1 Background

In Section 2.2 para. 2 sentence 7 of the German VAT Circular (UStAE), the Federal Ministry of Finance (BMF) has so far assumed that a member of a supervisory board performs his or her activities on a self-employed basis. In contrast, the ECJ (ruling of 13.06.2019 – C-420/18 – IO, see KMLZ VAT Newsletter 29 | 2019) and the Federal Fiscal Court (judgement of 27.09.2019 – V R 23/19, see KMLZ VAT Newsletter 06 | 2020) have ruled that a supervisory board member does not act on a self-employed basis if he or she receives a fixed remuneration for his or her activities and thus, does not bear any economic risk. In its current notification dated 8 July 2021, the BMF is adjusting the German VAT Circular accordingly.

2 The Federal Ministry of Finance’s notification dated 8 July 2021

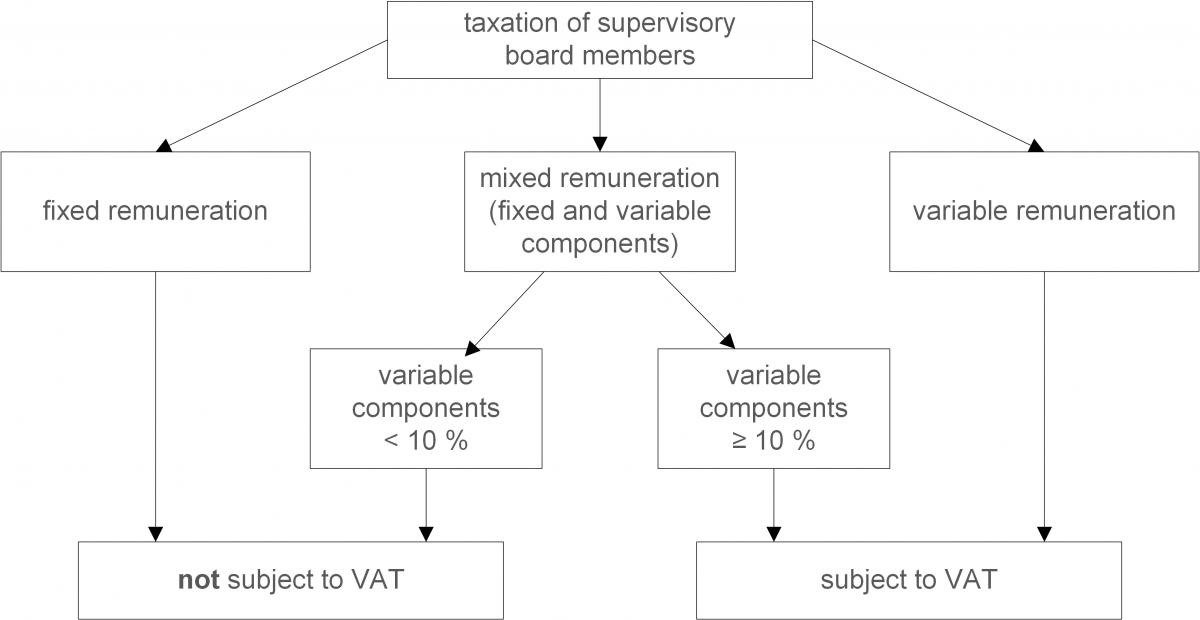

In its notification, the BMF first clarifies that a supervisory board member is not considered self-employed if he or she receives fixed remuneration and therefore does not bear any economic risk. Fixed remuneration is deemed to exist, in particular, if a supervisory board member receives a flat-rate expense allowance for the duration of membership of the supervisory board. Attendance fees paid only for actual attendance at meetings do not qualify as fixed remuneration. The same applies to expense allowances, which are calculated on the basis of actual expenditure. If the remuneration consists of both fixed and variable components (so-called mixed remunerations), the percentage of variable remuneration is decisive: If the variable component amounts to at least 10 percent of the total remuneration (including expense allowances) in a calendar year, the supervisory board member is generally considered to be self-employed. However, exceptions to this rule may apply in justified cases. However, the BMF does not elaborate as to when such a justifiable case might exist. Travel expenses are not taken into account when calculating the 10% threshold. All these criteria must be examined separately for each mandate carried out by a supervisory board member.

A liability for conduct, in the instance of a breach of duty (sec. 116 AktG), alone does not mean that a supervisory board member is acting independently. The same also applies to members of committees appointed by a supervisory board in accordance with sec. 107 para. 3 AktG. The same situation applies to members of other bodies that serve to monitor the management of companies. By contrast, these standards do not apply to members of management bodies.

These standards are applicable in all open cases. However, it will not be objected to if services performed up until 31 December 2021, are taxed according to the previous regulations of the UStAE.

3 Consequences for the practice

For services from 1 January 2022, at the latest, supervisory board members and companies must keep the value limit of 10% variable compensation in mind. Fixed compensation is also likely to include the additional compensation paid for serving as a chairperson or vice chairperson of a supervisory board or as a committee chairperson. It may be advantageous to structure variable compensation in such a way that the 10% limit is not reached and the supervisory board member is therefore not a taxable person: In this instance, the supervisory board member will not be required to file VAT returns and, at the same time, will not have the right to deduct input VAT for his or her supervisory board activities. In the case of companies that are not entitled to deduct input VAT, or are only partially entitled to deduct input VAT, there should be some financial advantages.

The BMF does not comment on the time of supply of the service. If the service is regarded as having been rendered in the period in which the annual general meeting takes place, the amount of the variable remuneration and thus the achievement of the 10% limit should be determined at this time. If the supervisory board member wants to make an input VAT deduction during the year, he or she must depend on a forecast as to whether or not the 10% limit will be reached. The same applies to a possible down payment taxation and the corresponding input VAT deduction if the supervisory board member already receives payments in advance. If the forecast does not materialize, subsequent corrections will be necessary.

It should be noted, however, that the BMF falls short of fiscal court case law, which also applies these standards to members of management bodies (see, inter alia, Tax Court of Lower Saxony, judgment of 19 November 2019 – 5 K 282/18, see KMLZ VAT Newsletter 19 | 2020).

Contact:

Dr. Thomas Streit, LL.M. Eur.

Lawyer

Phone: +49 89 217501275

thomas.streit@kmlz.de

As per: 16.07.2021