1 Introduction

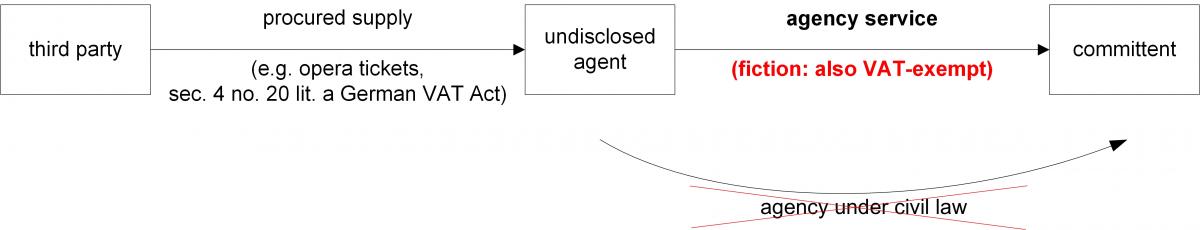

Commission transactions are a prime example of the fact that civil law and VAT law are not always synonymous. Undisclosed agents act in their own name and for the account of third parties, as opposed to proprietary traders and disclosed agents. Under civil law, this is an agency service (sec. 384 para. 2 German Commercial Code; sec. 675 German Civil Code). But be careful: This service provided by an undisclosed agent to a principal does not exist for VAT purposes and must not be invoices! From a VAT perspective a deemed supply chain of services is assumed. From a VAT perspective, an undisclosed agent shall be deemed to have received and supplied those services himself.

2 Federal Fiscal Court’s decision on personal characteristics of VAT exemptions

If the procured service, which is deemed to have been carried out to the undisclosed agent, is VAT-exempt, the question arises as to the VAT liability of the undisclosed agent's service to the customer. In sec. 3.15 (3) sentence 1 German VAT Circular, the tax authorities take the view that the personal characteristics / qualifications of the parties involved in the supply chain must be assessed separately for each supply. In its decision XI R 16/16 of 25 April 2018 (KMLZ VAT-Newsletter 35 | 2018), the Federal Fiscal Court transfers the personal characteristics relevant for the application of a VAT exemption to the commission service.

In the case of the ruling, a hotel service procured opera tickets for guests. The personal characteristics of the principal for the VAT exemption according to sec. 4 no. 20 lit. a German VAT Act were applied to the service of the undisclosed agent. The undisclosed agent usually charges a mark-up for his activity. The decision clarifies that the fiction and thus the VAT-exemption also extends to this mark-up. The general nature of the Federal Fiscal Court’s statements on the legal consequences indicates that the principles can be transferred to all undisclosed agents.

3 Federal Ministry of Finance’s notification dated 9 June 2021

The Court’s decision is scheduled for publication in the Federal Tax Gazette. The tax authorities must therefore apply the ruling. In this context, a new sentence 3 will be added to sec. 3.15 para 3 German VAT Circular. This reproduces the wording of the ruling mutatis mutandis and is limited to the VAT exemption of sec. 4 no. 20 lit. a German VAT Act.

4 Consequences for the practice

Although the adaptation of the German VAT Circular to the Federal Fiscal Court’s decision is, in principle, to be welcomed, the amendment falls significantly short of the expectations placed upon it. Since the basis of the service commission in Union Law – Art. 28 VAT Directive – is formulated in general terms, the Federal Fiscal Court has stated that the fiction of sec. 3 para 11 German VAT Act refers to the service itself and its content, but not to the person providing the service. Therefore, the service received and the service provided by the undisclosed agent share the same fate under VAT law. Both are always either subject to VAT or VAT-exempt. A restriction of these principles to the characteristics of the supplying taxable person as referred to in sec. 4 no. 20 lit. a German VAT Act is not possible. Thus, the new sentence 3 fits rather unhappily into the context of the surrounding sentences in sec. 3.15 para. 3 German VAT Circular. While the first, second and fifth sentences of sec. 3.15 para. 3 German VAT Circular continue to require a separate consideration of the personal characteristics for VAT purposes within the scope of Sec. 3 para 11 German VAT Act, the adjustment limited to sec. 4 no. 20 lit. a German VAT Act appears to be an exceptional case and thus contradictory.

Although not yet clarified by the highest court, the Federal Fiscal Court’s statements on the VAT-exemption could be transferred to all undisclosed agents. This concerns, for example, the characteristics / qualifications of the supplying taxable person for the following VAT exemptions:

- Medical practitioner status within the meaning of sec. 4 no. 14 German VAT Act (pending: XI R 18/20)

- Small entrepreneurs within the meaning of sec. 19 German VAT Act

- Flat-rate farmers and foresters as defined in sec. 24 German VAT Act

- Blind persons within the meaning of sec. 4 no. 19 German VAT Act

- General education and vocational training institutions as defined in sec. 4 no. 21 German VAT Act

- Legal entities under public law, administrative and business academies, adult education centres and institutions serving non-profit purposes or the purpose of a professional association (sec. 4 no. 22 German VAT Act)

The Federal Ministry of Finance’s notification is to be applied in all open cases. If undisclosed agents have, in the past, invoiced its services exempt from VAT under sec. 4 no. 20 lit. a German VAT Act, they should check whether a VAT refund is possible. In future, these undisclosed agents will no longer be permitted to charge VAT on their services. Any VAT nevertheless shown on their invoices will be owed according to sec. 14c para. 1 German VAT Act.

Undisclosed agents who do provide services according to another VAT exemption, must still fight for the VAT exemption before the fiscal courts. Due to the generally formulated basis of EU law in Art. 28 VAT Directive, the chances of obtaining VAT exemption are not bad.

Contact:

Dr. Markus Müller, LL.M.

Certified Tax Consultant, Dipl.-Finanzwirt (FH)

Phone: +49 211 54095387

E-Mail: markus.mueller@kmlz.de

As per: 21.06.2021