1 Facts

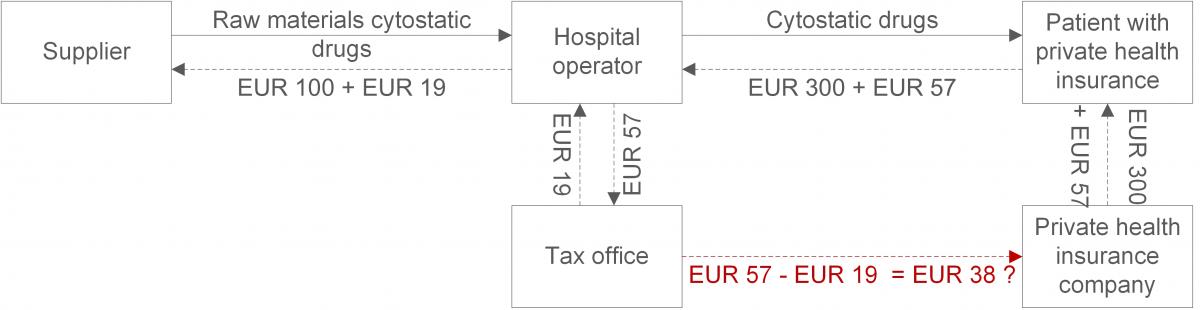

Within the framework of outpatient hospital treatments, cancer patients with private health insurance receive individually prepared cytostatic drugs from hospital pharmacies (dependent part of the hospital operator). In the years 2012 and 2013, the respective hospital issued invoices which either showed VAT or included the VAT amount in the price. The hospital paid the VAT and claimed input VAT deduction from the acquisition of the cytostatic drugs. The private health insurance company fully reimbursed the patients’ expenses.

In 2014, the Federal Fiscal court found, in a decision contrary to the tax authority’s opinion at that time, that the supply of individually prepared cytostatic drugs was VAT-exempt. In 2016, the Federal Ministry of Finance adopted this assessment for all outstanding cases. Arising from legally transferred rights, the private health insurance companies claimed repayment of the VAT amount less the subsequent deduction of input VAT from the hospital operator.

2 Federal Court decision

The Federal Court decided four of these cases on 20.02.2019. To date, the only commentary available regarding these four decisions is a court issued press release. According to this, the price agreements between the hospital operator and the patient were so-called “gross price agreements”. A VAT amount, which had been calculated by the parties into such a gross price amount, but which had not actually been incurred, cannot, as a general rule, be reclaimed.

According to the Federal Court, the situation can be viewed differently here due to the possibility of a supplementary contractual interpretation. If the parties had been in a position to have anticipated the 2014 and 2016 Federal Fiscal Court and Federal Ministry of Finance decisions, they would have, hypothetically speaking, agreed on a different price. They would not have included the VAT amount (EUR 57 in the diagram above). Due to the now VAT-exempt output transactions, input VAT deduction from purchases of cytostatic drugs would no longer be possible. The parties’ calculation would also have taken into consideration this lack of input VAT deduction by the hospital operator (EUR 19 in the diagram above). The price would have been lower by the amount of the difference (EUR 38). Neither the hospital operator’s administrative expenses for the reversal, nor the disbursement of the VAT by the patients, have to be taken into consideration in the calculation.

Such a supplementary interpretation of the contract does not seem to be possible in cases where the hospital operator is no longer able to enforce the amendment of the VAT assessment, vis-à-vis the tax office, from a procedural law perspective (e.g. enforceability). If the hospital operator has shown VAT in its invoices, it will be threatened with considerable interest payments. If the amount of interest reaches the above-mentioned difference (EUR 38 in the above diagram), a supplementary interpretation of the contract is, in the Federal Court’s opinion, also excluded.

Now, for the first time, the highest civil court in Germany has decided on the civil law situation concerning cytostatic drug cases on the basis of the amended VAT perspective. The principles will be applicable to the relationship between hospitals and statutory health insurances companies, as well as alternative health insurance funds (“Ersatzkassen”). Whether or not a repayment claim actually exists, will have to be decided on a case-by-case basis. Here, the following (non-exhaustive) points may play a role:

- Exact formulation of the contract between the hospital operator and the recipient (i.e. health insurance company or patient): It is conceivable that, deviating from the Federal Court case, these are net price agreements, which usually make it easier for health insurance to justify repayment claims.

- Procedural situation with regard to the VAT assessment of the hospital operator (in order not to be disadvantaged, health insurances companies are recommended to assert claims as soon as possible).

- Invoicing by the hospital operator showing VAT or not showing VAT.

- Any interest claims of the tax authorities against the hospital operator on the basis of issued invoices showing VAT.

- Changes in the hospital operator's deductible proportion of the input VAT may need to be taken into account.

Finally, it should be considered whether the tax-exemption, from a VAT-perspective, also applies to the supply of non-patient-individual drugs in the context of outpatient treatment by hospital pharmacies.

Contact:

Dr. Michael Rust

Lawyer

Phone: +49 89 217501274

michael.rust@kmlz.de

As per: 25.02.2019