1 Draft bill for an Annual Tax Act 2020

The legislator is not taking a break. Following on from the enactment of the two Corona Tax Assistance Acts, an Annual Tax Act 2020 is now also on the way. On 17.07.2020, the Federal Ministry of Finance published a 200 plus page draft bill, including the reasons for the law, with which necessary adjustments to EU law, ECJ case law and German Federal Fiscal Court case law are to be made. It also contains comprehensive VAT changes.

2 VAT related changes in the Annual Tax Act 2020

One third of the paragraphs in the VAT Act are being amended and four new paragraphs are being inserted. Apart from some minor and editorial adjustments, the changes can be grouped into the following thematic blocks:

- Supplies via electronic interfaces (marketplaces, platforms, etc.) / fictitious chain transactions / liability

- Imports of consignments with a maximum value of EUR 150 (sec. 21a VAT Act)

- New regulation for distance sales (sec. 3c VAT Act)

- Changes in passenger transport (sec. 5 VAT Implementing Regulation)

- VAT exemptions in the healthcare / nursing care / social services sector (sec. 4 VAT Act)

- VAT exemption for armed forces (sec. 4 and 5 VAT Act)

- Reverse charge scheme for telecommunication services to resellers (sec. 13b VAT Act)

- Discounts in a supply chain (sec. 17 VAT Act)

- Decentralised taxation of public authorities (sec. 18 para. 4f and 4g VAT Act)

- Fines regulations (sec. 26a, 26b, 26c VAT Act)

A comparison of the current regulations with the planned amendments, including the respective legal justification, can be found in the attachment (see below).

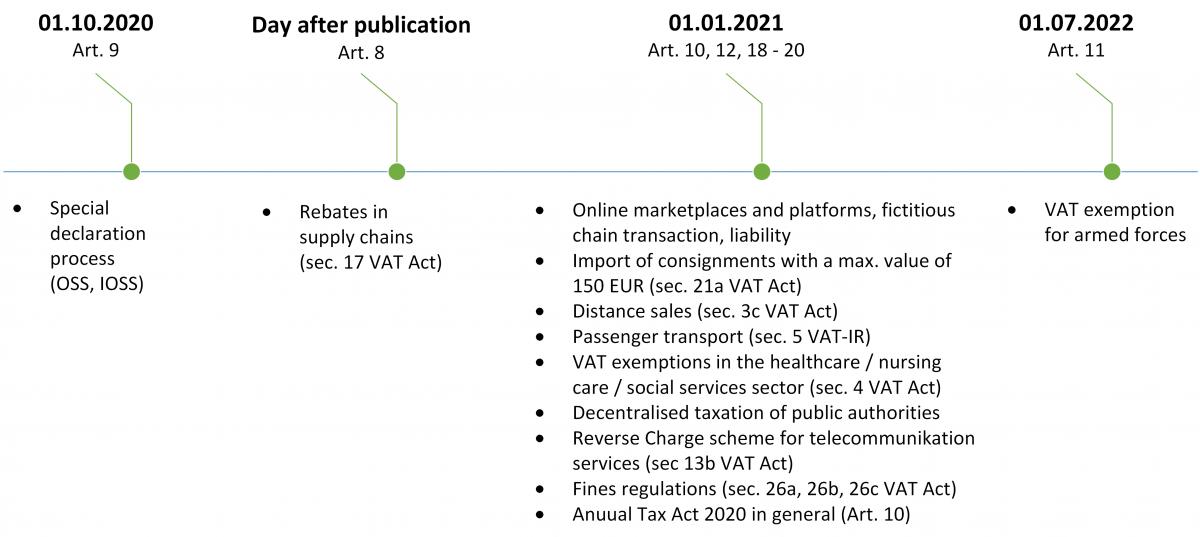

3 Entry into force

According to Art. 33, the Annual Tax Act 2020 should, in principle, enter into force on the day after its publication. However, the legal justification to Art. 33 contains a large number of exceptions and special provisions. Thus, only the amendment of sec. 17 VAT Act regarding rebates in supply chains would come into force upon publication of the Act. The vast majority of the changes are to take effect on 01.01.2021. The new regulations on the One-Stop-Shop and the Import-One-Stop-Shop are currently scheduled to come into force on 01.10.2020, because the notifications for this system are already permitted throughout the EU from this date. The new regulations on VAT exemptions for armed forces are, in turn, not to take effect until 01.07.2022, because the corresponding EU directive does not have to be implemented into national law until then.

4 Outlook

The legislative process has only just begun. Work will continue after the summer break. The current status of the draft Act therefore probably does not yet fully reflect what the final version will ultimately look like. However, many of the specifications are derived from EU law on EU directives that must be implemented. A large number of the draft regulations are therefore likely to be very close to the final version. The companies concerned can therefore already begin preparation of the practical implementation. In order to maintain an overview of the large number of changes and, at the same time, concentrate on the individually relevant changes, we will be examining the individual topic blocks separately in a series of daily newsletters.

Contact:

Ronny Langer

Certified tax consultant, Dipl.-Finanzwirt (FH)

Phone: +49 89 217501250

ronny.langer@kmlz.de

As per: 27.07.2020