1 Background

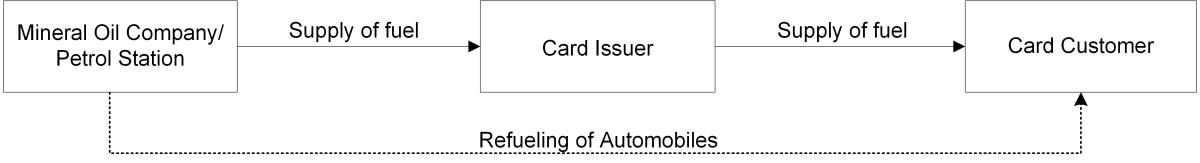

Usually, fuel card transactions are, for VAT purposes, set up as chain transactions. Mineral oil companies ("MOC") invoice supplies of goods to the card issuer ("CI"). The CI then invoices its own supplies to its card customer ("CC"):

With the CI being forming part of the supply chain, all refueling transactions and vehicle-related purchases of goods and services are bundled per card. Companies, that use fuel cards in their capacity as a CC no longer need to book their input VAT claim using laboriously collected individual receipts for small amounts. Rather, they can claim input tax much more efficiently from their monthly collective invoices.

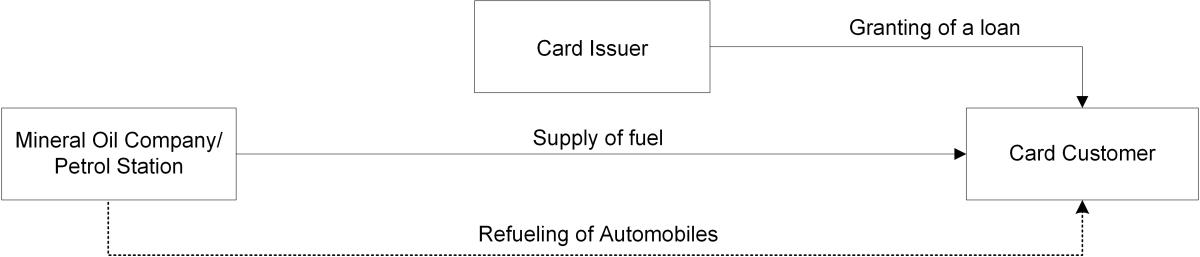

In its judgement Auto Lease Holland of 06.02.2003 (C-185/01), the ECJ ruled that petrol stations transfer the power of disposal of fuel directly to the lessee (CC) when dispensing fuel in return for the use of a fuel card and do not first sell it to the lessor (CI). The ECJ regarded the lessor's supply to the lessee as a tax-exempt financing service, see the following chart.

The German Ministry of Finance (BMF) reacted to this judgement in its Circular dated 15.06.2004 and significantly restricted the applicability of the principles from the ECJ ruling. A catalogue of prerequisites clearly specified when fuel supplies rendered, using fuel cards, constituted chain transactions. The industry carefully aligned its contracts herewith.

New legal uncertainty was then brought about by the ECJ ruling of 15.05.2019 (C-235/18) in the Vega International case (see KMLZ VAT Newsletter 25 | 2019), in which the ECJ confirmed a direct supply by the MOC to the CC and the granting of a loan by the CI to the CC with reference to Auto Lease Holland. Initially, no action was called for by the BMF. In general, Vega was regarded as a case-by-case ruling. The BMF Circular from 2004, along with its catalogue, remained applicable.

In other EU Member States, such as Austria and Latvia, attempts were also made to comprehensively implement the ECJ Vega ruling. However, by means of intensive discussions undertaken with those involved in the industry, it was possible to ensure that the special features of the fuel card business were taken into account.

2 Contents of the draft Circular with extensive effect

The previous BMF Circular of 15.06.2004 is now to be replaced by the new Circular. In this new Circular, the BMF fundamentally changes its previous view: The current draft classifies fuel card transactions as being equivalent to credit card transactions in its introductory sentence by qualifying them as a means of payment in all cases, regardless of the underlying contractual arrangements. In paragraph 1, the BMF then defines the “provision of tax-exempt credit services” to be the rule for VAT purposes for "fuel card transactions". Only as an exception should it be possible to provide fuel supplies as chain transactions - and only if the conditions of the new catalogue are cumulatively fulfilled. Compared to the previous conditions, however, these have been narrowed in accordance with the ECJ Vega ruling:

"The "CI" acquires the goods of the supply with the intention of resupplying it to the "CC". The "CI" is free to decide on the quality, quantity and the place and time of delivery. It is not sufficient if an [...] authorization by the "CI" is limited only to an automated check of compliance with existing [...] conditions/restrictions (e.g. checking the disposal limit of the respective card)." The legally secure implementation of these requirements is, in practice, likely to be difficult.

3 Conclusion

All companies involved in fuel card transactions must act quickly: They must check whether and how the new requirements for maintaining chain transactions can be implemented if the new Circular comes into force without changes to the draft as of 01.01.2022. Otherwise, they will be required to completely restructure and retool contractually, in terms of accounting and VAT. In addition, the companies concerned could possibly make further efforts to improve the catalogue of requirements via the associations in their comments and opinions to the BMF regarding the draft.

Contact:

Fresa Amthor

Lawyer, Certified Tax Consultant

Phone.: +49 (0) 89 217 50 1245

As per: 01.11.2021