1 Background

In the legal case of Cardpoint, the ECJ dealt with the question of whether activities which are outsourced by a bank to a service provider (operation of ATMs) are exempt from VAT as “transactions concerning payments and transfers”. The German Federal Fiscal Court asked the ECJ if and how a delimitation of the ECJ’s judgement Bookit is supposed to be made (see KMLZ Newsletter 07/2018). In the case of Bookit, the ECJ ruled that the processing of card payments, for the purchase of cinema tickets, cannot be classified as VAT exempt transactions concerning payments and transfers.

2 The facts

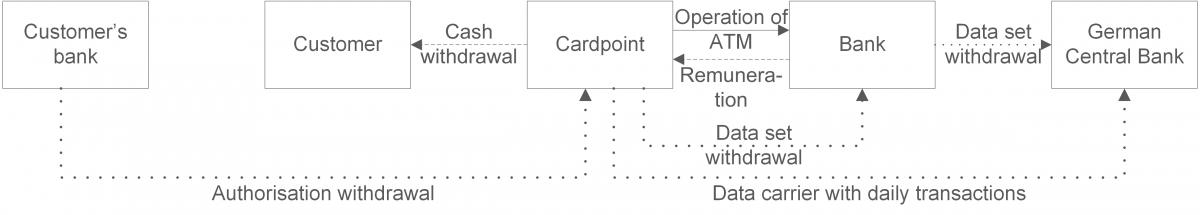

The Plaintiff (Cardpoint) installed and maintained completely functional ATMs on behalf of a bank. Furthermore, Cardpoint transported cash, provided by the bank, to the ATMs and stocked them with said money. If a customer wanted to withdraw money, it was Cardpoint who requested authorisation from the bank issuing the card. If Cardpoint made the payout it created a data set concerning the payment, Cardpoint then forwarded this data set to the bank, which had engaged Cardpoint. This bank then transmitted the data set to the German Central Bank for processing of the transaction between the involved banks. Additionally, Cardpoint sent an unalterable data carrier with all daily transactions recorded to the German Central Bank.

3 The ECJ’s decision

According to the ECJ, the operation of ATMs by Cardpoint was not VAT exempt. The ECJ found that VAT-exempt payment transactions only exist if the transaction, viewed broadly, forms a distinct whole. This distinct whole must fulfill the specific and essential functions of a bank transfer. Therefore, the supply must entail changes in the legal and financial situation resulting from the transfer of the money. By means of the respective turnover, the taxable person must, actually or potentially, transfer ownership of the funds in question or fulfil the specific and essential functions of such a transfer.

Cardpoint did not debit accounts and did not authorise transactions. In this respect, Cardpoint lacked the authority to decide. The physical payment of cash is also not sufficient as the bank transfers the ownership to the user. The data set with the daily transactions transferred to the German Central Bank by Cardpoint was only carried out for information purposes and therefore was found not to result in a transfer of money. Finally, the taxable amount for Cardpoint’s turnover could be calculated quite simply, allowing the ECJ to see its result confirmed by the purpose of the tax exemption.

4 Practical consequences

As a rule, any bank, which commissions a service provider, is not entitled to a full VAT deduction. Therefore, it is important for the bank that the outsourced supply is not charged with VAT. In the present case, this wish has been left unfulfilled. In principle, however, such a tax exemption for transactions, which have been outsourced by banks, is still conceivable. After mentioning the known general principles for tax exemption, the ECJ only decided the specific individual case. It dealt specifically with the facts mentioned by the German Federal Fiscal Court. It is therefore not possible to draw too many conclusions for other supplies based on this individual case.

The ECJ once again confirmed that, in the context of the transfer of money, it is not sufficient that the supply is absolutely essential to the transaction. However, it could potentially still be a criterion, which could tip the balance in uncertain cases.

The ECJ’s decision does not provide new, concrete indications as to how other typical outsourced transactions are to be assessed. For this reason, the supplies of a data centre or call centre will always depend on how the relations between the parties are structured in the individual case. The service provider should be given some responsibility and / or decision-making authority in order to ultimately achieve a VAT exemption. In this way, the ECJ stressed that Cardpoint itself did not authorise the transactions.