1 Background

Digitalization is constantly evolving in the field of VAT. In some countries special declarations already have to be transmitted to the tax authority via digital programming interfaces and, in some cases, in real time. The British Treasury (HMRC) has joined this trend. The project “Making Tax Digital” (KMLZ Newsletter 13|2018) stipulates that VAT returns can only be transmittedto the HMRC via a particular interface. The British tax authorities are anticipating additional revenues amounting to £625 million in the project’s first year of operation.

2 Concrete specifications of “Making Tax Digital”

The changes will come into effect on 1 April 2019 and will apply to all foreign companies, registered in Great Britain, that exceed the “Making Tax Digital threshold” of £85,000 worth of taxable supplies in Great Britain. The specifications will apply as of 1 October 2019 if a company is merely VAT registered in Great Britain. Consequently, it will no longer be possible for data to be manually recorded on HMRC’s website or for VAT returns to be submitted in this way. Furthermore, the data flow, which extends from the recording in the accounting department to the reporting to HMRC, must be completely digital as of 1 April 2020. Thus, “Making Tax Digital” means, for companies in particular, that:

- all transactions must be recorded digitally,

- digital links connecting programs and files have to be inserted and

- a special Application Programming Interface (API) has to be set up in order to transfer data to and receive data from HMRC.

3 Impact on existing compliance processes

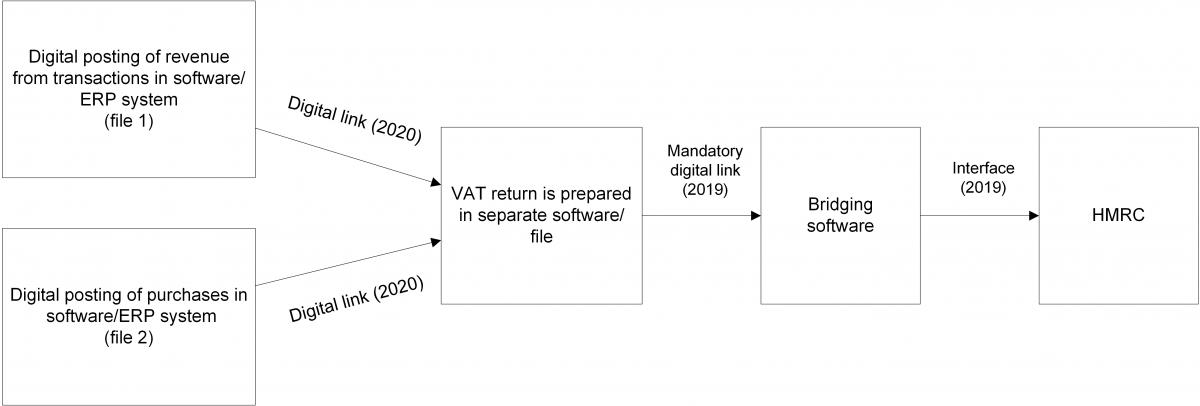

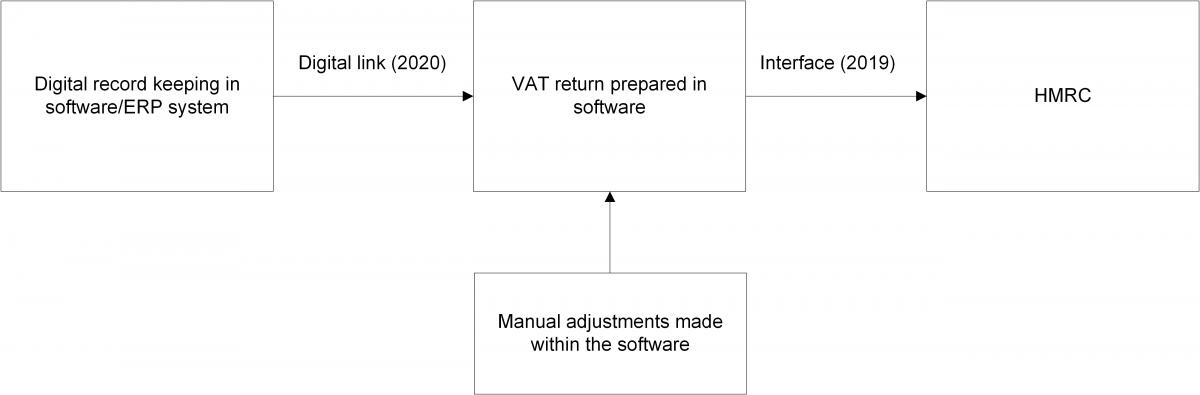

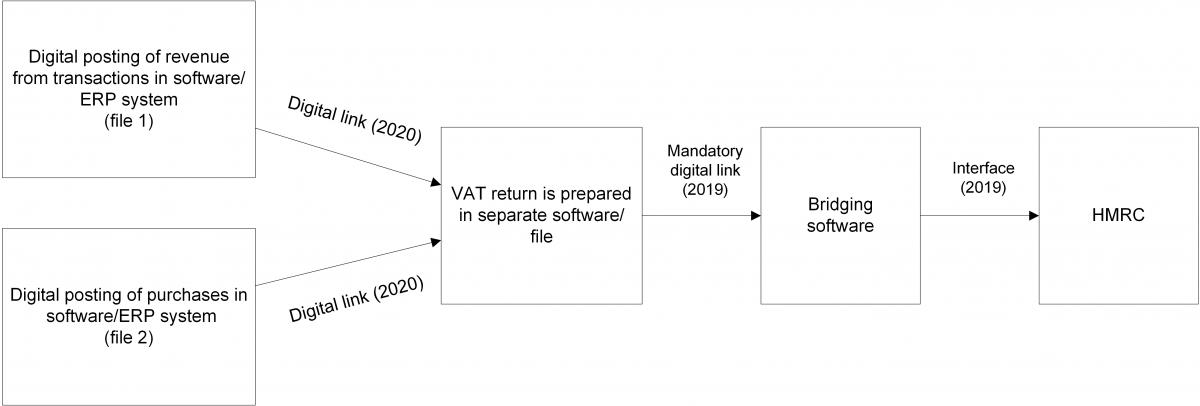

If accounting software has the required special Application Programming Interface (API), VAT returns can be transmitted directly via the software. However, this will only be possible in exceptional cases because manual adjustments are rarely made within the accounting software. Often, VAT reports are generated by accounting software while the VAT return’s final data is being calculated in a separate file. Afterwards, the actual VAT return itself is generated in other software or another file. In general, this procedure can be continued. However, the data transfer between the files or the files and the software has to be carried out via digital links. This includes linked cells in spreadsheets. A manual transfer via “copy and paste” will no longer be permitted. Each program and each file must be digitally connected to the subsequent source. Bridging software can be used for transmitting data to HMRC. This digital tool is a connection between the company’s accounting system, the used files and programs, and HMRC. Moreover, spreadsheets containing a special API will be possible.

4 KMLZ offers a software solution

KMLZ offers the filing of VAT returns via software with a digital API. With this API, the specifications of the digital data flow, valid as of 2020, can already be fulfilled today. Manual adjustments can be made within the software. In this way, the digital data flow will not be interrupted. Please feel free to contact us.

Contact:

Ronny Langer

Certified tax consultant, Dipl.-Finanzwirt (FH)

Phone: +49 89 217501250

ronny.langer@kmlz.de

As per: 10.12.2018