1 Background

Tax structuring is not common in VAT law. It is not very common for us to present Tax Court decisions in our KMLZ Newsletters either. We only do so if we consider a decision to be so crucial that we expect it to have a significant and broad impact. This was the case with the Tax Court of Lower Saxony decision of 19 April 2018, which we presented to you in our KMLZ VAT Newsletter 09 | 2020. You may remember: The Plaintiff claimed input VAT deduction, although this would have been ruled out due to sec. 15 para. 2 of the German VAT Act, by way of an upstream holding company. As it turned out and to the surprise of many, the court of first instance confirmed the Plaintiff’s view and granted him the deduction of input VAT. Let us have a quick look at the facts:

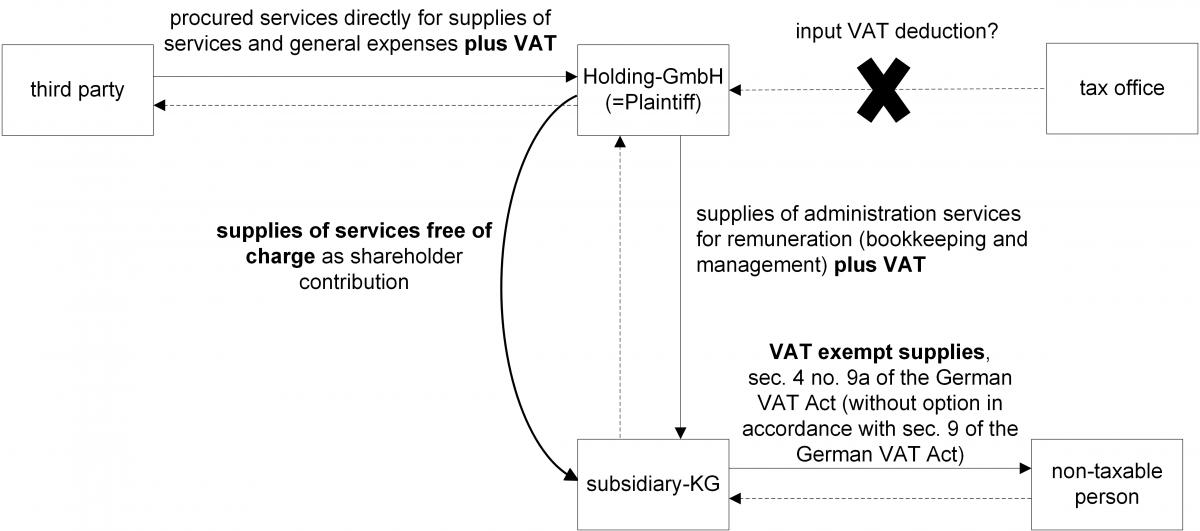

The subsidiary (KG) was not entitled to input VAT deduction according to sec. 15 para. 2 of the German VAT Act, as it rendered VAT exempt supplies. In order to nevertheless achieve the input VAT deduction, the parent company (Holding GmbH), instead of the subsidiary itself, procured the services. The Holding GmbH was made an economically active holding company by rendering supplies of administration services to the subsidiary in return for a small remuneration. There was no VAT group. In a second step, the holding company passes on the procured services, which it claimed input VAT deduction for, to the subsidiary as a shareholder contribution.

The Tax Court of Lower Saxony held that the upstream holding company was entitled to input VAT deduction as it was economically active. The procured services were deemed to be general expenses that could not be directly allocated and therefore entitled to input VAT deduction. There was no link to a non-economic sector of the holding company because shareholder contributions could also form part of the holding company’s economic activity. So, the input VAT deduction on the supplies was achieved by the structure of the upstream holding company.

2 Federal Fiscal Court refers the new upstream holding model to the ECJ

What should not be, cannot be – this is how the referral by the XI. Senate of the Federal Fiscal Court of 23 September 2020 (XI R 22/18) can be summarised. That is to say, there should not be any so-called “upstream models” in holding structures. The Federal Fiscal Court ruled that the holding company is, in principle, entitled to input VAT deduction. After all, it is an economically active holding company since it rendered – even if only to a very small extent – supplies of services to the subsidiary. However, the procured services could not be allocated to a specific output supply that would entitle the holding company to deduct input VAT. Therefore, the question arose as to whether the procured services were part of the taxable person’s general expenses and thus cost elements of the goods and services supplied by it. In this case, a direct and immediate link would exist. From the Federal Fiscal Court’s point of view, this is exactly the problem: The services were procured in order to be passed on to the subsidiary as a (non-taxable) shareholder contribution in a second step. Can these costs then constitute part of the cost elements of the taxable supplies of administrative services?

The Federal Fiscal Court doubts this. According to the more recent opinion of the ECJ in the C&D Foods Acquisition case, as regards input VAT deduction, the exclusive reason for the supply at issue should be taken into account. With reference to the case at hand, the Federal Fiscal Court considers the supplies to be directly and immediately linked to the (largely) VAT exempt activities of the subsidiary. It considers whether, in accordance with EU law, the holding company itself is irrelevant and must be seen through so that the subsidiary’s VAT exempt output supplies are decisive as regards the holding company’s input VAT deduction. Since these exclude input VAT deduction, the holding company can therefore not claim input VAT deduction. The procured services of the holding company are not a direct cost element of its supply of services to the subsidiary. Thus, no upstream model for VAT purposes, after all? In the event that the ECJ, contrary to expectation will, in principle, affirm input VAT deduction, the Federal Fiscal Court asks for clarification on whether this upstream model constitutes a form of abusive structuring. Although the VAT Directive does not provide for a provision, which corresponds to sec. 42 of the German Fiscal Code, the ECJ – in very narrowly defined exceptional cases – also sees a type of “abusive structuring”.

3 Conclusion

There are many arguments against input VAT deduction. The ECJ's decision will be interesting in any case. Whereas in the past, the extent of a holding company's economic activity would have been questioned in such a case, what matters today is whether and to what extent input VAT deduction can be limited. It is to be welcomed that the Federal Fiscal Court affirms the economic activity of a holding company even in the instance where only a small part of the holding company’s supplies of services are rendered to its own subsidiary. In principle, input VAT can then be deducted. This is an important signal. The former issue on the scope of the economic activity of holding companies will no longer be discussed. It is now for the ECJ to clarify the question as to which extent procured services, passed on to the subsidiary as non-taxable shareholder contributions, entitle to input VAT deduction.

Contact:

Prof. Dr. Thomas Küffner

Lawyer, Certified tax consultant,

Certified public accountant

Phone: +49 89 217501230

thomas.kueffner@kmlz.de

As per: 18.02.2021