1 Previous development

In 2015, the ECJ ruled in its decision Larentia + Minerva & Marenave that partnerships can be controlled companies of a VAT group. An exception to this rule can only be made for the purposes of preventing tax avoidance. In response, the V. Senate of the Federal Fiscal Court held that a partnership can be a controlled company, provided that all shareholders existing alongside the controlling company are financially integrated into the controlling company. The Federal Ministry of Finance has adopted this opinion in sec. 2.8 para. 5a of the German VAT Circular. In contrast the XI. Senate of the Federal Fiscal Court took the view that a German limited partnership (GmbH & Co. KG) can generally qualify as a controlled company of a VAT group. This divergence of opinion has led to considerable legal uncertainty.

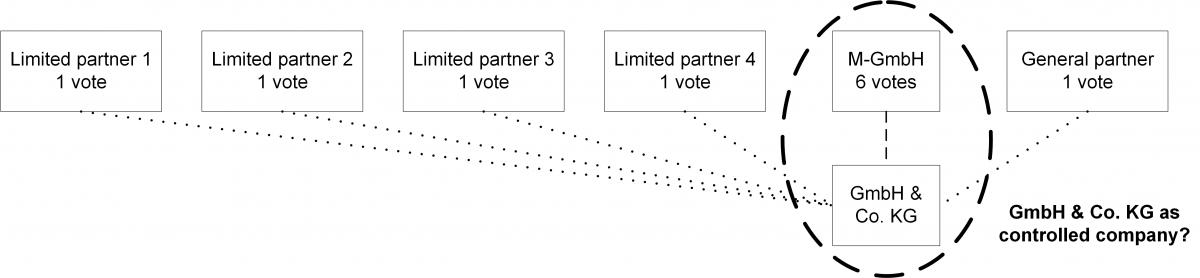

2 Facts

The M-GmbH is a limited partner of a GmbH & Co. KG (hereinafter referred to as KG) and has six votes in the KG’s shareholders’ meeting. The KG’s remaining four limited partners and the general partner each have one vote (thus a total of five votes). They are not financially integrated into the M-GmbH, which is why, in the opinion of the V. Senate of the Federal Fiscal Court and the Federal Ministry of Finance, the KG could not be a controlled company of the M-GmbH. The KG’s shareholder resolutions are generally passed by a simple majority. Organisational and economic integration are given.

The Tax Court referred to the ECJ. Essentially, it wanted to know whether the strict requirements of the V. Senate of the Federal Fiscal Court and sec. 2.8 para. 5a of the German VAT Circular, under which a partnership can be a controlled company, are contrary to Union law. According to the Tax Court, a VAT group between M-GmbH and KG must be possible, as the M-GmbH can enforce its will in the shareholders’ meeting of the KG and thus financial integration is given.

3 ECJ judgment

In its decision of 15.04.2021 (C-868/19) the ECJ provided a clear answer to the Fiscal Court’s question in ruling that the previous narrow view of the V. Senate and the Federal Ministry of Finance on partnerships as controlled companies is not in conformity with Union law. The ECJ thus confirms the opinion of the XI. Senate of the Federal Fiscal Court. The KG’s financial integration into the M-GmbH (and thus the VAT group) is to be assumed. Through the majority in the shareholders’ meeting, the M-GmbH was able to enforce its will in the KG. The mere theoretical possibility of amending the KG’s articles of association, to the effect that resolutions must be passed unanimously, is not sufficient to deny the financial integration. The principal of legal certainty – which the V. Senate of the Federal Fiscal Court precisely emphasised – does not call this result into question.

The objective of preventing tax avoidance also does not constitute justification for the restriction. There would have to be a number of objective indications of abusive practice for this to be the case. Evidential difficulties alone or a mere theoretical danger are not sufficient to justify the German regulation. Furthermore, according to the ECJ, the requirement of documentary proof or an approval of the VAT group by the tax authorities could be used as a more lenient means.

4 Consequences for the practice

Both, the opinion of the V. Senate of the Federal Fiscal Court and sec. 2.8 para. 5a of the German VAT Circular contradict the ECJ’s judgment. Partnerships can qualify as controlled companies under lower requirements than previously assumed in Germany. If the VAT group entails neither advantages nor disadvantages, taxable persons can continue to rely on the requirements of the German VAT Circular as regards their taxation. The same applies if taxable persons intend to avoid the formation of a VAT group. The tax authorities are bound by the German VAT Circular. Under the requirements of sec. 176 of the German Fiscal Code, legitimate expectations are protected (possibly important for court proceedings). If, however, a VAT group with a partnership is intended, despite one of the shareholders not being integrated into the controlling company, the taxable person can refer to the present ECJ ruling. The deviation from the German VAT Circular should be pointed out in the corresponding VAT return.

For the past, it is worth considering whether invoking the VAT group might only allow the VAT assessment of one of the companies to be amended to the advantage of the taxable person. This is conceivable if differences occur with respect to the non-appealability and the statute of limitations (see Tax Court Münster of 07.04.2020 – 15 K 3019/17 U). Taxable persons should examine this issue with respect to their VAT assessments.

In order to be financially integrated, the parent company must be able to enforce its will in the shareholders’ meeting of the subsidiary. In Germany, the party benefiting from a tax regulation must prove that the requirements are met. Therefore, the tax authorities, as well as the jurisprudence, is likely to set high standards for proving the integration of a partnership. Ultimately, it is to be hoped that the legislator will take up the ECJ's suggestion and revive existing reform ideas on the application procedure for the VAT group (see KMLZ VAT Newsletter 37 | 2019). The ECJ argues that an approval of the VAT group by the tax authorities would prevent legal uncertainties from the outset.