1 Facts

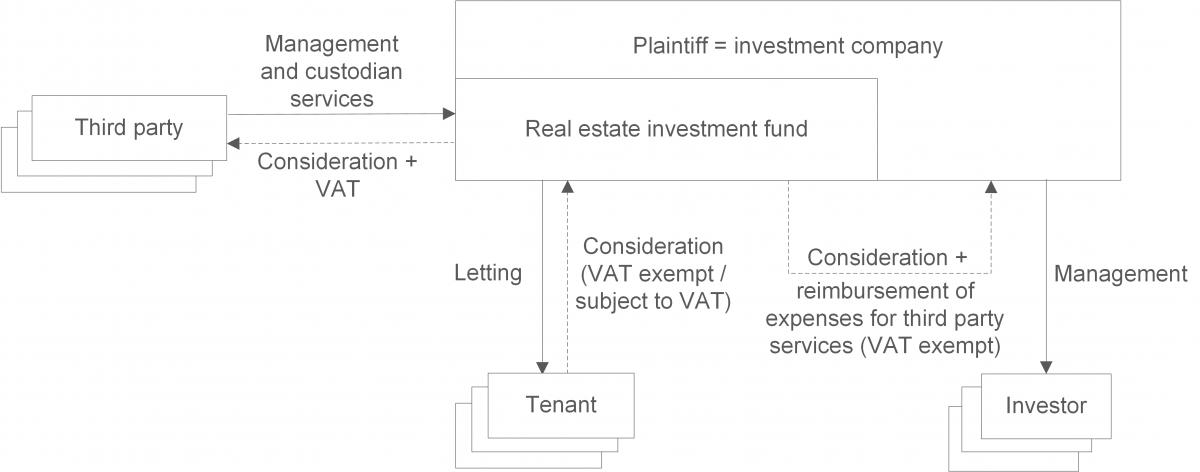

The Plaintiff was an investment company within the meaning of the Investment Act (applicable in 2006). As such, the Plaintiff set up and managed various real estate investment funds. For this purpose, the Plaintiff collected money from investors and used this money to purchase real estate which it then rented out, partly VAT exempt and party subject to VAT. The properties were owned by the Plaintiff but were each part of a real estate investment fund established by the Plaintiff. The Plaintiff thus acquired and managed the real estate for the joint account of the fund’s investors. The Plaintiff received a fee for the managing activities it provided to the investors, which it charged to the investment fund and which it considered as being VAT exempt.

The Plaintiff procured management services for the investment fund from subcontractors and a custodian bank which were subject to VAT. The Plaintiff passed on the expenses for these supplies to the investment fund, without showing VAT. However, the Plaintiff claimed a pro rata input VAT deduction from these expenses due to the partial taxable letting. The tax office subsequently denied this input VAT deduction.

2 Federal Fiscal Court decision

With its decision of 16 December 2020 (XI R 13/19), the Federal Fiscal Court, just like the Tax Court Munich before, denied the input VAT deduction from the subcontractor services and the custodian bank. Firstly, the Federal Fiscal Court deemed the requirements for input VAT deduction to have been fulfilled as the Plaintiff procured the services as a taxable person. Although the real estate was part of an investment fund, the Plaintiff was the landlord. In this context, the Federal Fiscal Court did not consider it decisive as to whether the Plaintiff acted for its own account or for the account of a third party.

However, the Federal Fiscal Court then went on to deem the input VAT deduction to be excluded as it considered the procured services to be merely cost elements of VAT exempt supplies. The Plaintiff provided the investors with a (uniform) VAT exempt supply in the form of the management of the investment fund in accordance with sec. 4 no. 8 lit. h of the German VAT Act (in its 2006 version). The Federal Fiscal Court considered the reimbursement of expenses, which the Plaintiff received from the investment fund for its payments to the custodian bank and subcontractors, in addition to the actual remuneration, to also constitute remuneration for the VAT exempt supply of management services. Therefore, according to the Federal Fiscal Court, the procured services, from which the Plaintiff claimed input VAT deduction, were merely a cost element of the VAT exempt supplies of management services.

3 Consequences for the practice

The Federal Fiscal Court arrived at its decision, based on the legal situation in 2006, which is no longer in effect today. Nevertheless, it is possible that the tax authorities would apply this decision to the present legal situation. Currently, capital management companies render VAT exempt supplies of management services to investors of certain alternative investment funds (AIFs). The German VAT Circular does not comment on input VAT deduction in this context. However, tax offices have already denied various capital management companies their input VAT deductions from corresponding services.

In this respect, an alternative legal view would certainly be justifiable. A supply procured must be a cost element of a supply provided in order for the two to be directly linked. The Federal Fiscal Court pointed out that the Plaintiff and the investment funds were one taxable person. This taxable person, in addition to VAT exempt supplies of management services, rendered (partially taxable) rental services to the investors. The Plaintiff was required to recover the costs for the custodian bank and the subcontractors through its rental income. Thus, the procured services also constituted cost elements of these rental services rendered by the Plaintiff as they were taken into consideration when the rental prices were set. The Federal Fiscal Court did not comment on this aspect in its reasoning. However, if the procured service is also a cost element of the taxable rental services, the input VAT deduction should be possible, on a pro-rata basis.

According to the wording of the current version of sec. 4 no. 8 lit. h of the German VAT Act, the requirements to be fulfilled by an AIF, in order for the capital management company to render VAT exempt management services to its investors, need to be considered. This is particularly important if the investors are banks, insurance companies or other taxable persons, which are not fully entitled to input VAT deduction. In particular, the question arises as to whether the management of a special AIF, which is only open to professional and semi-professional investors, can be VAT exempt. In the present decision, the Federal Fiscal Court assumed that, in 2006, the management of a special investment fund could be VAT exempt. A special investment fund only had a limited circle of investors. Although the wording of the German VAT Act and the situation under capital market law have changed, it should nevertheless be considered whether the Federal Fiscal Court’s present decision can be applied in this respect. At the very least, the background under Union law and the purpose of the VAT exemption are identical.