1 Background

In the case of the supply of goods that are used for both economic and non-economic (private) purposes (at least 10%), the taxable person has a right of allocation: they can allocate the portion used for economic purposes or the entire item to their economic sphere, but can also leave the item entirely in the non-economic sector. The (complete/partial) allocation of the item to the economic sphere requires an allocation decision, which must be documented in a timely manner. The tax authorities previously required notification of the decision by the statutory deadline for filing tax returns.

2 Federal Ministry of Finance's letter dated 17 May 2024

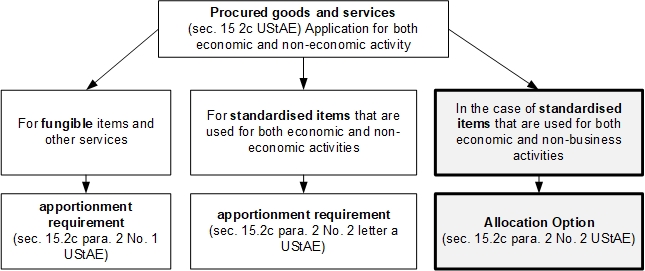

In implementation of the current German Federal Fiscal Court and ECJ jurisprudence, the Federal Ministry of Finance first addresses the allocation of a single asset to the economic sphere by applying well-known principles.

Allocation to the economic activity is characterised by the fact that the taxable person acts as such, in whole or in part, when acquiring the item and this characterisation can also be implied (implicit). The terms ‘allocation to the economic activity’ and ‘acting as a taxable person’ are to be understood synonymously. A decision made, outside the documentation period, to use a higher proportion of the supplies for economic purposes does not have a retroactive effect and therefore does not lead to an increase in the input VAT deduction. In practice, an important indication of the allocation decision – and at the same time its documentation – is the assertion of the input VAT deduction and the open VAT shown (on the invoice). If there is no other evidence of allocation to the economic activity, this cannot be assumed. In individual cases, it may also be possible to assume only a pro rata allocation if the corresponding evidence exists.

With regard to timely documentation, the Federal Ministry of Finance states that, in accordance with the principle of immediate deduction, the allocation decision must already be made at the time of procurement of goods or services. As an internal fact, the allocation decision requires documentation. This must be done by the statutory deadline for filing tax returns (documentation deadline). If the assertion of the input VAT deduction, as part of the declaration, does not indicate the allocation to the taxable sphere or its scope, other externally recognisable objective evidence must be used prior to the documentation deadline. This evidence can also be communicated to the tax office after the deadline has expired. In para. 13, the Federal Ministry of Finance cites specific examples of objectively recognisable evidence of the allocation to the economic sphere, including the purchase or sale of the asset under a company name, the business insurance of the asset, the accounting and income tax treatment of the asset and information in the building application documents or building plans that indicate economic use, at least if there are further indications of supporting evidence. Witness evidence including oral evidence, on the other hand, do not constitute objective evidence. If there is a lack of objective evidence in favour of an allocation, an explicit notification to the tax office, prior to the documentation deadline, is required. An allocation decision made in the pre-notification procedure can also be corrected up to the expiry of the documentation deadline.

3 Consequences for the practice

The Federal Ministry of Finance's letter is of great practical relevance in that no deadline-bound notification to the tax authorities is now required for the documentation of the allocation. Rather, it is sufficient if the tax authorities are notified of objectively recognisable indications, even after the documentation deadline has expired. However, this should be understood as a mere ‘stopgap’ if the documentation deadline has already been missed. The clear recommendation remains: The allocation decision should be documented, in writing, to the tax authorities prior to the deadline.

This applies, in particular, to immovable property, especially in terms of sec. 15 para. 1b, 2 of the German VAT Act. If the taxable person makes mixed use of immovable property, input VAT deduction is excluded, even if 100% of the property is allocated, insofar as the property is used for purposes outside the economic sphere. Without a written declaration, there will be no objective evidence in favour of an allocation beyond the business part. However, a complete allocation is advisable in order to secure possible input VAT relief in the long term (no ‘deposit relief’).

Contact:

Lawyer, Dipl.-Finanzwirt (FH)

Phone: +49 211 54095381

As per: 27.05.2024