1 Background

In the past, the German tax authorities assumed that members of supervisory boards performed their duties on a self-employed basis (sec. 2.2 para. 2 sentence 7 of the German VAT Circular). The Federal Ministry of Finance’s letter of 8 July 2021 served to publish a change in its legal opinion to the effect that it, henceforth, intended to follow the amended jurisprudence (KMLZ VAT Newsletter 26 | 2021). Therefore, the crucial factor for determining whether a supervisory board member is self-employed became the question of how he or she is remunerated. If the supervisory board member receives a purely fixed remuneration, then he or she is not self-employed (→ no VAT taxation). If the variable part of the member’s remuneration amounts to 10% or more of the total remuneration received, the member is self-employed (→ VAT taxation).

2 Federal Ministry of Finance's letter of 29 March 2022

However, some important questions of application remained unanswered by the Federal Ministry of Finance. The Ministry has now, in its letter of 29 March 2022, eliminated some of the primary resulting legal uncertainties that remained:

- Time of the supply

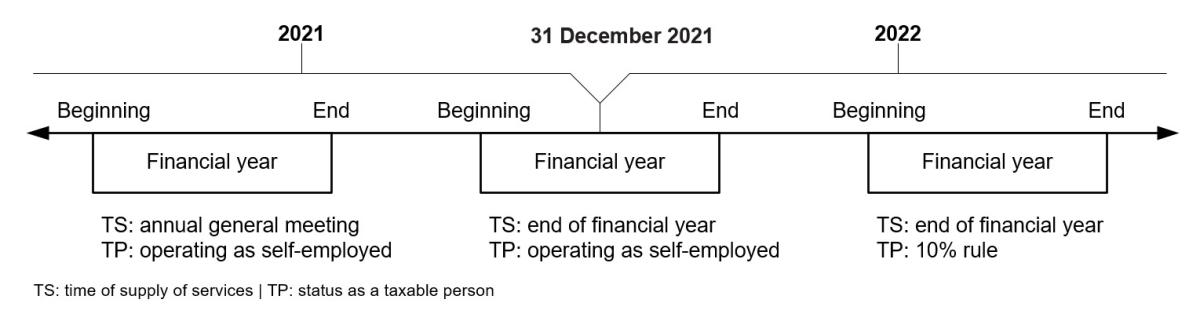

In its letter of 15 September 1980, the Federal Ministry of Finance assumed that the time of supply is the point in time the general meeting takes place and at which the supervisory board member is to be relieved of his or her duties in a specific financial year. This letter was annulled by the Federal Ministry of Finance’s letter of 29 March 2007. However, this should not qualify as a change in law. In its letter of July 2021, the Federal Ministry of Finance did not comment on the time of supply. However, now, with its most recent letter, the Federal Ministry of Finance has determined two different points in time as being eligible as the time of supply: The relevant time of supply is now generally the end of the company’s financial year. If a supervisory board member attends a supervisory board meeting and receives reimbursement of expenses and attendance fees, the relevant time of supply is deemed to be the day the supervisory board meeting took place.

- Calculation of the 10% threshold: forecast

Firstly, it has been clarified that only those remuneration components paid for supplies rendered in the company’s relevant financial year are to be considered when calculating the 10% threshold. The calculation is not based on the calendar year. Secondly, the calculation is dependent on a forecast. Thus, the relevant point in time for the evaluation of the 10% threshold is the beginning of the company’s financial year. In this evaluation, all attendance fees for planned supervisory board meetings in the particular financial year must be included. Subsequent changes are not to be considered, regardless of whether the supervisory board member attends all planned supervisory board meetings.

- Temporary scope of application / non-objection regulations

The current Federal Ministry of Finance’s letter is applicable to all open cases. Both, supervisory board members and supervised companies, can therefore also refer to it for the past. In addition, the Ministry provides for non-objection regulations to avoid transitional difficulties:

- Self-employed status: the previous administrative view (prior to the Ministry of Finance’s letter of 8 July 2021), which affirmed the supervisory board member’s self-employed status, even in the case of purely fixed remuneration, can be applied to all supplies rendered in a company’s financial year that began prior to 1 January 2022.

- Time of supply: for a company’s financial years ending prior to 1 January 2022, it is not objectionable if the time of supply for the general duties of the supervisory board member is based on the time the general meeting takes place.

3 Consequences for the practice

The adjustments by the Federal Ministry of Finance were urgently required and result in greater legal certainty, especially with regard to the 10% threshold. Focusing on a forecast and waiving the need to adjust the forecast to the actual circumstances reduces the risk of annual fluctuations in terms of whether the 10% threshold is reached. They avoid the need for corrections to be made to the taxation of supplies and the deduction of input VAT. The forecast should reflect actual expectations and should be documented. The different times of supply must be considered when invoicing and determining the date of taxation / input VAT deduction. It remains unclear, however, why the time of supply for duties pursuant to sec. 171 of the Stock Corporation Act, which the supervisory board member will only perform after the end of the financial year (e.g., audit of the annual financial statements, etc.) should already be at the end of the financial year.

Contact:

Dr. Thomas Streit, LL.M. Eur.

Lawyer

Phone: +49 89 217501275

thomas.streit@kmlz.de

As per: 08.04.2022