1 Background

In its letter of 14.11.2019, the Federal Ministry of Finance commented on sec. 2b para. 3 no. 2 of the German VAT Act. This regulation deals with the preferential VAT treatment of cooperation between two legal entities under public law. With effect as of 01.01.2017, the legislator created this regulation so that public bodies could, under certain conditions, cooperate in the new world of sec. 2b of the German VAT Act, in a VAT-privileged manner. The vast majority of public bodies have chosen the option laid down in sec. 27 para. 22 of the German VAT Act. They will apply the new sec. 2b regulations of the German VAT Act only after the expiry of the five-year transitional phase as from 01.01.2021. Now, shortly before this key date, the tax authorities are massively restricting the possibilities of beneficiary cooperation.

2 Withdrawal of the tax authorities

In accordance with the regulatory regime of sec. 2b para. 1 of the German VAT Act, legal entities under public law are not considered taxable persons if they act within the framework of the public authority and there is no threat of significant distortions of competition. Since the concept of the “significant distortion of competition” remains a mystery, the legislator included four examples in sec. 2b para. 2 and 3 of the German VAT Act, in which distortions of competition are excluded from the outset. The public body then operates as non-taxable person. At the relevant time, the national legislator had great difficulty with this version of sec. 2b para. 3 of the German VAT Act as the Union law in Art. 13 of the EU VAT Directive does not provide for any exceptions in the case of cooperation. Finally, the national legislator reached into his bag of tricks and pulled out the tool of procurement law. On the basis of the facts contained therein, the legislator then created the exception in accordance with sec. 2b para. 3 no. 2 of the German VAT Act for beneficiary cooperation. He saw this as a necessity, as most cooperation had already been exempted from taxation as so-called supplies of assistance services. It did not take long before German doubters started to express their concerns as regards Union law. This did not go unnoticed in Brussels, leading the European Commission to threaten infringement proceedings. In order to avert this possible outcome in a face-saving manner, it was apparently agreed that the new laboriously drafted regulation was to be so restrictively interpreted by means of a Federal Ministry of Finance letter that in fact no scope of application remained for sec. 2b para. 3 no. 2 of the German VAT Act.

3 The new interpretation of sec. 2b para. 3 no. 2 of the German VAT Act

Section 2b para. 3 no. 2 of the German VAT Act has now been degraded to an example. If the conditions are met, there is only a presumption that there are no significant distortions of competition. According to the requirements of the Federal Ministry of Finance, however, this is to be followed by a further verification: The prerequisites for a possible distortion of competition in sec. 2b para. 1 sentence 2 of the German VAT Act must be examined again. This could also have been shortened by deleting sec. 2b para. 3 no. 2 of the German VAT Act altogether. This would have been more honest and cleaner.

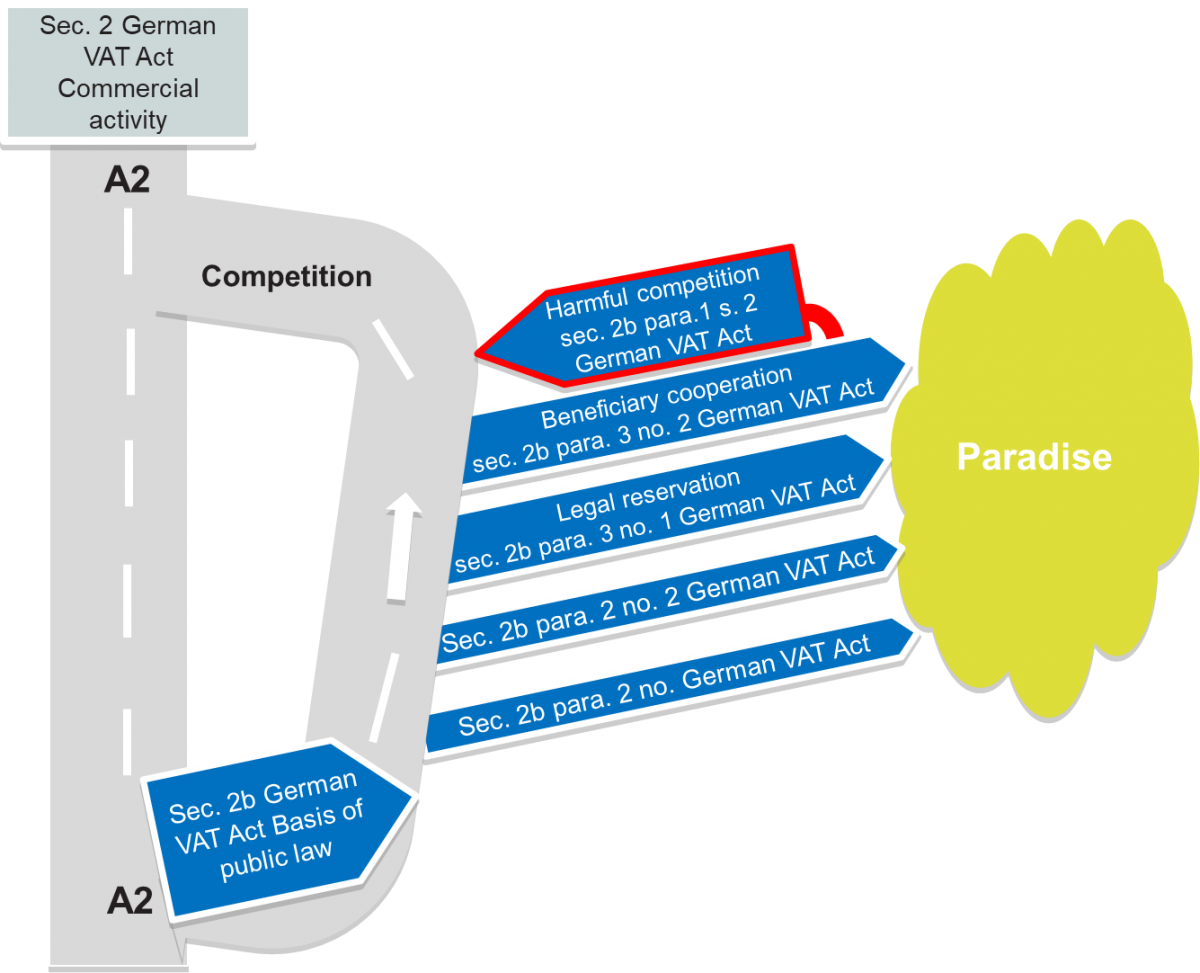

The new examination scheme is as follows: Every legal entity under public law will, in future, start on the A2 motorway (= sec. 2 "Normal" taxable person). The “exit to paradise” in sec. 2b of the German VAT Act can be taken where the remuneration is collected on a public law basis. However, the route there can only be taken via one of the four exits of the missing competition distortions. In the future, caution is required at the exit of sec. 2b para. 3 no. 2 of the German VAT Act. Here one can be suddenly rerouted back to the A2 - i.e. in cases where harmful competition exists.

4 Consequences for the practice

In practice, this means that, in the future, the VAT issue will be involved in cases of cooperation. The way via sec. 2b para. 3 no. 2 of the German VAT Act can only be taken when in possession of a binding ruling. The concept of competition is too diffuse to be able to make it into a tax paradise with legal certainty. In practice, public bodies are exposed to monstrous savings constraints. Citizens are right to expect that expensive double structures will be avoided. With the new Federal Ministry of Finance letter, cooperation will have to save an additional 19% VAT in the future. As a rule, this will not be possible.

What alternative possibilities are there? First of all, there is sec. 2b para. 3 no. 1 of the German VAT Act. However, this provision only applies if supplies are rendered that are reserved by law for legal entities under public law. Other possible approaches to a solution already begin with the exchange of goods and services by assuming a non-taxable expense pool. Finally, there is the new provision of sec. 4 no. 29 of the German VAT Act, which will apply as from 01.01.2020. However, even the new (tax-free) cost community will frequently not function in practice, as any tax exemption will also be abandoned there if distortions of competition threaten. Conclusion: Not much remains ...

Contact:

Prof. Dr. Thomas Küffner

Lawyer, Certified Tax Consultant,

Certified Public Accountant

Tel.: +49 89 217501230

As per: 21.11.2019