1 Consideration of the structuring

Imagine that you are not entitled to deduct input VAT due to your VAT exempt transactions. How about creating a small parent company for your existing company and then try using this structure to benefit from the input VAT deduction?

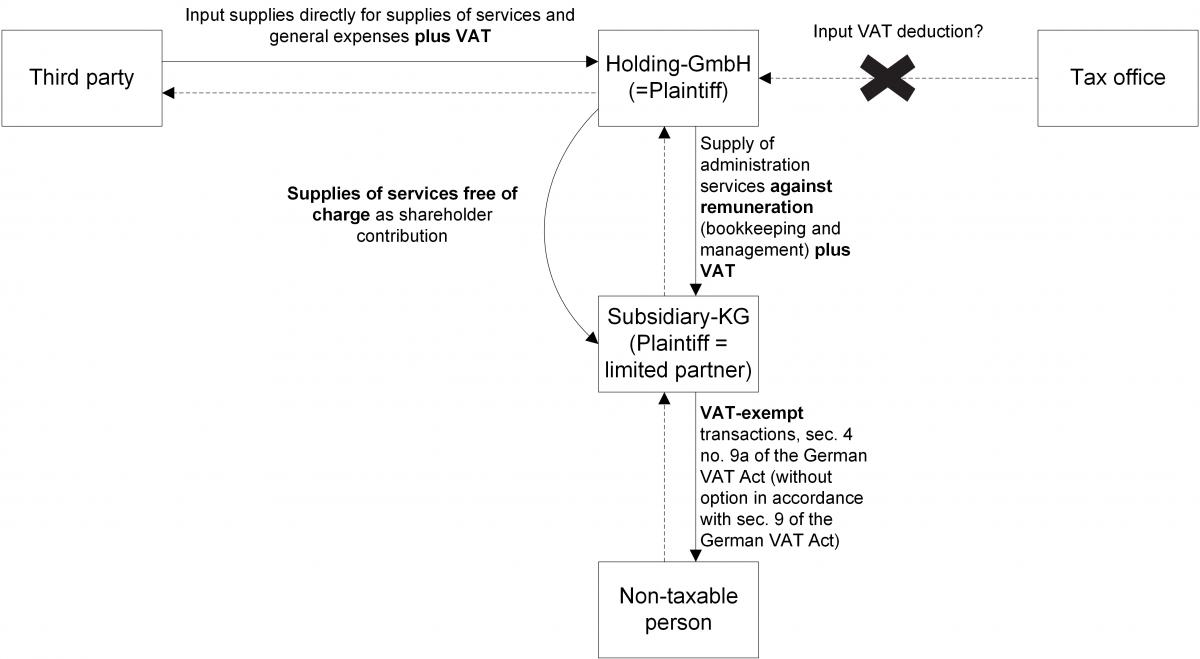

We call this parent company a holding company (in the diagram below: Holding-GmbH). The holding company should not only hold the participation passively, but should also exert active influence over the subsidiary (in the diagram below: subsidiary-KG). Finally, we need a holding company, which is economically active (a so-called management holding company). The holding company renders supplies of administration services to the subsidiary in the form of business and accounting services against remuneration. It is important, that the Holding and the subsidiary must not form a VAT group.

In order to achieve the deduction of the input VAT, a small change is necessary. The subsidiary no longer performs the purchases as it is not entitled to deduct input VAT. Instead, the parent company performs all future purchases. This should also be necessary for reasons beyond tax law, namely to avoid accusations of abuse of structuring at a later time. Corresponding evidence should be available. However, in order not to jeopardise the parent company’s input VAT deduction, the procured supplies are not passed on to the subsidiary against remuneration, but rather, are paid into the subsidiary free of charge as shareholder contributions. Is in such a constellation the parent company still entitled to input VAT deduction using this structure? Is this the new pull a rabbit out of a hat trick in VAT law?

It was for the Tax Court in Lower Saxony to decide on this issue in its decision of 19.04.2018 (Ref.: 5 K 285/16). The judgment is not final. An appeal is pending before the Federal Fiscal Court (Ref.: XI R 22/18).

2 Opinion

The Tax Court in Lower Saxony agreed with the Holding and came to the conclusion that it was entitled to deduct input VAT as a result of the fact that the Holding held the participation within the business sphere due to the supplies of administration services against remuneration. Thereby categorizing the parent company as a so-called economically active management holding company. The Tax Court found that the input VAT deduction was therefore to be granted in full for those general expenses, which could not be directly allocated. There is no reference to a non-business purpose. Supplies of services as shareholder contributions could form part of the economic activity. This decision of the Tax Court in Lower Saxony is consistent with the ECJ judgements "Marenave Schifffahrt" and "Larentina+Minerva". In the case of these judgments, the incoming supplies served the purpose of procuring capital, which was then deposited as shareholder contributions. In the opinion of the Tax Court in Lower Saxony, the facts of the said ECJ cases were comparable to the facts in the case it was asked to decide.

The Tax Court also found that the parent company gained no unlawful advantage in this situation. The Tax Court went on to state that: "To the same extent it would be "contrary to the system" if the shareholder contributions were allocated to the non-economic field of activity and the holding companies achieved revenue subject to VAT”. This would result in a final VAT charge despite fully taxable output supplies. The Tax Court rightly points out that the "system break" is thus not an isolated consequence of the application of the case law concerning the status, as a taxable person, of a management holding company to cases of non-cash contributions, but is immanent in the entire case law of the ECJ on the delimitation of the economic and non-economic area of a company in investment cases.

3 Conclusion

The court case is extremely interesting and consultants should familiarise themselves with this new approach. But be careful: “Pulling a rabbit out of a hat” tricks are used to describe solutions that are inventive or unusual. But, they can go wrong. The structure is actually not safe. The Federal Fiscal Court could conclude that the input supplies were directly connected to a benefit in kind and could therefore ultimately deny input VAT deduction.

Contact:

Prof. Dr. Thomas Küffner

Lawyer, Certified tax consultant,

Certified public accountant

Phone: +49 89 217501230

thomas.kueffner@kmlz.de

As per: 19.03.2020