1 Facts

We have already dealt with input VAT deduction by means of an upstream holding in two previous KMLZ VAT Newsletters (09 | 2020 and 05 | 2021). The question is whether an economically active upstream holding company can achieve input VAT deduction, despite restrictions on input VAT deduction being in place at the relevant subsidiary.

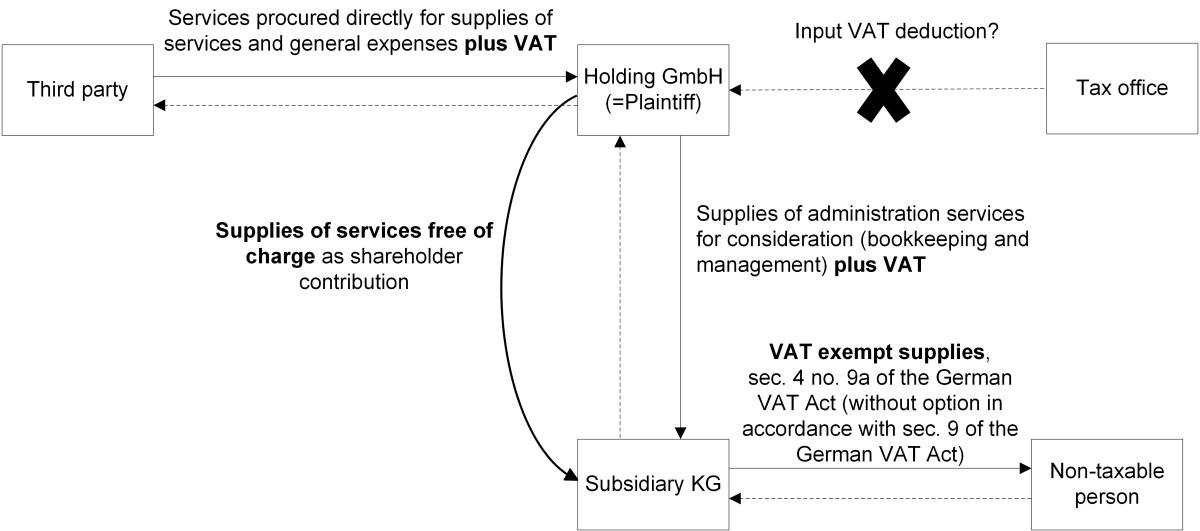

A subsidiary (KG) was not entitled to input VAT deduction, as it rendered VAT exempt supplies. Its parent company (Holding GmbH) rendered supplies of administration services to the subsidiary, for consideration. The Holding GmbH issued invoices for these services showing VAT, as there was no VAT group in existence between the Holding GmbH and the subsidiary. Further, the Holding GmbH procured services, which the subsidiary ultimately required, from third parties and passed along these procured services to the subsidiary in the form of a shareholder contribution. The Fiscal Court of Lower Saxony ruled that the Holding GmbH was entitled to input VAT deduction from the said procured services. In this context, the Court set out a number of grounds outside the scope of tax law, as reasons for the actions of the plaintiff and its subsidiary. The Federal Fiscal Court raised doubts about this outcome and referred the case to the ECJ for review.

2 Decision of the ECJ

The ECJ ultimately denied the Holding GmbH the right to input VAT deduction from the procured services which it had passed along to the subsidiary as a contribution in kind (judgment of 08.09.2022 - C-98/21). At the outset, the ECJ confirmed that the first of the two requirements necessary for the deduction of input VAT had been met and that the Holding GmbH acted in the capacity of a taxable person because it supplied its administration services for consideration.

However, the ECJ referred to a further prerequisite to be met, namely that the Holding GmbH used the procured services for the purposes of its taxed supplies. The ECJ held that there was no direct and immediate link between the Holding GmbH’s procured services, which it used as a contribution in kind, and the supplies (supplies of administration services) for consideration. In the circumstances, it then becomes crucial whether the procured services are deemed to be general expenses. These are directly and immediately linked to the taxable person’s overall economic activity. For this purpose, the expenses must be a cost element of the goods supplied or services rendered by the taxable person. However, the ECJ rejected such a link for two essential reasons. On the one hand, it held that the Holding GmbH used the procured services for shareholder contributions. Shareholder contributions pertain to the holding of company shares and therefore do not form part of the company’s economic activity. They also do not constitute expenses incurred for the purposes of the acquisition of the participation. On the other hand, the procured services were received in order to pass them on to the subsidiary, free of charge. This establishes a direct link with the subsidiary’s VAT exempt supplies (which exclude input VAT deduction).

The ECJ did not go on to offer any comments on whether, despite the relied upon grounds existing outside the scope of tax law, an abusive structure was involved, as the Federal Fiscal Court indicated it suspected in its second question.

3 Consequences for the practice

The primary consequence for the practice resulting from the ECJ judgment is that this proposed method of input VAT deduction by means of an upstream holding has failed. Even via the diversion of a Holding GmbH, input VAT deduction is not achievable in the case of pre-existing corresponding restrictions. Only in a subordinate clause did the ECJ make mention of the issue of input VAT deduction from procured services (e.g. consultancy services) for the acquisition of a participation to which a holding company subsequently renders supplies of (administration) services for consideration. The cost of such supplies of services are also not included in the price calculated for subsequent supplies of administration services rendered to the acquired susidiary. Nevertheless, input VAT deduction from such procured services is possible according to the consistently held jurisprudence of the ECJ. In this respect, a more precise delimitation would have been desirable. However, it is important that the ECJ does not question its jurisprudence according to which the Holding GmbH is economically active through its supplies rendered to the subsidiary for consideration.

It would also be interesting to see what would apply if the subsidiary in the present case had only rendered supplies entitling it to input VAT deduction. Would the procured services then also be linked to the holding of the company shares and thus part of the non-economic sector (the ECJ's first argument)? The consequence would be the exclusion of input VAT deduction. Or would the direct link with the subsidiary’s taxable supplies also apply (the ECJ's second argument), so that input VAT deduction would be achievable? It would be consistent to allow the input VAT deduction in such a constellation, especially since the ECJ emphasises the actual link to be crucial in its decision. However, no legal certainty currently exists in this regard.