1 Background

Council Directive (EU) 2021/514 sets out specific due diligence and reporting obligations for digital platform operators (the so-called DAC7 Directive). The Member States are obliged to implement the DAC7 Directive into national law by 31 December 2022. On 12 July 2022, the Federal Ministry of Finance presented a draft bill on the Platforms Reporting Obligations and Information Exchange Act (PMAustG) to implement the DAC7 Directive. According to this, digital platform operators are obliged to report information on income generated by providers on these platforms to the tax authorities. The Platforms Reporting Obligations and Information Exchange Act will come into force on 1 January 2023.

2 Affected platforms

All so-called platform operators are subject to the obligations of DAC7. This term covers any system based on digital technologies that enables users to contact each other via the internet using software and to conclude legal transactions aimed at (1) the provision of relevant activities by providers for other users or (2) the collection and payment of remuneration related to a relevant activity. It does not include platforms that (1) process payments in connection with a relevant activity, (2) list a relevant activity or advertise a relevant activity by users or (3) redirect or forward users to a platform.

3 Activities subject to the reporting obligation

The activities subject to the reporting obligation are (1) the temporary transfer of use and other rights of any kind in immovable property, (2) the supply of personal services, (3) the sale of goods, and (4) the temporary transfer of use and other rights of any kind concerning transport.

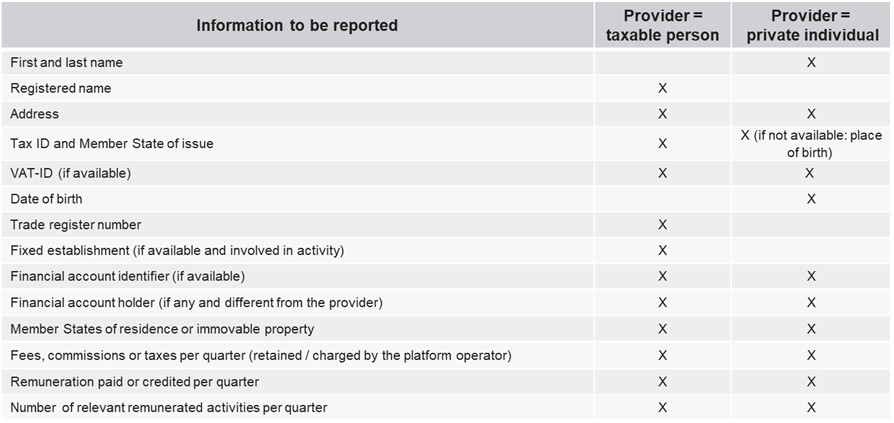

4 Information to be reported

If providers transfer the use and other rights of any kind in immovable property for a limited period of time, platform operators are required to also report further information (e.g. addresses of the advertised properties).

5 Due diligence obligations for platform operators

Platform operators are required to collect the information to be reported and ascertain the provider’s place of residence. In addition, platform operators must check the plausibility of certain reportable information (the seven first-mentioned information in the overview above). If a Member State or the EU provides an electronic interface for the validation of a tax ID or a VAT-ID free of charge, the platform operators must use this.

6 Reporting procedure

The information must be electronically reported to the German Federal Central Tax Office in accordance with the officially required dataset by means of remote data transmission via officially specified interfaces. The report for the respective calendar year must be submitted by 31 January of the following year, at the latest. Incorrect, incomplete or delayed reporting constitutes an administrative offence and may be punishable with a fine of up to EUR 50,000.

7 Recommendation for action

The reporting obligations in accordance with the DAC7 initially result in additional administrative obligations for the platform operators concerned. Section 22f of the German VAT Act already sets out special obligations for operators of electronic interfaces (e.g. online marketplaces) to keep records concerning the supply of goods from online traders to customers. However, the information to be reported pursuant to DAC7 goes far beyond the information to be recorded in accordance with section 22f of the German VAT Act. Moreover, not only online marketplaces that support the supply of goods fall within the scope of DAC7, but also platforms through which providers can, for example, render supplies of rental services or supplies of personal services. Affected platform operators should now review their previous practice of recording relevant information and adapt it to the new requirements by the end of the year. For the purpose of fulfilling their due diligence obligations, platform operators may also engage a third-party service provider or another platform operator.

Contact: