1 Facts

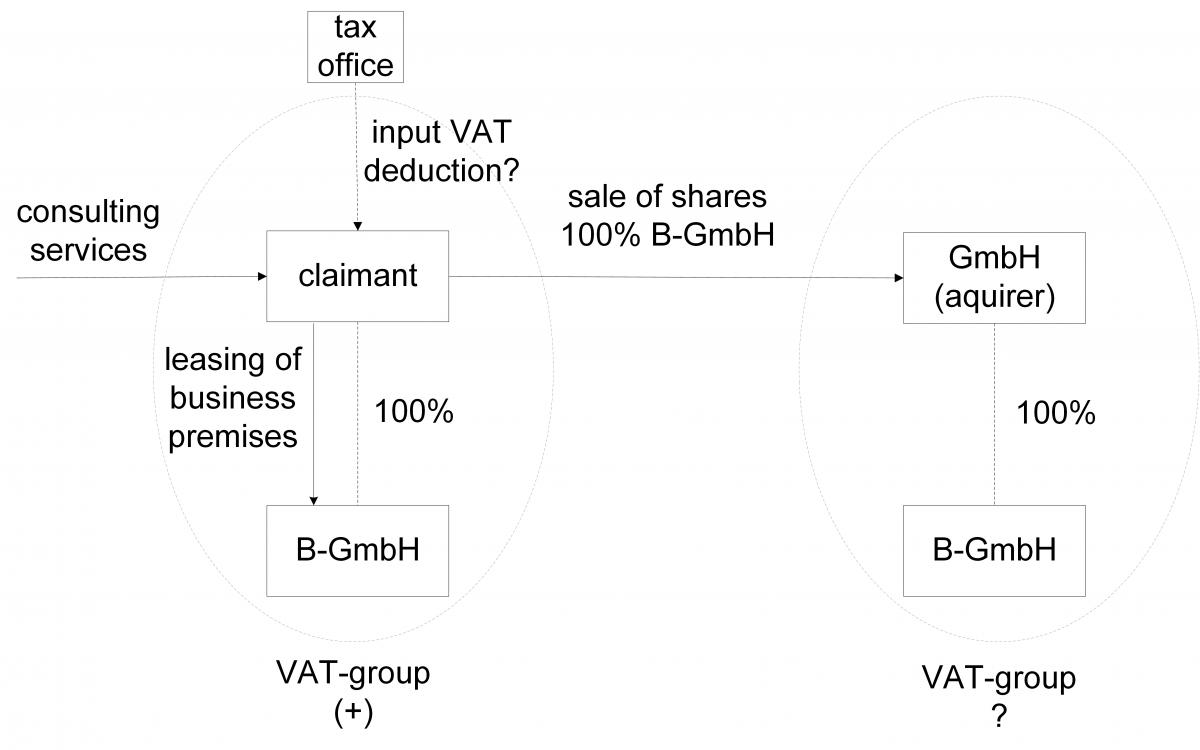

The claimant held, as part of its corporate assets, 100% of the shares in B-GmbH. The claimant leased business premises to B-GmbH for consideration and was economically active in this respect. The claimant was the controlling company of B-GmbH. Together with B-GmbH, the claimant carried out its own business activities in the form of producing goods. The claimant subsequently sold 100% of the shares in B-GmbH which was VAT exempt. The claimant did not opt for taxation. Also, the business premises were not transferred to the acquirer. It is unclear whether a VAT-group existed as between the acquirer and B-GmbH. The claimant requested a deduction of input VAT for consulting services fees, which services it had received for the sale of the shares. The claimant disputed in this regard with the tax office.

2 Legal assessment of the Federal Fiscal Court

In its decision of 18 September 2019 (XI R 33/18), the Federal Fiscal Court ruled as follows: Since the claimant had only sold shares and no other assets to the acquirer, the transaction was basically VAT exempt pursuant to sec. 4 no. 8 letter f) of the German VAT Act. Since the claimant did not opt for VAT pursuant to sec. 9 para. 1 of the German VAT Act, the deduction of input VAT would normally be excluded according to sec. 15 para. 2 no. 1 of the German VAT Act. Consequently, in the event of a dispute, the right to deduct input VAT would only be possible if the transfer of a going concern, pursuant to sec. 1 para. 1a of the German VAT Act (Art. 19 of the VAT Directive), was applicable.

Against the background of the case X (ECJ, judgement of 30 May 2013 - C-651/11), the Federal Fiscal Court concluded that the mere sale of 100% of a company’s shares does not constitute a transfer of a going concern. In the view of the Federal Fiscal Court, the mere sale of shares does not enable the aquirer to continue an independent economic activity. However, to continue an independent economic activity is a condition for the transfer of a going concern. Consequently, further circumstances must be apparent in the case of a share sale. In the view of the Federal Fiscal Court, such further circumstances will exist if the acquirer – as it was previously the case with the claimant – forms a VAT-group with the acquired company, in this case, B-GmbH. The claimant carried out its own entrepreneurial activities with the controlled company, B-GmbH. This activity consisted of the production of goods. If the acquirer also had a VAT-group with B-GmbH, the acquirer could continue this activity – namely, the production of goods. It would not be detrimental to the business that the business premises had not been transferred to the acquirer, in circumstances where the acquirer had procured such a property itself. The Federal Fiscal Court referred the case back to the Tax Court, so that the Tax Court could establish the facts necessary for a VAT-group on the aquirer’s side. The Tax Court had previously failed to do so.

3 Conclusion

The decision of the Federal Fiscal Court provides clarity for constellations of this kind. An examination of the VAT group on both the side of the seller, as well as that of the buyer, is thus of increased importance. It will not always be easy for a seller to assess whether an acquirer intends to establish a VAT group with the acquired company. He should therefore take necessary precautions to ensure that he can prove the existence of a VAT group on the acquirer’s side. He should also include a corresponding value added VAT clause in the civil law contracts in order to prevent possible financial risks.

In addition to the case decided by the Federal Fiscal Court, a non taxable transfer of a going concern can also be considered in terms of other constellations of the sale of a 100% shareholding. If the seller provides services in return for payment to a wholly-owned investment company whose shares he holds as an entrepreneur, and if he transfers this service relationship in return for payment to the purchaser, in addition to the shares in the company, the transfer of a going concern should be given. The acquirer is enabled by the paid service relationships to continue an independent economic activity as legal successor of the seller. In cases of doubt, sellers should secure themselves by applying for a binding ruling.

Contact:

Dr. Thomas Streit, LL.M. Eur.

Lawyer

Phone: +49 89 217501275

thomas.streit@kmlz.de

As per: 11.02.2020