1 Facts, Federal Fiscal Court, decision of 12.02.2020 – XI R 24/18 (simplified version)

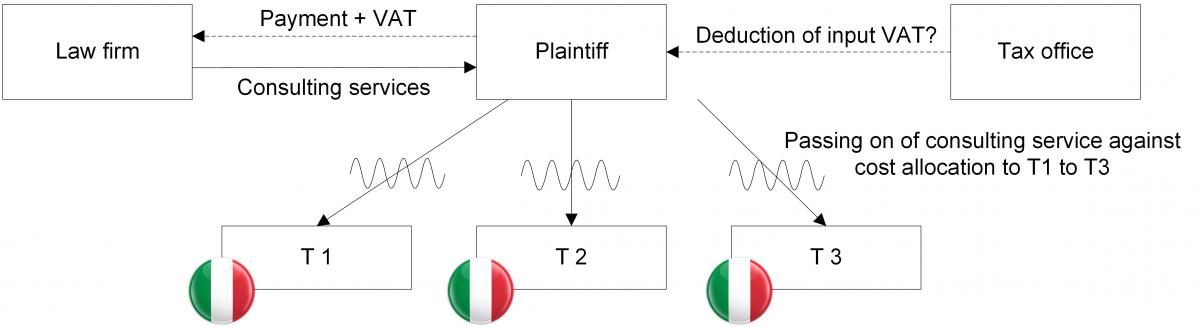

In September 2011, the Plaintiff (established in May 2011) acquired the shares of three Italian subsidiaries (T1 to T3) for the purpose of operating plants in Italy. A law firm provided legal and tax consulting services to structure the overall project. The corresponding contract with the law firm was concluded by the Plaintiff’s parent company B-AG, prior to the Plaintiff being established. On the basis of an amendment to this contract, the Plaintiff retroactively entered into the contract with the law firm as a contractual party in February 2012. Accordingly, the law firm issued its invoices showing VAT exclusively to the Plaintiff. The Plaintiff deducted the VAT shown in the law firm’s invoices as input VAT. Based on an oral agreement, the Plaintiff then passed these invoice amounts on to T1 to T3 without a profit mark-up. The Plaintiff calculated the amounts to be passed on based on the nominal output of the plants operated by T1 to T3.

2 Grounds

The Federal Fiscal Court has not yet made a final decision as to whether the Plaintiff is entitled to deduct the claimed input VAT from the law firm's invoices. The Federal Fiscal Court referred the case back to the Tax Court, as the Tax Court still has to establish some additional facts in the case. As is often the situation with holding companies, the question is whether the Plaintiff received the supplies in the capacity of a taxable person.

According to the Federal Fiscal Court, a holding company is acting as a taxable person only if it provides supplies to all its subsidiaries in return for consideration. Such supplies are not required to be of a particular quality and the holding company is free to procure them before the subsidiary is established. Contrary to the opinion of the tax office, the mere passing on of costs of supplies without a profit mark-up does not preclude such consideration. The costs to be passed on can be calculated on the basis of the nominal output of the plants operated by T1 to T3. The Tax Court had considered this to be an appropriate estimate. Furthermore, the Plaintiff, as a holding company, is not required to use its own personnel to provide its supplies.

However, contrary to the Tax Court’s opinion, the Federal Fiscal Court does not consider the Plaintiff to have acted as an undisclosed agent. The Plaintiff procured the law firm’s services partly in its own interest. This is contrary to the nature of the undisclosed agent scheme. However, the Plaintiff may still provide supplies to T1 to T3 for consideration. In this respect, the taxable supply is to be distinguished from a shareholder contribution. To this end, the Tax Court must, in the second instance, include the oral agreement between the Plaintiff and T1 to T3, as well as their articles of association as part of its assessment of the overall circumstances. For the assumption of a taxable supply it is decisive that the consideration be dependent upon the subsidiaries’ service contribution.

3 Consequences in practice

The decision contains clarifications regarding numerous factual elements which tax offices often use to deny a holding company’s taxable activity and thus the right to deduct input VAT. The Federal Fiscal Court specifically clarifies that supplies for consideration are to be understood very broadly. The holding company is not required to provide a specific supply such as the subsidiary’s administration. The mere passing on of costs is sufficient to assume supplies for consideration. Even losses in passing on costs need not preclude taxable activity. However, the shortfall should not be too significant. An (intermediate) holding company often has no personnel of its own. The Court’s clarification that this does not preclude the provision of taxable supplies is therefore also very helpful.

In addition, however, the judgement also shows at what point care must be taken when structuring the relationship between the holding company and the subsidiary. It is crucial that the service relationships are properly structured and named. On the one hand, it must be clearly agreed with the external third party (in this case the law firm) that the holding company is its contractual partner. Also, an agreement must be concluded between the holding company and its subsidiary regarding the provision and content of the supplies for consideration. Contrary to the case at hand, this should be done in writing rather than orally, so that it can be used as proof. A corresponding written agreement can also be used to illustrate, that the holding company provides supplies to its subsidiary and that these do not constitute shareholder contributions.