1 Background

In a letter dated 11 March 2024, the Federal Ministry of Finance published amendments to the GoBD (principles for the proper keeping and storage of books, records and documents in electronic form and for data access). The GoBD in the new version will apply from 1 April 2024. Implemented are the amendments to sec. 146, 146a and 158 of the German Fiscal Code from the DAC7 Implementation Act adopted at the end of 2022 and clarifications on data access (Z3 access) and data transfer.

2 Changes to data access rights (Z3 access)

The Federal Ministry of Finance clarifies that the tax authorities' access to data is limited to the scope of the respective external audit. This clarification in the GoBD is to be welcomed. According to the wording of sec. 147 para. 6 of the German Fiscal Code, the tax office could also have requested Z3 access from the taxable person outside of external audits. According to the new GoBD, data that must be recorded and retained can be provided to the tax authorities, upon request, in any machine-readable format. In addition to the data carrier previously specified by the regulation, this now also includes, for example, the transfer via data exchange platforms for which the tax authorities have opened access (sec. 87a para. 1 German Fiscal Code). The tax authorities' request can now be claimed with the audit order within a reasonable period prior to the start of the audit, in accordance with sec. 197 para. 3 of the German Fiscal Code.

3 Accounting as the basis for taxation

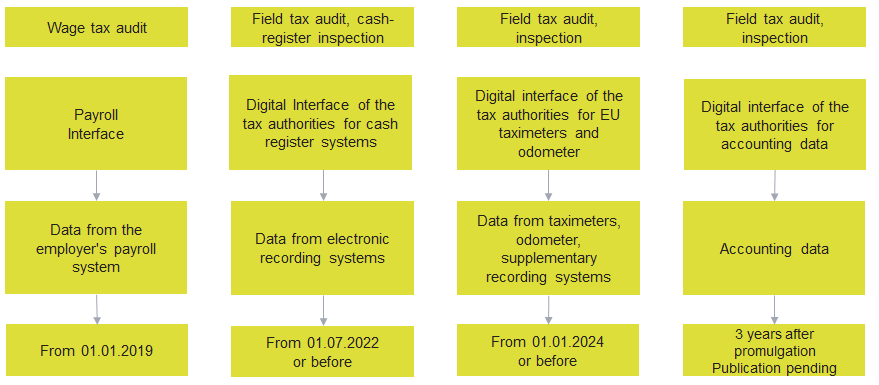

In principle, a taxable person's accounting and records form the basis for taxation in accordance with sec. 158 of the German Fiscal Code. The new GoBD clarify that this principle does not apply insofar as the electronic data has not been provided to the tax authorities in accordance with the specifications of one of the prescribed digital interfaces (sec. 158 para. 2 no. 2 German Fiscal Code). If the taxable person does not use the digital interfaces, they risk having their accountings rejected during the tax audit. In order to guard against this risk of rejection, businesses should ensure that data is provided via the following interfaces:

4 Annex: Additional information on data transfer

The attachment to the GoBD now summarises additional information on data transfer and the tax authorities' "IDEA" audit software. There is also a positive catalogue for supported file formats of the audit software and a negative catalogue for file formats that are no longer supported for tax periods commencing after 31 December 2024. Businesses should check their systems to see whether the file formats used are still recognized and adapt them if necessary.

5 Consequences for the practice: Procedural documentation and TCMS

To implement the GoBD in compliance with the law, taxable persons must also maintain procedural documentation. The aim of this is to ensure the traceability and verifiability of a taxable person's accounting and document filing. Tax auditors are now increasingly requesting the procedural documentation at the beginning of the audit in order to gain an insight into the data processing processes relevant to tax and accounting and the underlying systems. From a VAT perspective, the an automated tax determination in the ERP system is of particular interest here. The procedural documentation must therefore sometimes be very detailed in technical terms. For an SAP system, for example, this includes complete records of tax codes, tax classifications, condition tables, access sequences, user exits or any tax engine used. Taxable persons should review and, if necessary, revise an existing procedural documentation or create a procedural documentation for the first time.

The review of the technical requirements for data access indicated by the adaptation of the GoBD also offers businesses the opportunity to implement automated controls as part of their Tax Compliance Management System. According to the legal definition established as part of the DAC7 audit reform, the tax control system must continuously map the tax risks. An automated IT control system as part of the TCMS and the summarisation of the control functions in the procedural documentation help taxable persons to comply with this legal requirement.

Contact:

Dr. Kristina Echterfeld

Lawyer

Phone: +49 211 54 095 372

kristina.echterfeld@kmlz.de

As per: 23.04.2024