1 New legal regulation in sec. 4 no. 29 of the German VAT Act as of 1 January 2020

With effect from 1 January 2020, the German legislator implemented the VAT exemption for cost sharing groups, in accordance with Art. 132 para. 1 lit. f of the EU VAT Directive, into national law. According to this provision, supplies of services carried out by independent groups of persons to their members are VAT exempt in circumstances where the members use these supplies directly for the purpose of exercising activities that serve the common good. A further condition is that these groups merely claim from their members exact reimbursement of their respective share of the joint expenses and that the VAT exemption is not likely to cause distortions of competition. Germany has adopted the Union law regulation almost word for word in the new version of sec. 4 no. 29 of the German VAT Act. Unfortunately, the new VAT exemption provision has, to date, seldom been applied in practice. In particular, the requirements of direct use, exact cost reimbursement and exclusion of competitive distortion are too vague and need to be interpreted. Therefore, binding rulings have rarely been provided. The tax offices were waiting for the Federal Ministry of Finance's letter, which was announced almost two years ago, to be issued. Now the draft is finally available. The letter is currently being discussed with the associations and it can already be stated that the authorities have really tried their best for the non-profit sector.

2 Practical relevance

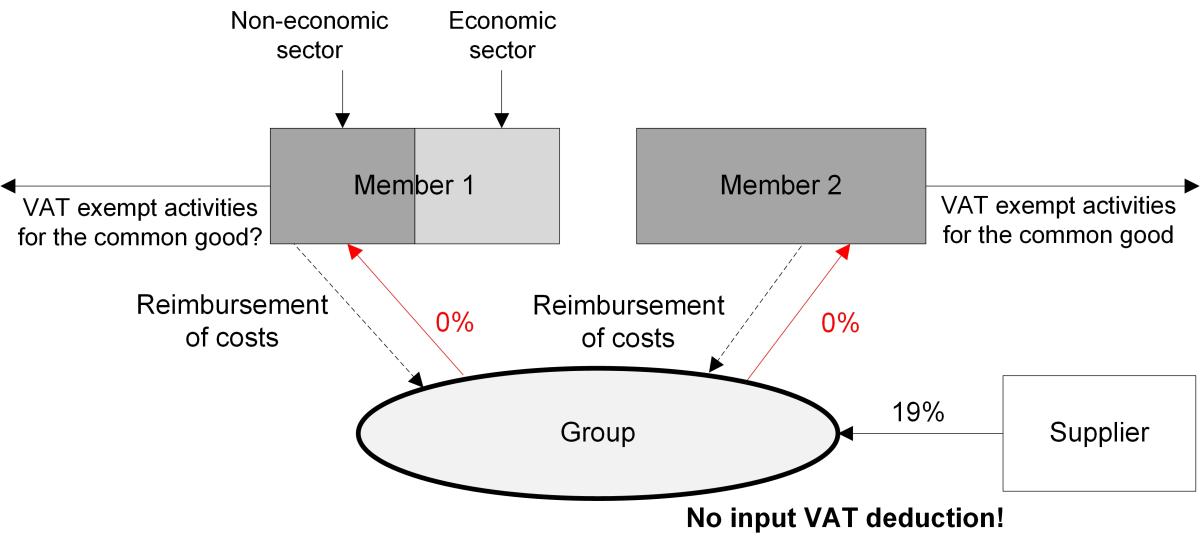

The VAT exemption in accordance with sec. 4 no. 29 of the German VAT Act is very important for non-profit institutions and public bodies, as it allows them to cooperate with each other without incurring VAT charges. The establishment of a VAT group is usually not an option as the necessary integration requires the majority of voting rights and is usually difficult in the case of public law cooperations anyway. This is precisely where the VAT exemption for the cost sharing group comes into play. No majority stake in the group is required, rather each member can benefit from the VAT exemption. Our European neighbours are therefore right to call this VAT exemption a “small VAT group”. The group formed by the members may render its supplies to the members VAT exempt. However, the VAT exemption does not apply the other way around. It is therefore a kind of one-way street.

3 Clarifications by the Federal Ministry of Finance

The group must be independent and autonomous (a differentiation from the so-called expense pool) and may consist of several members. The following can be considered as a group: partnerships and corporations, registered cooperatives (e.G.), registered associations (e.V.), associations of residential property owners (WEG), special-purpose associations, institutions under public law and other legal entities governed by public law (jPöR), but not foundations, as they do not have any members.

The supplies carried out by the group must serve certain activities of the members for the common good. The member receiving the supply must therefore be a person who provides non-taxable supplies or VAT exempt supplies for the common good, as defined in sec. 4 no. 11b, 14 to 18, 20 to 25 or 27 of the German VAT Act. In its draft, the Federal Ministry of Finance remains unsure as to whether a link to the non-economic (sovereign) sector is sufficient for members who form a legal entity governed by public law or whether activities for the common good must also be carried out. It is to be hoped that the latter will not be required, since the public sector is in need of alternatives for VAT-privileged cooperations with the de facto abolition of sec. 2b para. 3 no. 2 of the German VAT Act.

It is to be welcomed that the concept of direct use is to be interpreted very broadly. Accordingly, the provision of IT infrastructure (provided it is tailored to the members) and similar activities are also to be covered by the VAT exemption. However, it is not sufficient if the activity of the members is only indirectly supported (e.g. supply of general administrative services in the form of bookkeeping, master data maintenance, auditing, back office activities, cleaning services, provision of personnel).

What practitioners are most pleased about is that the competition criterion need not be interpreted too narrowly. Even if an independent significance is attributed to this criterion, the Federal Ministry of Finance has stated elsewhere that a relevant distortion of competition would not exist, in particular, if the group can be sure that its members’ customers will be maintained, regardless of any taxation or exemption. This effectively removes the concept of competition.

Finally, the Federal Ministry of Finance devotes a separate chapter to groups of legal entities governed by public law. Due to the new regulation of sec. 2b of the German VAT Act, with effect from 1 January 2023, in particular the inter-municipal cooperation will be subject to taxation – provided there is no legal exclusion of competition. It is to be welcomed that the Federal Ministry of Finance intends to treat the transfer of activities for infrastructure facilities, social, youth and health administration and even tourism to the group as VAT exempt if the tasks are transferred and carried out in such a way, that a distortion of competition is excluded. It is difficult to believe, but the Federal Ministry of Finance is in the mood for Christmas!

Contact:

Prof. Dr. Thomas Küffner

Lawyer, Certified tax consultant,

Certified public accountant

Phone: +49 89 217501230

thomas.kueffner@kmlz.de

As per: 02.12.2021