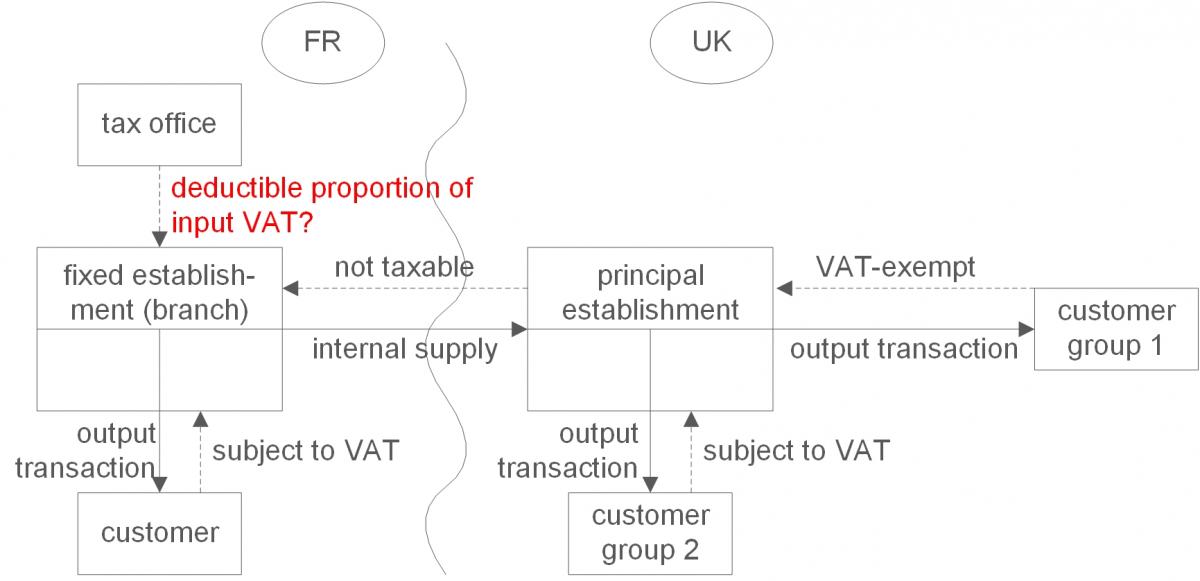

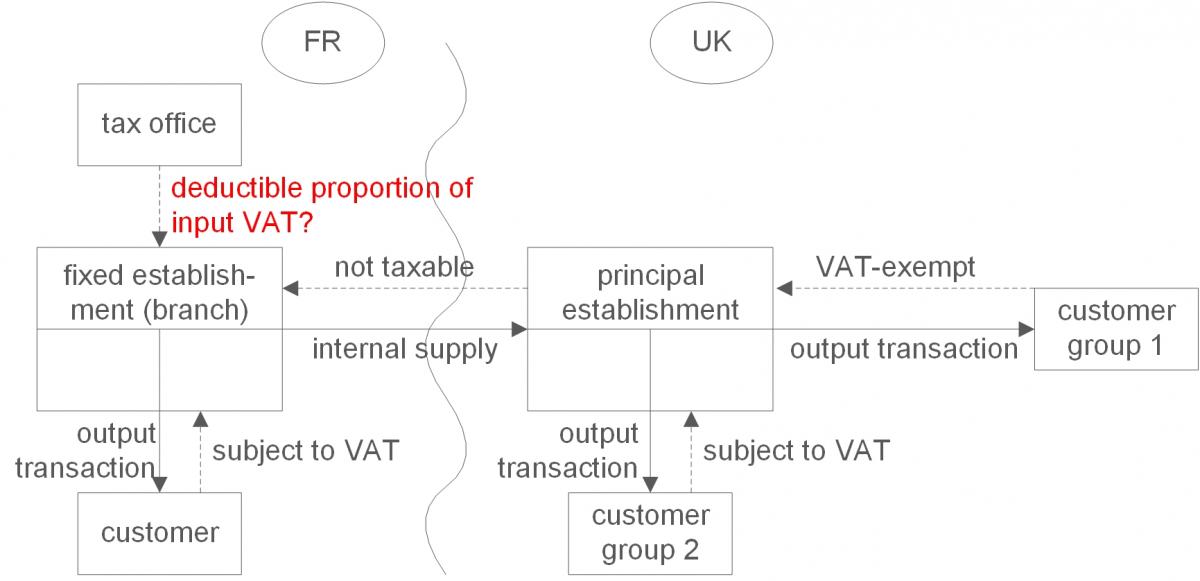

1 Facts - ECJ, judgment of 24.01.2019 – legal case C-165/17 – Morgan Stanley

The principal establishment of Morgan Stanley, located in the United Kingdom, carries out taxed and VAT-exempt transactions. The Morgan Stanley fixed establishment (branch) in France has opted to be liable to VAT on its financial supplies to local customers. The branch did not pay VAT on the supplies rendered against payment to the principal establishment, as these were internal supplies. The branch used its acquired services for supplies to its own customers, to the principal establishment or to both. In the case of the principal establishment, all supplies rendered by the branch are used for rendering taxed and VAT-exempt transactions and, therefore are general costs.

2 Decision of the ECJ

Input VAT deduction is only possible if the taxable person uses the supplies for transactions subject to VAT. Morgan Stanley's branchand principal establishment are one company and therefore supplies rendered between them are non-taxable internal supplies. The input VAT deduction of the French branch therefore depends on the nature of the output transactions of the principal establishment, in the case of acquisitions, which the branch uses for such internal supplies. These output transactions must be taxable not only in the Member State of the principal establishment (here, the UK), but (possibly also after exercising the option) also in the Member State of the branch (here, FR). The output transactions of the principal establishment were only partly subject to VAT, leading the ECJ to form a deductible proportion of input VAT (pro-rata rate) using a turnover-based allocation proportion. The fraction is formed as follows:

- Denominator: Sum of all output transactions by the principal establishment to which the input supplies of the branchrelate.

- Numerator: Sum of all taxable output transactions to which the input supplies of the branchrelate (this means the same supplies as in the dominator minus, above all, the VAT-exempt transactions).

If the branchuses the acquisitions for transactions to their own customers and to the principal establishment, the output transactions of the branchwill have to be added, in each case, when the above calculations are made.

3 Calculation exampleThe French branchof Morgan Stanley purchases three desks for EUR 1,000 each + EUR 200 French VAT. The first desk is used by an employee who only works for the branch’s customers. In France, the branchis entitled to full input VAT deduction (exclusively transactions subject to VAT).

The second desk is used by an employee, who exclusively renders internal supplies to the principal establishment in the UK. The principal establishment renders VAT-exempt output transactions in the amount of EUR 3,000,000 and taxed transactions in the amount of EUR 1,000,000. The taxed transactions would also be subject to VAT in France. The branchis entitled to input VAT deduction from the desk located in France in the amount of EUR 1,000,000 / EUR 4,000,000 = ¼, i.e. EUR 50.

The third desk is used by an employee who works for the branch’s customersand also renders internal supplies to the principal establishment. The branchrenders taxed output transactions in the amount of EUR 2,000,000. Therefore, in the fraction to be formed, the amount of these transactions of the branch shall be added to the transactions of the principal establishment in the numerator and in the denominator, since the acquisitions are intended for both. The branchis entitled to deduct input VAT from the desk located in France in the amount of EUR 3,000,000 / EUR 6,000,000 = ½, i.e. EUR 100.

When forming the pro-rata rate, the ECJ did not consider the extent to which the third desk is used for the different types of branch supplies. Taxable persons in Germany could take this into account. The ECJ’s decision should be considered by all taxable persons with VAT-exempt output transactionsand branches in other Member States, when forming a proportion for input VAT deduction. For these taxable persons it is, above all, important to observe that output transactions of the establishment receiving internal supplies have to be subject to VAT in both member states for these transactions to be taken into account when forming the pro-rata rate of the other establishment, which renders the internal supply.

Contact:

Dr. Michael Rust

Lawyer

Phone: +49 89 217501274

michael.rust@kmlz.de

As per: 31.01.2019