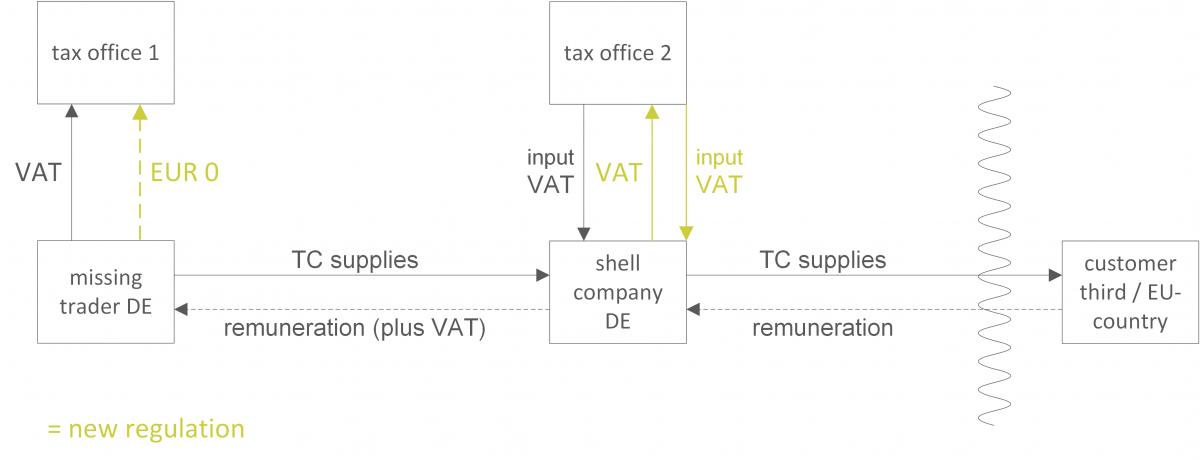

In accordance with sec. 13a para. 1 no. 1 of the German VAT Act, the supplying taxable person so far has been liable for VAT chargeable for the supply of telecommunication services (= TC supplies). The legislator has now observed increased evidence that VAT losses are occurring in the Voice over IP (= VoIP) sector. These losses are the result of individuals, responsible for such fraud models, typically acquiring German shell companies. The respective shell company purchases TC supplies from a so-called “missing trader”. It then resells these TC supplies, usually to third countries or other Member States, so that the supply is outside the scope of German VAT. The shell company deducts input VAT from the purchase of the TC supplies. However, the “missing trader”, for its part, does not pay any VAT. This interaction of the shell company and the missing trader leads to the aforementioned loss of VAT:

2 Legal innovations

By means of the Annual Tax Act 2020, the legislator now intends to put a stop to such fraudulent activities by ordering the application of the reverse charge mechanism. Based on Art. 199a para. 1 lit. g of the EU VAT Directive, sec. 13b para. 2 of the German VAT Act will be supplemented by no. 12 for “supply of services in the telecommunications sector”. Further, an additional sentence has been added to sec. 13b para. 5 of the German VAT Act, following the previous sentence 5. The recipient of the TC supplies (para. 2 no. 12) is liable for the VAT “if [the recipient] is a taxable person whose main business activity, in regards to the purchase of these supplies, consists of the resale of the same supplies and whose own consumption thereof is of secondary importance” (a so-called reseller). These two criterions must be fulfilled cumulatively.

3 Consequences

In order for sec. 13b para. 2 no. 12 of the German VAT Act (new version) to apply, TC supplies must be given and the purchaser must be a reseller:

TC supplies:

The definition of TC supplies can be found in Art. 24 para. 2 of the EU VAT Directive, in conjunction with Art. 6a of the EU VAT Implementing Regulation and in sec. 3a.10 of the German VAT Circular. Thus, for example, telephony, SMS, data transmission, VoIP, internet access, etc. fall within the scope of the newly implemented regulation.

Resellers:

By its use of the reseller criterion, the draft legislation is obviously referring to the regulations in the electricity and gas sector, which also refer to the reseller status, (see sec. 3g, 13b para. 2 no. 5, para. 5 sentences 3 and 4 of the German VAT Act). According to these regulations of the tax authorities, the criterion of "main business activity" is met if the taxable person resells more than half of the quantity he has purchased (see sec. 3g.1 para. 2 sentence 2 of the German VAT Circular). Own consumption is of secondary importance if no more than 5 % of the purchased quantity is used for own purposes (see sec. 3g.1 para. 2 sentence 5 of the German VAT Circular). Since the supplying taxable person usually does not know the internal affairs of the recipient, the tax authorities have created the so-called reseller certificate. If the recipient submits this certificate to the supplier, which is valid at the time the supply is rendered, the supplier is right to assume that the recipient is a reseller (see sec. 13b.3a para. 1 sentence 5 of the German VAT Circular). At the moment it is unclear what a reseller certificate for TC supplies should look like.

4 Conclusion

Taxable persons who buy and/or sell TC supplies must prepare to undertake an adjustment of their internal processes and systems. On the purchasing side, an input VAT deduction that is too high and, on the sales side, the incorrect application of sec. 13b of the German VAT Act, must be avoided. The current draft brings with it a great deal of legal uncertainty. Considerable difficulties in the application are becoming apparent. The proposed new regulation extends to all TC supplies. A limitation, along the lines of the British model, to the identified fraud susceptible VoIP would be legally possible and proportionate. The variety of different supplies in the TC sector is so diverse and complex, that it is necessary to clarify, by law, whether a resale can only be assumed if the purchased supply is passed on, unchanged. Just as the provision for cases of doubt became law in sec. 13b para 5 sentence 7 German VAT Act, the reseller certificate should also be embodied in law. Additionally, the companies will be excessively burdened since the proposed date for the law coming into effect on 01.01.2021 coincides with the adjustment of the VAT rate.

Contact:

Dr. Thomas Streit, LL.M. Eur.

Lawyer

Phone: +49 89 217501275

thomas.streit@kmlz.de

As per: 07.08.2020