1. Facts

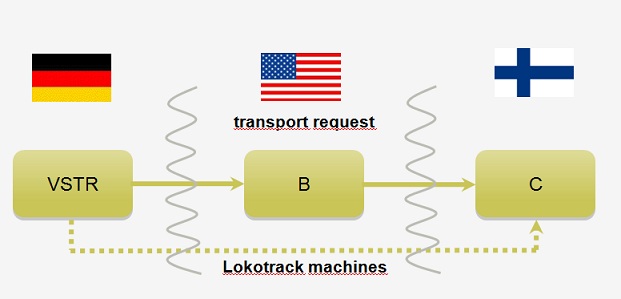

In November 1998, a German-based subsidiary of VSTR sold Lokotrack machines for the breaking of stones to the US-based company B. B had a branch in Portugal, however, it was not registered for VAT purposes in any member state of the EU. VSTR required B to disclose its VAT-ID-No. B did not disclose its own VAT-ID-No. in response to the request but rather that of its customer, C, a company based in Finland. An examination conducted by VSTR indicated that the VAT-ID-No. of C was valid. On behalf of B, a forwarding agency collected the Lokotrack machines from VSTR and transported them to Lübeck (Germany). The machines were subsequently shipped from Lübeck to Finland. VSTR issued an invoice to B with the VAT-ID-No. of C regarding a zero-rated intra-Community supply.

2. Shortened lawsuit history

In the first instance, the tax court in Saxony (Germany) deemed VSTR’s supply to B to be subject to VAT. There would be no zero-rating without B’s VAT-ID-No. VSTR appealed against this decision before the German Federal Fiscal Court. By decision of 10 November 2010, the Court submitted the issue to the ECJ for a preliminary ruling, asking whether zero-rating could depend on the customer’s VAT-ID-No. The German Federal Fiscal Court considered the supply by VSTR to B to be the supply to which the transport should be ascribed and did not make the question of assignment of this supply the subject of its discussion. The ECJ handed down its judgment on 27 September 2012 – C-587/10. The XI. Senate continued the proceedings and

issued the latest decision on 28 May 2013.

3. Key statements by the German Federal Fiscal Court

In its decision, the XI. Senate remitted the litigation back to the tax court in Saxony. From the XI. Senate’s point of view, the factual findings made by the tax court are not sufficient to determine to which of the supplies the transport should be ascribed. Furthermore, the German Federal Fiscal Court adds legal considerations to be considered by the tax court.

Firstly, the XI. Senate comments on sec. 3 para 6 sentence 6 of the German VAT Act. This section regulates the determination to which of the supplies the transport should be ascribed in a chain transaction if the middle entrepreneur transports or dispatches the item. Sec. 3 para 6 sentence 6 of the German VAT Act includes a statutory presumption to the effect that the first supply is the supply the transport should be ascribed to in a chain transaction. This statutory presumption can be rebutted. The XI. Senate refers to the fact that the 6th EU Directive did not include any regulation which is equivalent to sec. 3 para 6 sentence 6 of the German VAT Act. The XI. Senate does not share the popular opinion that sec. 3 para 6 sentence 6 of the German VAT Act fails to comply with EU law.

According to the XI. Senate’s point of view, sec. 3 para 6 sentence 6 of the German VAT Act does indeed comply with EU law. A full evaluation of all of the particular circumstances of an individual case is decisive. If this evaluation results in the conclusion that the first buyer has transported or dispatched the item as a supplier, the movement of goods cannot be assigned to the first supply. According to the XI. Senate’s opinion, it is relevant when the second person acquiring the goods receives the power to dispose of the goods. Consequently, VSTR does not carry out a zero-rated intra-Community supply if C already had the power to dispose of the machines before the intra-Community movement to Finland took place.

However, according to the XI. Senate, it is not necessarily decisive if B informs VSTRabout the selling-on of the machines before they had been handed over. Here, the XI. Senate strongly opposes the legal opinion of the German Federal Fiscal Court’s V. Senate. The V. Senate ruled, by judgment of 11 August 2011, (V R 3/10) with reference to the ECJ’s judgment in the legal case Euro Tyre Holding (judgment of 16 December 2010 – C-430/09) that such information is a decisive criterion. If the first buyer informs its suppliers about the selling-on before the transportation or dispatch, the movement of goods can no longer be assigned to the first supply. According to the XI. Senate, this opinion is not consistent with the ECJ’s jurisdiction in the legal case Euro Tyre Holding but even more so it cannot be applied on the judgment in the legal case VSTR.

Furthermore, the tax court in Saxony also needs to determine if VSTR has taken all necessary measures to receive the VAT-ID-No. of the first buyer, B.

4. Conclusion

It seems that, as yet, there is no final word regarding the determination to which of the supplies the transport should be ascribed in a chain transaction. The tax court in Saxony will, once again, take on the VSTR case. It remains to be seen how the V. Senate will react to the XI. Senate’s jurisdiction the next time it decides on a chain transaction. In judicial disputes, decisions concerning all circumstances require comprehensive detailed work. Entrepreneurs should continue to proceed with the utmost caution when “creating” chain transaction.

Contact:

Thomas Streit, LL.M. Eur.

Lawyer

Phone: +49 (0)89 / 217 50 12 - 75

thomas.streit@kmlz.de

As per: 25.09.2013