1 Facts

The plaintiff was a university professor of medicine and also the director of a medical “clinic”. As the clinic director, the plaintiff was entitled to treat private outpatients and inpatients and self-pay patients in his own name and to issue his own invoices to his patients for these treatments. The plaintiff and the tax office treated the former’s income from private medical invoices as income from freelance activities and VAT exempt supplies of medical treatment.

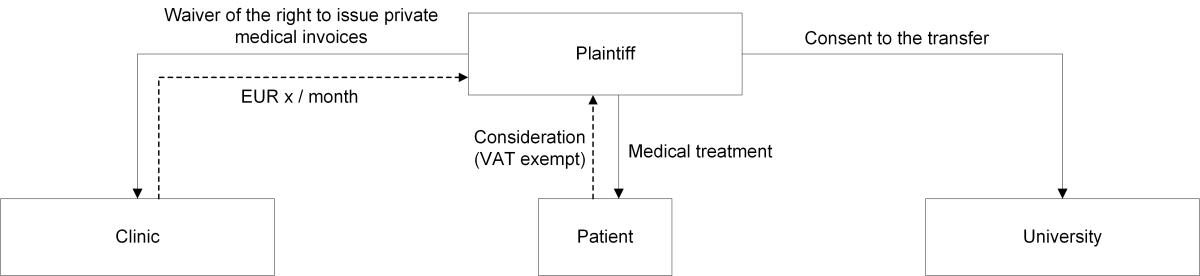

In the course of a restructuring, the plaintiff concluded a tri-party contract with the university and the clinic. In this contract, the plaintiff waived his right to manage the clinic and his right to perform and invoice patients for private medical treatment. He agreed to be transferred by the university to another research area. According to this agreement, the clinic paid the plaintiff a monthly amount as “compensation for the waiver of his right to perform and issue invoices for private medical work and all other financial disadvantages arising from this contract”.

2 German Federal Fiscal Court judgment of 30 June 2022 - V R 36/20

The Fiscal Court still assumed that the waiver of rights by the plaintiff did not take place “within the scope of his business activity”. Rather, the waiver was predominantly prompted by civil service law due to a link with the consent to the transfer. The German Federal Fiscal Court (BFH) took a different view. According to the BFH, the payment by the clinic was solely a consideration paid for the waiver of the right of the plaintiff to issue invoices in his own name for private medical treatments. In this respect, there was no reason under civil service law. The waiver of the right to manage the clinic was not compensated for by the monthly payment. Due to a violation of the rules of logic, the BFH did not consider itself bound by the contrary findings of the Fiscal Court. From the BFH’s point of view, the clinic, being the payer of the severance payment, was primarily concerned with the plaintiff’s authority to issue invoices in his own name vis-à-vis the patients. According to the wording of the contract, it was precisely for this reason that the payment was made. The BFH was not made aware of the other financial disadvantages of the plaintiff, which were named in the agreement. In such circumstances, where money is paid by the clinic, a direct link is considered to exist between the waiver of the right to issue invoices and the payment. This direct link also results in the finding that there is no taxable compensation.

This supply, in the form of a waiver, is not VAT exempt. Such a waiver does not constitute a medical treatment within the meaning of sec. 4 no. 14 of the German VAT Act. The waiver does not result in the treatment of a disease. The BFH’s previous jurisprudence on the so-called “actus contrarius” also does not provide for VAT exemption. Take for example, a tenant’s waiver of his right to continue a tenancy relationship in return for consideration. According to the BFH’s jurisprudence, this consideration is also VAT exempt, just like the VAT exempt letting itself. However, the BFH distinguishes the present case from this scenario. In the cases decided so far, the actus contrarius is found to take place in the same two-person relationship as the VAT exempt supply (i.e. between tenant and landlord). In the present case, however, the VAT exempt supplies and the waiver took place in different relationships. The plaintiff provided the medical treatment to the private patients, the waiver was agreed between the plaintiff and the clinic.

3 Consequences for the practice

Two conclusions can be drawn from the BFH judgment, interest in which extends beyond the individual case. On the one hand, the BFH judgment comments on the relationships in tri-party contracts. In order to determine the correct VAT treatment, the supplier, the recipient and the nature of the supply must be determined. In this respect, it must be determined as to what the interests of the parties involved are and who receives which benefits. If, based on this interpretation, the supplier (here the plaintiff) has an interest in the payment precisely with regard to the supply (here the waiver of the right to income received from carrying out private medical services), a direct link exists between the two. Even if the supplier also carries out a supply (here consent to the transfer) to a third party under the tri-party contract, this does not affect the direct link that has arisen. In this respect, the judgment is in line with corresponding decisions on the right to input VAT deduction.

On the other hand, the BFH generally specifies the conditions under which a waiver, as an actus contrarius, is like the supply itself, VAT exempt or not. The BFH clarified that the waiver must take place between the same persons as those participating in the actual supply. Another aspect, not addressed by the BFH, but also resulting from the three-person relationship, speaks in favour of this result. In the case at hand, the possible actus contrarius (waiver) is carried out by the person who also provided the VAT exempt supplies (medical treatment). In the cases decided so far, it has always been the recipient who has performed the actus contrarius.

Contact:

Dr. Michael Rust

Lawyer

Phone: +49 89 217501274

as per: 23.11.2022