1 Background

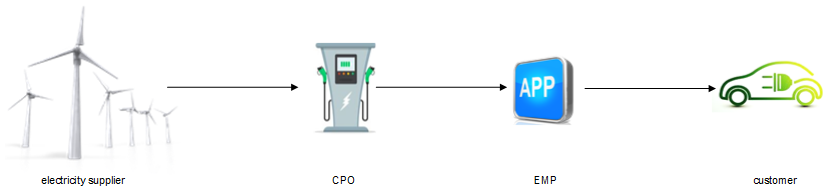

The European Commission’s VAT Committee is once again dealing with the practical questions associated with the VAT treatment of recharging electric vehicles (so-called e-charging). In this respect, the VAT Committee has previously been requested by France to provide an opinion (see KMLZ Newsletter 27 | 2019). The charging process is (simplified) regularly as follows: The electricity supplier provides the charging station with electricity. The charge point operator (“CPO”) offers further service features, in addition to the actual charging services (e.g. remote booking, information about free terminals, etc.). The mobility operator (e-mobility provider, “EMP”) acts on its own behalf vis-à-vis the end customer. It concludes an agreement with the end customer and forwards the service components received from the CPO to the end customer (possibly with additional service features). The end customer recharges the electric vehicle at the charging station with electricity.

2 Opinion of the VAT Committee

The European Commission first pointed out that it had already taken a position on the VAT treatment of e-charging on 13.05.2019. The European Commission clarified that the CPO’s supply constituted a supply of electricity, i.e. a supply within the meaning of Art. 14 para. 1 and 15 para. 1 of the VAT Directive. In contrast, the supplies rendered by the EMP have not yet been assessed from a VAT perspective.

According to the VAT Committee, in a typical electric vehicle charging process, (and insofar as this is reflected in the contractual agreements), the CPO first supplies goods (electricity) to the EMP. Finally, the EMP renders the same supply to the end customer. The VAT Committee will now provide more legal certainty at the level of the EMP and, to this end, plans to draw up corresponding guidelines concerning the supplies rendered by the EMP.

The VAT Committee also discussed the practical problems of the VAT treatment of e-charging in cases where the e-charging takes place in several Member States. One possible solution being discussed is to extend the One-Stop-Shop procedure (OSS) to these supplies in B2C scenarios and to apply the reverse charge mechanism in B2B scenarios. The potential impact of the fuel card cases as regards e-charging, (differentiation between supply of fuel and supply of financial services), were also discussed. One delegation referred to the ECJ judgments in the cases Vega International (C-235/18) and Auto Lease Holland (C 185/01) and the need to establish a common interpretation in all Member States.

3 Consequences for the practice

The VAT Committee has recognised the widespread legal uncertainty in practice and has again addressed the VAT treatment of e-charging. Following on from the past position adopted by the VAT Committee on supplies rendered by the CPO, it has now clarified that, in principle, the EMP also renders a supply of goods (electricity) to the end customer. Exemptions are, however, still possible. This would be the case, for example, if the contractual agreements resulted in a supply of goods (electricity) by the CPO to the end customer. Then there would be good reason to assume that the EMP merely renders a supply of service. This view is also supported by the jurisprudence on fuel cards, which can possibly also be applied to cases involving e-charging.

From a VAT point of view, things become more complicated when (at least) one EMP is involved in the charging process, in addition to the CPO. The question then arises as to who renders the supply of goods (electricity) to the customer (CPO or EMP). The answer to this question is crucial for determining the place of supply, the correct invoicing and the registration obligations for CPOs and EMPs.

These questions are currently increasingly arising in the retail sector, due to the German legislator’s requirement that retailers set up charging points for electric vehicles on their premises by the end of 2024. If the retail trade provides the electricity for customer acquisition purposes, free of charge, questions will also arise concerning the taxation of a supply carried out free of charge, as well as concerning possible models to avoid such taxation.

Contact:

Dr. Matthias Oldiges

Lawyer

Phone: +49 211 54 095 366

matthias.oldiges@kmlz.de

as per: 22.10.2021