1 Facts

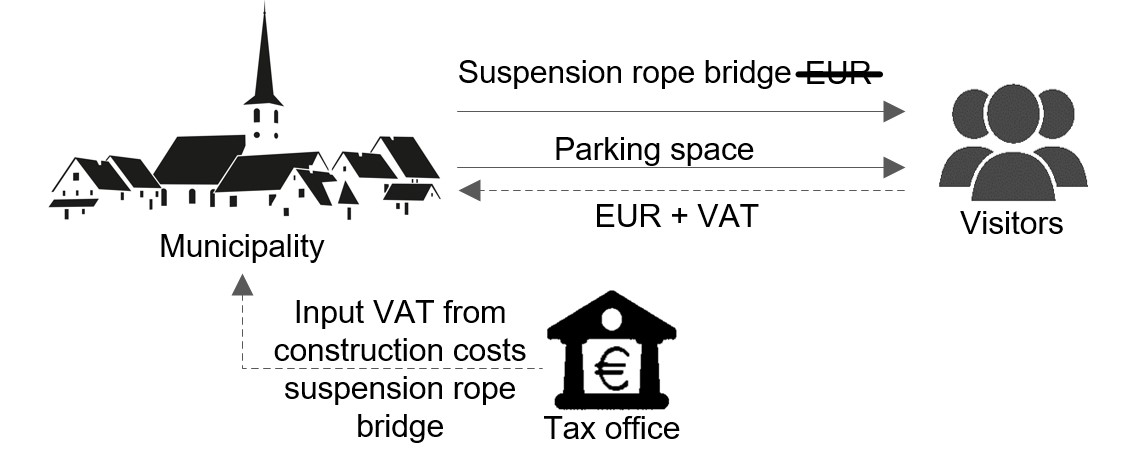

The dispute concerned the input VAT deduction from supplies procured by a municipality in connection with the operation of visitor parking spaces. These parking spaces were in spatial connection with a newly erected suspension rope bridge, which served as a tourist attraction. The municipality was of the opinion that the input VAT deduction from the acquisition of the suspension rope bridge (2015) should be granted. Although, the general public’s free of charge use of the bridge generated no direct revenue, it had, nevertheless, to be taken into account that a paid car park (2016) had also been built and could be used by visitors to the bridge. The municipality therefore subsequently claimed input VAT deduction.

The tax office, however, did not recognise the link between income and expenditure and denied the input VAT deduction. In the tax office’s opinion, the bridge was operated without the intention of generating income which is why the municipality was not engaged in economic activity. Furthermore, the tax office denied a direct and immediate link to the parking revenue.

The Fiscal Court of Rhineland-Palatinate, however, upheld the municipality’s claim. The municipality had engaged in economic activity by charging parking fees. The direct and immediate link was affirmed with reference to the ECJ jurisprudence in the Sveda case. In this case, the ECJ had recognised the input VAT deduction from the construction of a free of charge mythology path, at the end of which a souvenir stand had been erected.

2 Federal Fiscal Court decision

The Federal Fiscal Court ruled in favour of the municipality and considered the input VAT from the construction of the bridge to be deductible on the merits of the case. Input VAT deduction requires a supply for consideration. In this context, the Federal Fiscal Court points out that the existence of a supply for consideration is not to be assessed according to civil law, but exclusively according to Union law. It is undisputed that the bridge was made available to the general public free of charge and that the parking fees were not charged for the use of the bridge. The bridge could be used by anyone free of charge. In this respect, the paying car park user does not receive any advantage over any other (non-parking) visitors. However, the Fiscal Court found, in a manner that was not objectionable according to the principles of appeal proceedings, that there was a link between the procured supply at issue and a supply for consideration. In this respect, the Federal Fiscal Court refers to the jurisprudence of the ECJ in the Sveda case. In the present case, the Federal Fiscal Court allowed it to suffice that the generation of revenue through parking fees had played a role in the financing of the bridge and that this had already become apparent at the start of construction. Without the bridge, there would have been no reason whatsoever in the municipality to use paid parking spaces, so that no significant revenue could have been generated. The investment does not have to be earmarked for the output supply.

Also interesting for fans of public sector taxation, are the Federal Fiscal Court’s comments on the municipality’s status as a taxable person based on the operation of the parking spaces. The municipality acted under public law. However, significant distortions of competition existed. In this respect, the Federal Fiscal Court considered it irrelevant whether the access road to the individual parking spaces, like the parking spaces themselves, was dedicated as a road under public law. In the end, however, the Federal Fiscal Court did not grant the municipality the full input VAT deduction. This was because the car park was initially provided, in part, free of charge and the municipality had, to this extent, acted as a non-taxable person. Only insofar as it provided the parking spaces for a fee, did it act as a taxable person. In order for the Fiscal Court to determine the input VAT deduction more precisely, the municipality must calculate a deductible proportion of input VAT by way of an appropriate estimate. The Federal Fiscal Court provides the important hint that if the municipality uses a turnover-based allocation key, grants are also part of the “total turnover” and therefore reduce the deductible proportion of input VAT.

3 Consequences for the practice

The judgment very clearly shows how important it is to take precautions with regard to evidence. The necessary link must be provided at an early stage in order to secure the benefit of input VAT deduction. The judgment will have a broad impact and will result in a subsequent windfall not only for municipalities. In the case of the provision of paid parking spaces with a touristic background (parking spaces near popular sights, hiking trails, etc.), it is important to check whether input VAT deduction might be possible.

Contact:

Prof. Dr. Thomas Küffner

Lawyer, Certified tax consultant,

Certified public accountant

Phone: +49 89 217501230

thomas.kueffner@kmlz.de

As per: 23.03.2022