1 Background and current developments concerning taxable transactions

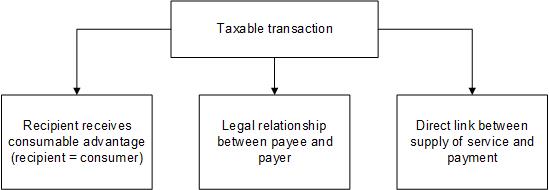

A transaction is only subject to VAT if all of the following conditions are met:

The ECJ and the national courts recently clarified the facts concerning the issue of what constitutes a direct link between a supply of service and payment. It was found that uncertainties can interrupt this direct link. Thus, the ECJ (C-432/15 - Baštová) and the Federal Fiscal Court (V R 21/16) denied that placement-dependent winnings resulting from horse races and poker tournaments are subject to VAT (see KMLZ Newsletter 37 | 2017).

2 Facts

In 2009, the Plaintiff participated in a TV show where 12 participants moved into a house together, with an ultimate winner to be determined through a series of matches. The Plaintiff won the show. In addition to a weekly "expense allowance", the Plaintiff received a winning called "project prize". The participants transferred both their picture and sound recording rights to the producers of the show. In addition, prior to the airing of the show’s first episode, the participants were required to make themselves available for various promotional activities, including photo shoots and interviews.

The tax office assumed a direct link between participation in the TV show and all achievable payments. Through their personal behavior, the participants could influence whether or not they remained on the television show. Therefore, the tax office was of the opinion that the element of luck and moments of coincidence were not as pronounced as in a poker game and that the weekly lump sums and prize money were not infinite.

In its judgment, the Tax Court in Munster contradicted the decision of the tax office (judgment of 12.09.2017, 15 K 2665/14 U). The Court found that both the "lump-sum for expenses" and the "project prize" were subject to uncertainties. Thus, there could be no direct link in accordance with the principles of the Baštová judgment. Also, the transfer of the contestants’ picture and sound recording rights could not result in a direct link. The appeal was not allowed. Consequently, the tax office then filed a complaint in accordance with sec 115 para 2 No 1 of the Code of Procedure of Fiscal Courts against the non-admission of the appeal.

In its decision of 25.07.2018 (XI B 103/17), the Federal Fiscal Court adopted the tax court’s decision and rejected the complaint of the tax office as being unjustified. It had already been clarified, by the case law of both the ECJ and the Federal Fiscal Court, that it was merely the appearance money and other fixed remuneration, which led to a taxable transaction when participating in competitions, not placement-related winnings. Procedurally correct, the Tax Court in had held that the remunerations were entirely performance-related winnings. In so doing, it also took into consideration the transfer of picture and sound recording rights, which were connected with participation in the show. Insofar, however, a direct link between this transfer of rights and the producers’ supplies was denied.

The judgment of the Tax Court and the Federal Fiscal Court decision confirmed this latest development as regards the direct link between supply and payment. The principles can also be applied to other scenarios. Accordingly, the decisive parameter for a direct link between a supply of service and payment is whether or not the activity, to which the performance-related payment relates, is associated with any uncertainties. For example, transaction is not subject to VAT if the remuneration is only paid upon achievement of a personally influenced competitive result. This is due to the fact that the ultimate result is uncertain. According to consistent ECJ case law, the question of whether a supply of service exists cannot depend on the success of an activity. In contrast to this, appearance money is subject to VAT because it is paid for the mere appearance and thus for a fixed event. According to the Federal Fiscal Court decision, the fact that, in addition to the activity associated with uncertainties, there is a further, definite activity for which no fixed payment is made - in the decided case - the granting of exploitation rights, does not lead to the success payment being taxable. At the time of the transfer of the rights, any payments were uncertain. Whether or not the granting of rights is subject to VAT must not depend on a payment to be made only in the event of uncertain success. The term of supply of services is objective in nature and is applicable irrespective of the purpose or results of the transactions concerned. It would be contrary to this to assume a supply being subject to VAT only when a certain result is achieved.

Taxable persons are recommended to check very carefully to which activities payments relate and at what point in time any uncertainty about such payments exists, when concluding contracts for success-dependent remuneration. If there is uncertainty, at the point in time the service is rendered, whether or not a payment will be made, the transaction is not subject to VAT.

Contact:

Eveline Beer

Lawyer, Certified Tax Consultant

Phone: +49 211 54095335

eveline.beer@kmlz.de

As per: 20.02.2019