1 Background

In general, a company’s head office and its branch are regarded as one taxable person – even across the border. Therefore, supplies between them are generally not taxable. However, in 2014, the ECJ made a decision in the case Skandia America (C-7/13) which established an exception to this general rule. Skandia America’s head office was established in the USA and its branch was located in Sweden. The latter was part of a Swedish VAT group. The ECJ assumed that, in this case, services rendered between the head office and its branch could be taxable.

2 Facts

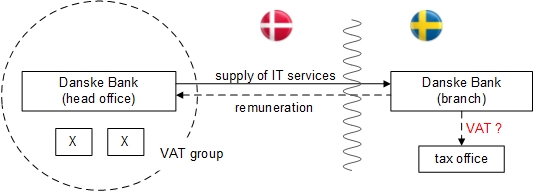

The ECJ has now ruled on similar facts in the case Danske Bank (C-812/19). Danske Bank’s head office is situated in Denmark and is part of a Danish VAT group. Danske Bank maintains a branch in Sweden. The head office provides IT services to its Swedish branch against reimbursement of costs. According to the Swedish tax authorities, these supplies of IT services are subject to VAT in Sweden under the reverse charge mechanism.

3 ECJ judgment

Taxable supplies always require two parties. The supplies of IT services would therefore not be taxable if the head office and branch formed one taxable person (as the supply would constitute an “internal transaction”). In the case at hand, however, the ECJ considers Danske Bank’s head office and its branch to be two separate taxable persons. In Denmark, the VAT group itself, and not the head office, is considered to be the taxable person. Since the effects of a VAT group are limited to the territory of one Member State, the Swedish branch cannot be part of the Danish VAT group. Thus, according to the ECJ, the VAT group (as one taxable person) renders the IT services to the Swedish branch (as another, separate taxable person), resulting in a taxable supply of services for consideration. The ECJ thus applies the principles of its judgment in Skandia America to the present case.

4 Consequences for the practice

This judgment could have far-reaching practical consequences. It is conceivable that, following this judgment, services rendered between head office and branch might be considered taxable in all cases in which head office and branch are established in different countries and one of them is part of a VAT group. As regards some points, the ECJ judgment contains statements, which are phrased more generally than was the case in the Skandia America judgment (e.g. para. 26). The taxation of these supplies becomes economically relevant if the recipient is not fully entitled to deduct input VAT.

However, in Germany in particular, the question arises as to which constellations the ECJ judgments Danske Bank and Skandia America are applicable. The ECJ considers the VAT group itself to be the taxable person. The VAT group renders or procures the services. This is why, according to the ECJ, no internal transactions between a head office and its branch can be assumed. From a German point of view, however, the controlling company of a VAT group is considered to be the taxable person. The controlling company renders or procures the services. If, for example, the head office is the controlling company, internal transactions with the branch (to or from the controlling company) are possible. No other taxable person, such as the VAT group, is involved.

In this context, the additional question arises as to whether the German system of a VAT group, with the controlling company being the taxable person (and not the VAT group as such) will be upheld. We remember: The XI Senate of the Federal Fiscal Court, unlike the V Senate, has expressed its doubts in an ECJ referral as to whether the German law may consider the controlling company to be the taxable person (see KMLZ-Newsletter 15 | 2020 and 26 | 2020).

What is to be done in the light of all of these hitherto open questions? In Germany, sec. 2.9 para. 2 sentence 2 of the German VAT Circular, to the extent that it applies, grants protection of legitimate expectations until such time that it is amended. According to this provision, cross-border supplies within one taxable person (e.g. controlling company and fixed establishment) are deemed to be non-taxable internal transactions. At the same time, however, each cross-border supply must be analysed according to the law of the respective other Member State. It is to be determined how the local tax authorities have so far dealt with the Skandia America judgment and how they will deal with the Danske Bank judgement.

The Federal Ministry of Finance published a draft letter regarding the ECJ judgment Skandia America. According to this draft, the ECJ judgment would have been applied only in a very restrictive manner. In doing so, the Federal Ministry of Finance was in line with the recommendation of the EU Commission’s VAT Expert Group. However, the Federal Ministry of Finance has not published a final letter to this effect.