1 Background

The question of the extent of input VAT deduction is always a sensitive issue for legal entities under public law and for associations. Often, the subject offers great potential for discussion with the tax office and fills numerous court files. The extent of an input VAT deduction depends on the scope of the economic activity (unless exemptions are applicable). The demarcation of the non-economic “idealistic” area from the economic area is a tightrope walk. Often the boundaries cannot be precisely drawn. Membership fees charged by associations to their members prove to be particularly problematic. The judgement in the Kennemer Golf case from 2002 (C-174/00) is one of the formative ECJ judgements. According to the ECJ, it depends on whether the membership fee is matched by an individual advantage for each of the members or whether the overall interests of the members have priority. To date, the tax authorities are postponing the taxation of membership fees charged by associations in line with union law and treating membership fees differently from the case law. Now, for the first time, the Federal Fiscal Court has had to take a position on the question of membership fees with a professional association. Result: "Stones instead of bread".

2 New Federal Fiscal Court case law

In its judgment of 13 December 2018 (Ref. V R 45/17), the Federal Fiscal Court ruled that a professional association, within the meaning of sec 5 para 1 No 5 of the Corporate Tax Act, can only provide paid services, to its members or third parties, to a limited extent within the framework of an economic business operation. The Plaintiff is a professional association, within the meaning of sec 5 para 1 No. 5 of the Corporate Tax Act, and takes the legal form of a registered association. According to its statue, the professional association pursues the interests of a certain industry. However, the association did not represent the individual interests of one or more of its members, whose interests did not coincide with the overall interest of the industry the association represented. In order to finance its activities, the association charged membership fees. In its invoices, it showed a VAT amount of 19 %. The Plaintiff claimed full input VAT deduction. While the tax court had concluded that the Plaintiff was exclusively economically active, such that it would be entitled to full input VAT deduction, the Federal Fiscal Court was of the opinion that this reasoning could not be followed unrestrictedly. From the Federal Fiscal Court decision it ultimately follows that, the preferential character of a professional association, under corporate tax law in accordance with sec 5 para 1 no. 5 of the Corporate Tax Act, and a full deduction of input VAT are mutually exclusive. To justify its decision, the Federal Fiscal Court referred to the provision of sec 5 para 1 No. 5 of the Corporate Tax Act, which states that the activity of a professional association may not be directed towards an economic business enterprise. The main activity of a professional association must be aimed at the general protection of the interests of its members. Advantages for individual members may only result indirectly or reflexively from this. A professional association may only provide further services to the individual members in the form of a secondary activity.

3 Consequences for the practice

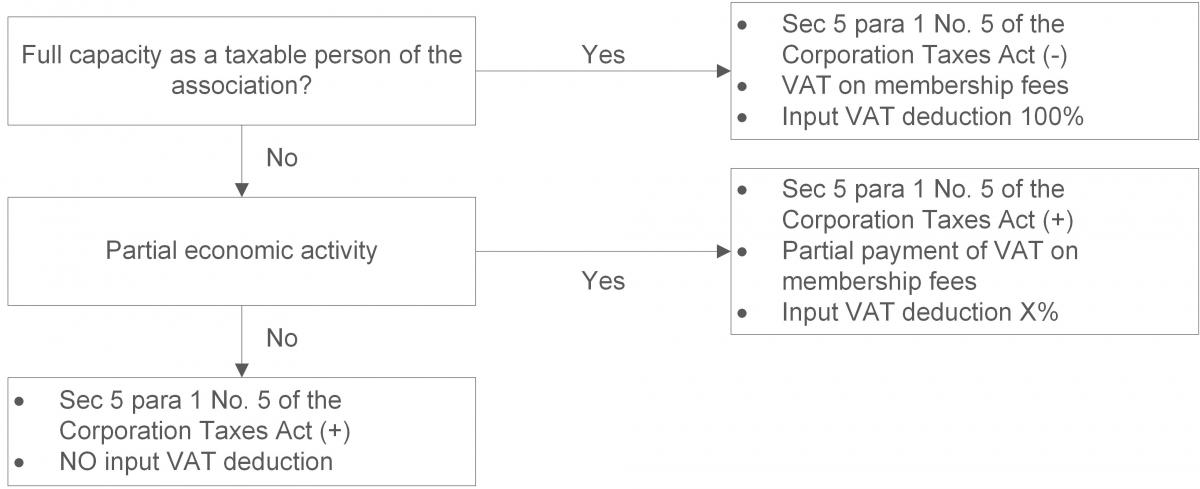

The judgement has a broad effect on all clubs and associations. What these institutions have in common is that they usually collect contributions from their members to finance their activities. Sec 2 para 1 sentence 3 of the German VAT Act and Art. 132 para 1 letter f of the VAT Directive already make it clear that, even in the case of (exclusive) action with regard to one's own members, an entrepreneurial position within the meaning of the German VAT Act can be affirmed. If no VAT exemption applies, the right to deduct input VAT exists in the case of economic activity. However, in its decision, the Federal Fiscal Court makes it clear that there is no cherry picking permitted in this respect. Should an association directly benefit its members from individual advantages, in accordance with its main purpose, this is generally associated with a loss of a corporate tax exemption. The effects are as follows:

Affected associations are therefore recommended to thoroughly examine the extent to which they provide their members with individual advantages. If the association claims full input VAT deduction, it must not be overlooked that this may have consequences for the corporate tax treatment. This is why sensitivity is required. On the other hand, according to the Federal Fiscal Court, a partial status as a taxable person would have no effect on the corporate tax classification. Insofar, however, the membership fees would have to be divided. However, the Federal Fiscal Court does not inform us how this division is to be undertaken. Nor does it comment on the amount of the deduction. It merely refers to the well-known principle that such a deduction will always be a matter of direct and immediate connection with the various areas of the institution. And here, we the practitioners are in demand: The facts of the case and the financial accounting must be designed in such a way that this connection can later also be understood by the tax authorities.

Contact:

Prof. Dr. Thomas Küffner

Lawyer, Certified tax consultant,

Certified public accountant

Phone: +49 89 217501230

thomas.kueffner@kmlz.de

As per: 05.04.2019