1 Decision of the German Federal Fiscal Court of 27.09.2018 – V R 49/17

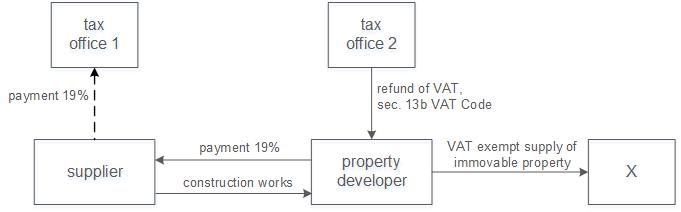

The dispute concerned the conditions under which a property developer can claim a refund of wrongly paid VAT from the tax authority pursuant to sec 13b German VAT Act (reverse charge scheme). The German Federal Fiscal Court has now clarified that, contrary to the opinion of the tax authorities (cf. German Ministry of Finance, letter dated 26.07.2017, Federal Tax Gazette I 2017, 1001, recital 15a), this is possible without restriction.

The refund claim is not dependent upon the property developer paying the VAT amount to the supplier. It also does not depend on whether the tax authorities can offset the claim. The property developer must receive the VAT refund under the general procedural conditions. No restrictions on the property developer’s claim have been specified by the legislator. It is not an abuse of rights, if the property developer applies for the refund of the VAT prior to having paid it back to the supplier. The court found that it was the tax authorities’ guideline which actually resulted in the property developer having wrongfully paid the VAT amount to the tax authorities.

2 Consequences for the practice

The judgment is particularly relevant in those cases in which a property developer cannot or need not satisfy the supplier‘s claim for payment. For instance, a developer cannot pay if he is insolvent. He need not pay if the civil claim of the supplier is, for example, time-barred. The statute of limitations is three years and it commences at the end of the year in which the developer has made the refund claim and the supplier first becomes aware of it (cf. German Federal Court of Justice, judgment of 17.05.2018 – VII ZR 157/17, recital 38).

Furthermore, a claim for refund interest, pursuant to sec 233a German General Fiscal Code, on the part of the property developer is now likely to be successful. The property developer's refund claim applies with respect to the taxation period for which he wrongfully declared and paid VAT. According to the German Federal Fiscal Court, sec 17 German VAT Act is not applicable.

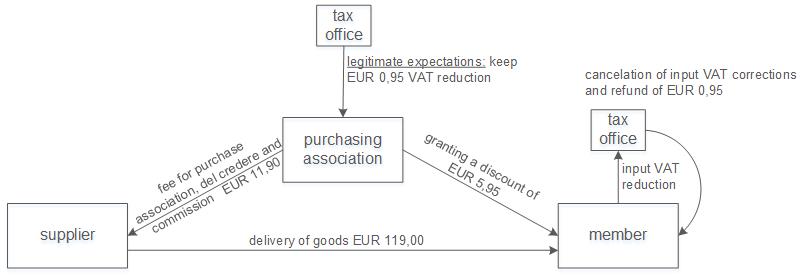

The findings of the German Federal Fiscal Court are also important for other industries: In the purchasing associations sector, intermediaries can no longer reduce their VAT due to changes in jurisprudence in circumstances where they have granted their members price reductions at the expense of their own commission (KMLZ Newsletter 07|2015). In exchange, the members are no longer required to reduce their input VAT deduction on the basis of the benefits passed on to them. In its letter of 27.02.2015, the German Ministry of Finance granted protection of legitimate expectations for purchasing associations. In this sector – comparable to property developer cases – the situation arose that members cancelled their input VAT corrections and applied for refunds, while the purchasing association relied on the protection of legitimate expectations. In some cases, this protection of legitimate expectations was interpreted more strictly by tax offices than it normally is. The present ruling of the German Federal Fiscal Court should now also clarify these cases: The tax authorities cannot and must not attach additional, stricter criteria to the doctrine of legal legitimate expectations!

Contact:

Dr. Thomas Streit, LL.M. Eur.

Lawyer

Phone: +49 89 217501275

thomas.streit@kmlz.de

As per: 27.11.2018