1 Background

In order to attract new customers, sellers of subscription models (e.g. magazines, internet, telephone, cell/ phone and electricity rates, checking accounts) frequently offer new customers a free promotional gift when they take out a subscription. The question then arises as to whether the promotional gift, as a dependent ancillary supply, shares the fate of the main supply or whether it is a separate supply. If the latter is "free of charge", it must then be determined whether this transaction is subject to VAT as a supply carried out free of charge. While the tax authorities have previously classified the supply of a magazine with a gift in kind as a single supply at a reduced VAT rate, at least in the case of long-term magazine subscriptions, case law has recently rejected a single supply and taxed the promotional gifts separately, at the standard rate.

2 ECJ Judgment of 05.10.2023 (C-505/22) - Deco Proteste - Editores Lda

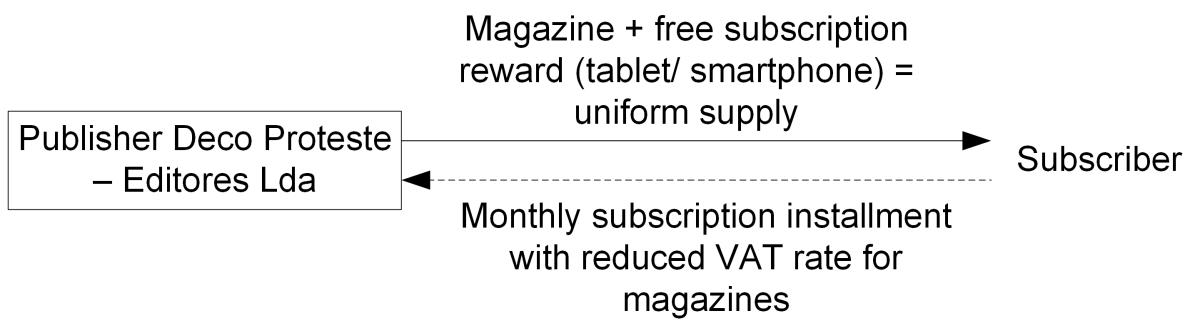

The publisher, Deco Proteste - Editores Lda, sells magazines in Portugal exclusively as subscriptions, without a fixed contract period. To attract new subscribers, it offers a campaign, several times a year, where new customers receive a free one-time subscription reward when they take out a subscription. The subscription reward is a smartphone or tablet with a purchase price of less than EUR 50. After paying the first monthly subscription installment, the new subscriber receives the magazine and the subscription reward. The subscriber may keep the subscription reward even if he cancels his magazine subscription immediately after receiving the subscription reward. The publisher treated the subscription reward as an ancillary supply to the main supply of the magazine and applied the reduced VAT rate for magazines. The tax authority, on the other hand, considered the free subscription reward to be a taxable supply carried out free of charge, which it subjected to the standard tax rate of 23%, calculated on the purchase price.

The ECJ ruled in favour of the plaintiff: The subscription reward is a dependent ancillary supply to the main supply of the magazine.

The ECJ established two criteria for the qualification of the subscription reward as an ancillary supply:

1. The subscription reward may not constitute an end in itself for the customer, but merely the means to make use of the main supply of the supplier under optimal conditions. From the point of view of an average consumer, however, the sole purpose of the subscription reward is to provide an attraction to subscribe, thereby increasing the number of subscribers and boosting profits. In this context, it is irrelevant that some subscribers cancel immediately after receiving the reward, as this is considered in the publisher's commercial calculation. In addition, the subscription reward makes it possible to use the main supply of the magazine under the best possible conditions, by allowing access to the magazine in digital form.

2. The subscription reward must have a low value in relation to the main supply. In the absence of information on the monthly subscription rate, the ECJ used the low value of gifts as a guideline, which is less than EUR 50 in Portugal (and EUR 35 net in Germany, sec. 3.3 para. 11 sentence 2 German Administrative VAT Guidelines).

The legal consequence of the qualification of the subscription reward as an ancillary supply is that (1) the monthly subscription installment is the uniform consideration for two supplies (= the supply subject to VAT according to the agreement and - In terms of VAT law - the supposed gift), (2) a uniform (reduced) VAT rate applies, (3) the full input VAT deduction is to be granted if the main supply is subject to VAT, and (4) there is no independent (subject to VAT) supply carried out free of charge.

3 Consequences for the practice

The ECJ expands the view of the tax authorities regarding subscriptions with a short notice period and at the same time restricts it (as did Hamburg Fiscal Court, ruling dated 19 January 2022 - 6 K 16/20) to the effect that the promotional gift must serve the ideal use of the main supply. The ECJ‘s criteria are likely to apply not only to promotional gifts in connection with supplies of goods, but also with supplies of services. The classification as ancillary supply can become problematic if the main supply is to be qualified as VAT-exempt. In this case, the input VAT deduction would also be excluded for the promotional gift.

In the event that the two criteria are not fulfilled and the gift is to be regarded as an independent supply, the question arises as to whether it is subject to VAT as a supply carried out free of charge pursuant to sec. 3 para. 1b no. 3 of the German VAT Act. In this context, it must be remembered that, according to the recent case law of the ECJ (see KMLZ VAT Newsletter 19 | 2021), a reduction of the German provisions, in accordance with EU law, must be made. If the procured goods and services are necessary for the taxable person and the costs (imputed) are included in the price of its rendered supplies, taxation of a supply carried out free of charge can now be omitted.

Contact:

Prof. Dr. Thomas Küffner

Lawyer, Certified tax consultant,

Certified public accountant

Phone: +49 89 217501230

As per: 18.10.2023