1 Background

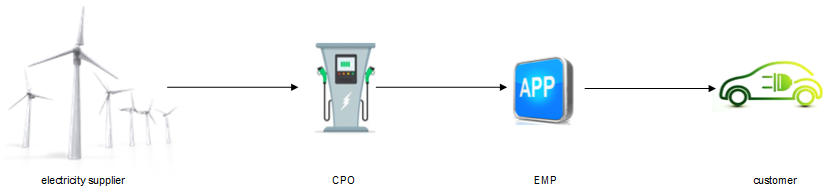

France has asked the European Commission's VAT Committee for an opinion on the VAT treatment of recharging electric vehicles (so-called “e-charging”). The charge point operator ("CPO") inter alia offers remote reservation in addition to the actual charging service, provides information on free terminals and their location and also provides a parking space. The e-mobility provider ("EMP") acts on its own behalf, vis-à-vis its customers, and forwards the service components received from the CPO to the end customer pursuant to an agreement concluded with the end customer.

2 Questions to the VAT Committee

The above scenario raises a large number of VAT-relevant questions, especially if an EMP is involved in a charging process, in addition to the CPO. The VAT Committee will give its opinion on whether the charging operation constitutes a single supply or several independent supplies. In the case of a single supply, the question arises as to whether it should be qualified as a supply of services or as a supply of electricity. In addition, in the case of a supply of electricity, it must be determined to whom the electricity supplier transfers the right to dispose of the electricity, i.e. to the CPO, the EMP or the end customer.

3 Interpretation by France

The French view is that the charging process constitutes a single supply, consisting of several components. The recharging of the battery is the principal supply. All other components of the supply share, from a VAT perspective, the fate of the principal supply, i.e. the battery charging process. France takes the view that, for VAT purposes, the battery charging operation constitutes a supply of electricity. It may be argued that the energy supplier transfers the right to dispose of the electricity to the CPO, which then renders a single supply in the form of a supply of electricity to the EMP. Finally, the EMP provides a single supply in the form of a supply of electricity to the end customer.

The French tax authorities are of the opinion that the principles established by the ECJ in the Auto Lease Holland case (ECJ, judgment of 19.09.2002 - C-185/01) do not apply to the relationship between the CPO, the EMP and the end customers. In Auto Lease Holland, the ECJ affirmed a direct supply of fuel by the oil company to the lessee in the relationship between the oil company, the fuel card issuer, the lessor and the lessee. In France's view, the present case differs from the Auto Lease Holland case, because in the present case, the EMP renders other supplies to the final customer in addition to the actual supply of electricity and acts in its own name and for its own account. France therefore considers that the CPO does not render a direct supply of electricity to the final customer.

4 Consequences for the practice

The VAT treatment of charging electric vehicles is controversial. Against this background, the electric mobility industry can look forward to a clarification by the VAT Committee. However, it should be noted that the VAT Committee cannot make legally binding decisions. For more legal certainty, a corresponding letter from the German Federal Ministry of Finance is to be issued, which, according to reports, may be published in the summer of 2019.

France's argumentation that the principles established by the ECJ in the Auto Lease Holland case should not apply in the present case is quite understandable. However, it should also be borne in mind that the ECJ, in its ruling of 15.05.2019 in the Vega International case (C-235/18), repeated and confirmed the principles of Auto Lease Holland. In its judgment, the ECJ denied a supply of fuel from the card issuer in the case of a refuelling process using a fuel card. Instead, the ECJ assumed the supply of a service from the card issuer in the form of a loan (see KMLZ VAT Newsletter 25/2019). If these principles are applied to the present case, the EMP’s supply would not be qualified as a supply of electricity, but rather like the supply of the card issuer, as a supply of a service.

Once the opinion of the VAT Committee is published, conclusions could also be drawn as to how the supplies of entrepreneurs with a comparable business, such as fuel card issuers, are to be treated from a VAT perspective.