1 Background

If grants are awarded to non-profit institutions, the question always arises as to how the grant is to be classified. The grant can either be a genuine (non-taxable) or a non-genuine (taxable) grant (see sec.10.2 of the German VAT Circular). It may also constitute consideration by a third party. If the grant is found to be non-taxable, the question of input VAT deduction follows. Taxable persons generally have a hard time discussing the qualification of grants with the tax authorities, as the Federal Fiscal Court has repeatedly ruled that grants are to be regarded as taxable. This was also the case in 2008, when the Federal Fiscal Court considered a grant to a church association, for the provision of journalistic media work, to be taxable (decision of 27 November 2008, V R 8/07). Has the time now come for a change in the jurisprudence?

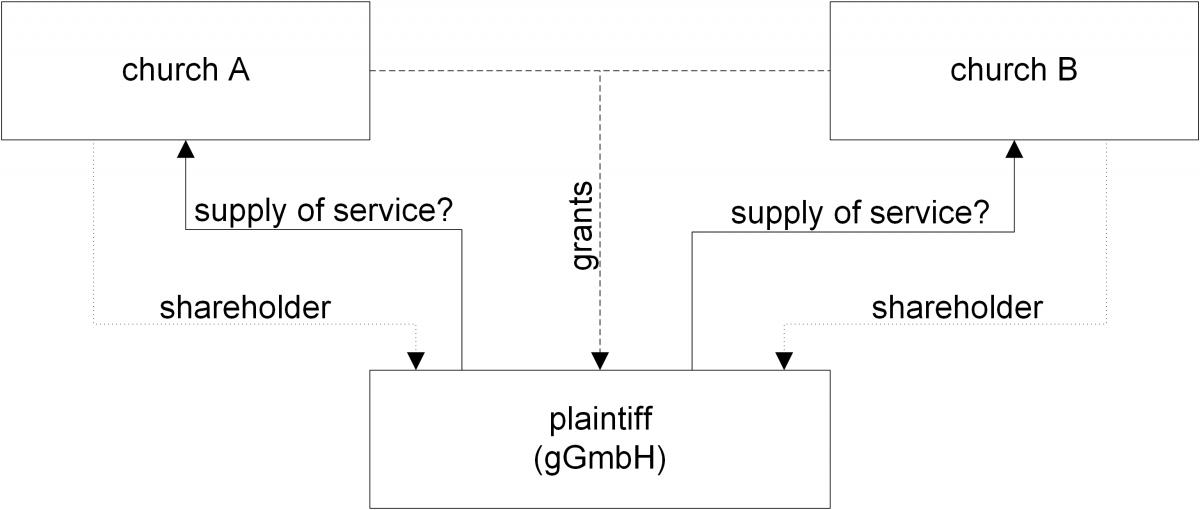

2 Facts

The facts underlying the new decision of 23 September 2020 (XI R 35/18) were quite similar to those underlying the decision of 2008. Again, it was about a church institution in the form of a non-profit limited liability company (gGmbH) that procured and circulated news. It received grants in the form of financial allocations from its two shareholders, churches A and B. Once a year, the gGmbH reported its financial requirements, dividing the amounts between the two churches, based on the number of members or the cash situation. The Fiscal Court Baden-Württemberg ruled that the gGmbH had taken on the media work for both shareholders and thus provided them both with a consumable benefit. The Fiscal Court referred to the Federal Fiscal Court’s decision of 2008, according to which, it is not decisive, for the purposes of determining whether a supply is taxable, whether the supply is in the public interest or not. A public interest in the supply does not exclude the recipient’s identifiability.

As the appellant’s legal representatives, we took a different view. We pointed out the differences in the facts of the two decisions and made it clear that the activities of the gGmbH did not benefit the two shareholders, but rather the general public. Lastly, if necessary, the VAT exemption according to Art. 132 lit. f of the VAT Directive could have been applied.

3 Reasons for the Federal Fiscal Court decision

The tax dispute proved to be a worthwhile exercise. The Federal Fiscal Court adapted its previous line of jurisprudence, considered the appeal to be justified and referred the case back to the Fiscal Court. All in all, an outstanding success. Although the legal relationship required for a taxable supply of goods or services can, in principle, also arise from the articles of association, the consumable benefit must be analysed in the light of the more recent jurisprudence of the ECJ and the Federal Fiscal Court. The mere exercise of the shareholders’ general interests is no longer sufficient to assume a taxable supply of goods or services. A consumable benefit can only be assumed if an individual recipient derives a concrete benefit from the supply. Indirect benefits, however, are not sufficient.

It is extremely interesting that the Federal Fiscal Court not only considers Art. 132 lit. f of the EU VAT Directive to be applicable, but also considers the VAT exemption according to Art. 132 lit. l of the EU VAT Directive to be relevant. Whereas the so-called cost sharing group has now been implemented by sec. 4 no. 29 of the German VAT Act, the Federal Fiscal Court held that Art. 132 lit. l of the EU VAT Directive (supplies of services by religious institutions to its members) has not yet been fully implemented into national law. Both VAT exemptions under EU law have in common that no significant distortions of competition may occur. However, the Federal Fiscal Court sees little room for competition. For one thing, this requirement should not be interpreted too broadly. Furthermore, when considering the fulfilment of the church’s proclamation mission, it is to first be determined whether the church is entitled to select the persons participating in this mission. Competition could therefore be excluded from the outset.

4 Consequences for the practice

This decision is an important development for the practice. It is certain that a taxable supply of goods or services requires an identifiable recipient. Indirect benefits for the grantor resulting from the exercise of general interests are, in any case, not sufficient to assume a taxable supply. Therefore, as is so often the case, it is a matter of determining the individual facts. It is also to be welcomed that the Federal Fiscal Court has demonstrated new approaches as to how the concept of competition, within the meaning of sec. 4 no. 29 of the German VAT Act, can be interpreted in a restrictive manner. For more than a year, the tax authorities have not succeeded in finalizing the Federal Ministry of Finance’s draft letter in this regard. The comments on competition were too vague. As the Federal Fiscal Court has now clarified, the concept of competition should not be interpreted too strictly.

Contact:

Prof. Dr. Thomas Küffner

Lawyer, Certified tax consultant,

Certified public accountant

Phone: +49 89 217501230

thomas.kueffner@kmlz.de

As per: 30.03.2021