1 Italy taxes Facebook (Meta)

Italy has issued a VAT assessment of EUR 870 million against the social network Facebook. According to the Italian tax authorities, the VAT liability is based on a barter transaction between the company and its users. Even if users do not pay money for access to the Facebook platform, they do provide personal data. This data can be further exploited by the company and thus form the basis for the online company’s billions in turnover. The Italian VAT liability is based on an evaluation of the user data collected by Facebook.

2 Background

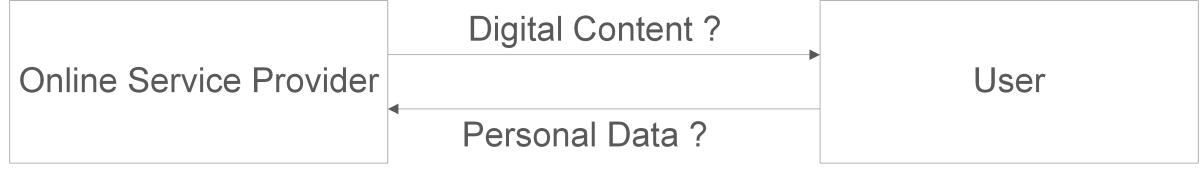

In principle, only supplies rendered for consideration are subject to VAT. However, in order to constitute a taxable supply within the meaning of VAT law, the consideration does not necessarily have to be provided in monetary form. A barter transaction, in which the parties provide supplies to each other, is sufficient. In recent decades, digital offers have developed for which the user is not required to contribute monetary consideration. If the user himself provides a supply, it must be examined whether a taxable barter transaction exists. A supply provided by the user can be seen in the consent to the use of data by the company. If both supplies are directly related to each other and the exchange is based on a legal relationship, VAT may apply.

3 Online business models to be examined

The Facebook platform is available to its members free of charge. However, in order to create and use a Facebook account, members must consent to the collection of personal data. This data may then be further exploited by the company. In this model, the Italian tax authorities have determined the existence of a barter transaction. Other providers of "free" platforms face the same fate. It is questionable whether a distinction must (and can) be made between members who actively use their accounts and fill them with data and those who are more passive and only consume content. And what about members who do not (or no longer) use the platform at all, but have consented to cookies and other tracking tools being installed on their end devices by the platform so that it can collect data from members? If the consent to data collection is sufficient, the question arises whether websites that can currently still be consumed free of charge, but where users must actively decide whether they want to receive advertising and disclose personal information via tracking measures, also generate barter transactions. Alternatively, the users can choose a paid subscription. Other companies rely, for example, on donations from users. All of these online offers are therefore either based on monetary consideration (which is usually undoubtedly subject to VAT) or a more or less clearly ask request of users to provide personal data. A large part of these developments may be the result of increasingly strict data and consumer protection laws. However, this makes it more obvious that personal data is being provided, and sooner or later there will probably be a debate about whether this is an exchange of supplies within the meaning of VAT law.

4 Questions to be clarified

Whether "free" online services are actually subject to VAT must be examined in each individual case. Various questions arise in this context:

- Do users actually provide services themselves? If so, are these to be regarded as independent or are these only ancillary and support the optimal use of the provided online services?

- Are the company’s supplies and those provided by the users directly related to one another? Is the exchange of supplies based on a legal relationship?

- Does the online company still provide a B2C service? Or do the private users themselves become taxable persons subject to VAT and thus establish a B2B relationship? And to what extent do users, who are already taxable persons for other reasons, provide services as part of their taxable activities?

- What is the taxable amount for the potential supply? What components must be included in the tax base? Does the quality of the data or perhaps even its actual exploitation for the internal or external purposes of the online service provider play a role? Can alternative subscription models be used as a reference for determining the tax base?

5 Recommendations for the practice

Taxation of Facebook (Meta) is just one current example of how online services are increasingly coming under the scrutiny of tax authorities. The taxation of other online platforms and influencers has recently also been gaining more and more attention. Companies offering online services should therefore monitor these developments and check whether their business models are subject to VAT, even if the digital content is made available to users "free of charge". Furthermore, VAT should not be ignored when setting up new business models. By designing the online services accordingly, later doubts about the correct VAT treatment can be avoided.

Contact:

Ronny Langer

Certified Tax Consultant, Dipl.-Finanzwirt (FH)

Phone: +49 89 217501250

ronny.langer@kmlz.de

As per: 17.03.2023