By means of two decisions of 11 December, 2013 the Federal Fiscal Court has, with the exception of its question on the input VAT deduction of holding companies (see Newsletter 06/2014), referred questions on VAT groups to the ECJ (C-108/14 and C-109/14).

1. Starting point

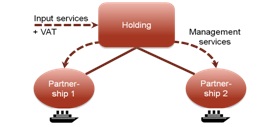

The parent companies of partnerships operating ships had incurred input VAT on the costs of raising capital for finan-cing of the partnerships. Please see our newsletter 06/2014 for the details on the relevant cases.

The holding companies argued that they were entitled to an input VAT deduction with respect to the costs of raising capital, as the partnerships were controlled companies in a VAT group.

2. The decision of the Federal Fiscal Court

The statutory requirements of a VAT group were not satisfied in the said cases. This is because, pursuant to the provision of sec. 2 para. 2 sent. 1 no. 2 of the German VAT Act, only corporations are eligible controlled companies of a VAT group. Partnerships cannot be controlled companies of a VAT group in Germany.

The Federal Fiscal Court takes the position that sec. 2 para. 2 sent. 1 no. 2 of the German VAT Act is not in line with the VAT Directive. The reason is that the rules of the VAT Directive do not prohibit partnerships from being controlled companies of a VAT group. This is because art. 11 of the VAT Directive provides that the member states may treat several „persons“ as one single taxable person.

Further, the Federal Fiscal Court calls into question whether the requirement of a relationship of subordination of the controlled company is in line with art. 11 of the VAT Directive. The Federal Fiscal Court has previously stated that affiliated companies, such as sister companies, could not form a VAT group (see Federal Fiscal Court of 22 April 2010 – V R 9/09). However, pursuant to art. 11 of the VAT Directive, it is sufficient for the existence of a VAT group that several persons are closely bound to one another by financial, economic and organizational links. Also, the Federal Fiscal Court argues that, pursuant to recent decisions of the ECJ (inter alia, ECJ of 25 April 2013 – C-480/10) the member states are not entitled to require conditions for the existence of a VAT group other than those laid down in art. 11 of the VAT Directive.

If the ECJ should also take the position that sec. 2 para. 2 sent. 1 no. 2 of the German VAT Act is not in line with European law, then it will have to decide whether the taxable persons can directly apply art. 11 of the VAT Directive.

3. Conclusion/Recommendations

If the ECJ also decides that partnerships are eligible controlled companies of a VAT group, it will be decisive whether the taxable persons will be entitled to directly apply art. 11 of the VAT Directive. If this is the case, taxable persons would have a right of choice to include partnerships in VAT groups. The tax authorities could not directly apply the VAT Directive as they would be bound by the current statutory rule of sec. 2 para. 2 sent. 1 no. 2 of the German VAT Act, at least until it is changed by the legislator.

If the ECJ decides that the requirement of a relationship of subordination of the controlled company under the controlling company is against the VAT Directive, a statutory amendment would not be necessary for the inclusion of affiliated companies in VAT groups. Rather, the requirements of a financial, economic and organizational inclusion would have to be interpreted differently. Therefore, not only the taxable persons, but also the tax authorities, could include affiliated companies such as sister companies in VAT groups. In the light of the massive consequences of such a decision by the ECJ, it would be extremely helpful if the tax authorities would then issue a grandfathering rule.

Companies that might be affected by the decision of the ECJ should start considering the consequences of the upcoming decision. If an inclusion of partnerships subsidiaries and affiliated companies is beneficial, it is possible to take steps in order to meet the requirements of a VAT group also with respect to these companies. Otherwise, companies should think about the necessary steps to be taken in order to prevent affiliated companies and partnership subsidiaries from becoming controlled companies of a VAT group.

Contact:

KÜFFNER MAUNZ LANGER ZUGMAIER

Rechtsanwaltsgesellschaft mbH

Unterer Anger 3

80331 München

Phone: + 49 (0) 89 / 2 17 50 12 - 20

E-Mail: office@kmlz.de

As per: 03.04.2014