1. Tax court Munich’s judgment of 13 March 2013

The tax court Munich has broken new ground concerning VAT grouping. The court came to the conclusion that partnerships can be controlled members of a VAT group.

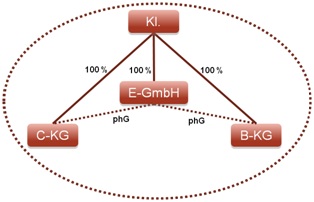

The tax court’s judgment is based on the following factual situation: The complainant provides advisory and administrative services in the area of rehabilitation, medical care, care and lodging. The complainant is the sole shareholder of the B and C limited company (both operating companies for retirement homes) as well as of the E limited company. During the relevant year, the B and C limited companies were transformed into a GmbH & Co. KG (equivalent of a LLP where the limited partner is the managing company). After this transformation, both the complainant (as limited partner) and the E limited company (as personally liable partner) were involved in the B and C limited company

The E limited company was authorized to manage both of the limited partnerships. The CEO of the E limited company, on the other hand, held a leading position at the complainant.

The complainant regarded the B and C limited partnerships as part of the VAT group even after the transformation. Consequently, supplies to the B and C limited partnerships were deemed to be not subject to VAT.

The tax court Munich has acknowledged the complainant’s point of view and affirmed the prerequisites of the VAT group. The B and C limited partnerships can also be controlled members of the VAT group as partnerships of the complainant, as both companies are integrated a) organizationally, b) economically and c) financially into the complainant according to sec. 2 para. 2 no. 2 of the German VAT Act

a) The CEO of the E limited company runs the businesses for the B and C limited partnerships at the same time. Furthermore, the CEO holds a leading position at the complainant’s.

b) The complainant carries out supplies for consideration to the B and C limited partnerships in the area of controlling, accounting, legal advice, IT and personnel administration.

c) The complainant holds 100% of the shares in the B and C limited partnerships. The complainant is able to directly impose his will on the B and C limited partnerships via the E limited company.

2. The interpretation of national law in line with Union law

The tax court Munich decided that it is not relevant that the B and C limited partnerships are not legal entities and, according to the wording of the national law in sec. 2 para. 2 no. 2 of the German VAT Act, do not fulfill the conditions for a VAT group. According to this, only legal entities (i.e. a limited company) can be controlled member of a VAT group.

However, the complainant can, to his benefit, refer to the favorable Union law, according to the tax court Munich’s opinion. The tax court justifies this with the principle of tenure neutrality. According to this tenure neutrality, partnerships and incorporated companies are generally to be treated equally. Therefore, not only legal entities can be a controlled member of a VAT group. A limitation like thiswould violate the principle of tenure neutrality.

This particularly applies if it is about a capitalistically structured partnership such as a GmbH & Co. KG. As this case is of fundamental significance, the tax court permitted the appeal with the Federal Finance Court.

3. Recommendations for the practice

The judgment allows plenty of scope for companies. By integrating partnerships into the VAT group, tax burdens can be reduced. This particularly applies for companies with VAT-exempt supplies that exclude input VAT deduction (health sector, financial industry, social institutions, etc.). As the tax court achieved this result by making direct reference to the Union law, taxpayers have a right to choose: They can refer to the favorable Union law but are not obliged to do so. The fiscal authority, however, does not have the possibility to choose as it is bound by the national law which would first have to be changed.

The tax court Munich’s judgment is trend-setting, as new ground is being broken concerning the VAT group. In the meantime, the tax court has received confirmation of its jurisdiction from the European Court of Justice (ECJ). The ECJ has recently concentrated on European prerequisites of a VAT group (art. 11 of the Directive 2006/112/EC) (see, inter alia, ECJ of 09 April 2013, C-85/11 – Commission/Ireland). According to this jurisdiction, even nontaxable bodies such as financial holdings, non-profit institutions or public authorities can form part of a VAT group. Under these circumstances, it is to be expected that the Federal Finance Court will confirm the tax court’s judgment.

Contact:

Prof. Dr. Thomas Küffner

Lawyer, Certified tax consultant, Certified public accountant

Phone: +49 (0)89 / 217 50 12 - 30

thomas.kueffner@kmlz.de

As per: 09.08.2013