1 In-kind donations in tax law

Former German Federal President Gustav Heinemann once said that you can discern a society’s standards by the way it treats the weakest of its members. But what about the meaning of this sentence from a VAT perspective?

This question arises time and time again when taxable persons want to donate foodstuff to charitable organisations such as food banks or give away goods that have already been discarded for logistical or economic reasons. These goods no longer have any real value for the taxable person. He would like to donate them for a good cause. However, it is precisely at this moment, that these goods might become subject to tax. With respect to income tax, a tax liability can be avoided by means of sec. 6 para. 1 no. 4 sentence 4 of the German Income Tax Act, according to which in-kind donations withdrawn from business assets can be accounted for at book value. From a VAT perspective, however, the situation is quite different.

2 The VAT issue

Only supplies of goods and services for consideration are subject to VAT. In-kind donations, however, are made without consideration, which is why, initially, they do not constitute a taxable supply. However, the German VAT Act considers certain supplies carried out free of charge to be equivalent to a supply for consideration and thus taxable. If in-kind donations are made, it is therefore to be determined whether they are taxable as supplies carried out free of charge within the meaning of sec. 3 para. 1b of the German VAT Act. Furthermore, the taxable amount is to be determined. Following pressure from numerous charities, the Federal Ministry of Finance has now tried to find a solution to this problem. This was not an easy task, as, to date, the taxable amount of an in-kind donation has not been determined by the original acquisition or production costs but rather by the fictitious purchase price at the time of the donation – even for goods produced by a company itself.

3 Tax authorities’ approach

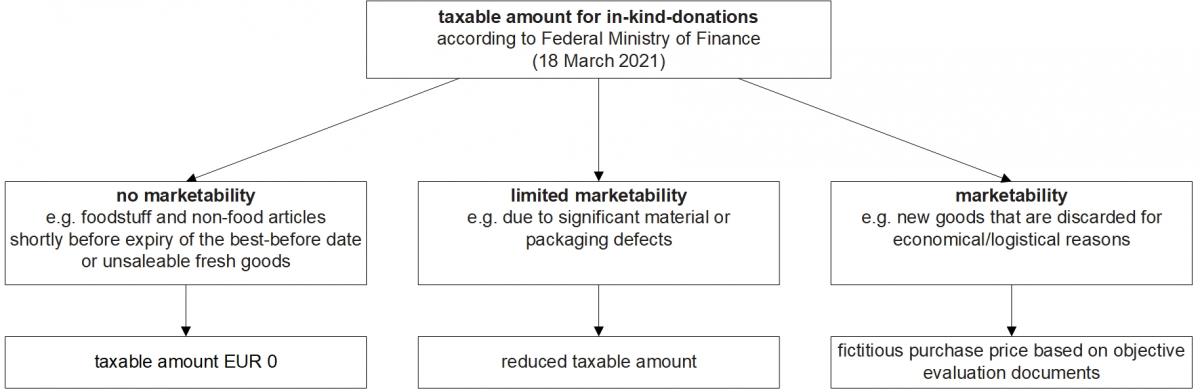

The Federal Ministry of Finance first points out that the issue concerning the taxable amount would not arise at all if the goods were given away at a very low price instead of as a free donation. This is correct, but it does not solve the problem. Someone who has the intention to do a good deed does not wish to be paid for it. The Federal Ministry of Finance therefore sees the solution in the interpretation of the so-called “fictitious purchase price”. For this purpose, the tax authorities want to distinguish between marketable goods, goods with limited marketability and foodstuff:

It is irritating that the tax authorities classify the in-kind donation of new goods as marketable goods for which a fictitious purchase price must be assessed. According to the Federal Ministry of Finance, new goods are not limited in their marketability if they are, without any impairment, discarded from trade for economic or logistical reasons. This should apply even if these new goods would otherwise be destroyed. Exceptions to this rule are only to be granted for retailers during the ongoing Corona crisis: in-kind donations made from 1 March 2020 to 31 December 2021 will not be taxed in the instance where retailers are being significantly affected by the Corona crisis.

4 Opinion

The Federal Ministry of Finance’s approach will prove helpful in some constellations so that a taxable amount of EUR 0 may be assumed. In many cases, a reduced taxable amount might possibly be achieved. This is, however, bound to result in tax disputes, as it is currently unclear how such a reduced taxable amount is to be determined. This will result, in most cases, in in-kind donations not being made at all. After all, who wants to do good and then be faced with VAT claims years later?

In my opinion, a better approach would have been not to seek a solution through the question of the taxable amount but rather to have interpreted the taxation of supplies carried out free of charge in a restrictive way. In accordance with Art. 16 of the EU VAT Directive, a supply carried out free of charge is not to be assumed if there is no threat of untaxed final consumption. Sec. 3 para. 1b of the German VAT Act must be interpreted in conformity with the Directive. This is also in line with the ECJ (see ECJ judgment of 16 September 2020, para 66, Mitteldeutsche Hartstein-Industrie, and KMLZ VAT Newsletter 52 | 2020). In the absence of a specific identifiable recipient, there is, in fact, no risk of untaxed final consumption if the in-kind donation goes to a charitable institution and is thereafter distributed to people in need. The fact that the advantage may ultimately benefit a group of persons in need, i.e. the “weakest members”, is not sufficient for the assumption of a taxable supply carried out free of charge – entirely in the spirit of Gustav Heinemann’s words.

Contact:

Prof. Dr. Thomas Küffner

Lawyer, Certified tax consultant,

Certified public accountant

Phone: +49 89 217501230

thomas.kueffner@kmlz.de

As per: 25.03.2021