1 Background

In order to determine the entitlement to deduct input VAT from supplies procured, a taxable person must first attempt to directly and immediately link each input transaction to a particular output transaction. If this direct allocation is possible, the taxable person is permitted to deduct the input VAT, in full, if the supply can be directly allocated to a taxable output transaction. If a direct allocation is possible but only to a VAT exempt output transaction, then no deduction is permitted. If such a direct allocation to an individual output transaction is not possible, the taxable person can still (partially) deduct input VAT if a direct and immediate link exists between the costs incurred and the overall taxable activity.

In the case of this allocation to the overall activity, it must be determined to what extent, the supplies procured are attributable to output transactions that are or are not eligible for input VAT deduction. Sec. 15 para. 4 sentence 2 and 3 of the German VAT Act (UStG) state that, when determining the necessary deductible proportion of input VAT, the taxable person may calculate it by way of an appropriate estimate and that the total turnover-based allocation key is subordinate to other keys. Following the Federal Ministry of Finance’s (BMF) most recent comments on the input VAT apportionment for immovable property in this context, made in 2022 (KMLZ VAT Newsletter 42 | 2022), the focus has now turned to the so-called total turnover-based allocation key and its relationship to other allocation keys.

2 Content of the BMF’s letter dated 13 February 2024

According to the BMF, any other allocation key is to be given priority if it provides more precise results than the total turnover-based allocation key. Allocation keys based on turnovers that only include part of the supplies (eg those of individual departments) also take precedence. As before, it is up to the taxable person to choose which of the various, more precise methods, to use. This need not be the most precise method. Only when the taxable person does not choose a more precise method, may the tax authorities apply an appropriate and more precise allocation key than the total turnover-based allocation key. As previously, the BMF basically considers the area-based allocation key for buildings to be an apportionment method that takes precedence over the property-related allocation key and, to this end, it has included the corresponding Federal Fiscal Court judgment in the German Administrative VAT Guidelines.

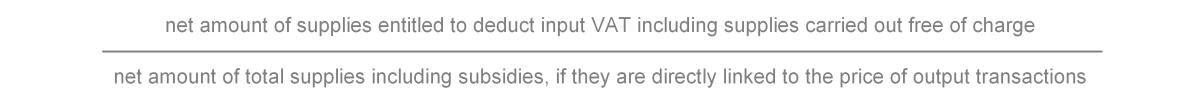

When applying the total turnover-based allocation key, a fraction is to be formed as follows in accordance with sec. 15.17 para. 3a of the German Administrative VAT Guidelines:

Special supplies that would distort the result (eg certain auxiliary transactions, transfer of going concern, investment income, sales of capital goods) are not to be included in either the numerator or the denominator. Supplies to be added must be included with their taxable amount and, in cases of taxation under sec. 25 (Tour Operator Margin Scheme) or sec. 25a (margin taxation) UStG, with the consideration received at the time VAT is incurred. The input VAT allocation key from the previous year can be used in the periodical VAT returns. A correction must then be made in the annual VAT return.

When calculating the rate, rounding to the second decimal place is generally required. Rounding up to the full percentage is only possible when using the total turnover-based allocation key. With this new regulation, the BMF is seen to be implementing a corresponding ECJ judgment from 2016 (C-186/15 - Kreissparkasse Wiedenbrück).

With regard to the adjustment of the input VAT deduction (sec. 15a UStG), the BMF clarifies that if a total or partial turnover-based allocation key is applied, a review is regularly required in subsequent years.

3 Consequences for the practice

Essentially, in its current letter, the BMF clarifies, in various places in the German Administrative VAT Guidelines, the requirements for input VAT apportionment in the case of mixed use. This does not result in any significant changes.

It is important to note that the BMF also maintains that it is primarily up to the taxable person to decide which one of the different appropriate input VAT allocation keys he uses. However, the key used is not required to be the most precise key. Only if the taxable person does not make an appropriate allocation, or only does so according to the total turnover-based allocation key, can the tax office apply what it considers to be an (appropriate) input VAT allocation key. In this respect, the new regulation in the German Administrative VAT Guidelines goes slightly beyond the BMF’s previous explicit statements. The BMF now also differentiates between a total turnover-based allocation key and other turnover-based allocation keys. If neither party can find a “more” appropriate method, the total turnover-based allocation key will be used. It is therefore important for every taxable person to think in advance about how they want to allocate input VAT. Those affected should make appropriate bookings during the year and collect the data required for the allocation. In practice, it has been shown that subsequent apportionment, according to a key other than a turnover-based allocation key, is rarely possible.

The German Administrative VAT Guidelines have not yet implemented the jurisprudence on rounding up the input VAT rate in cases where a total turnover-based allocation key is used. In contrast, rounding up in other cases will no longer be possible. In this respect, the current BMF letter is in line with the Federal Fiscal Court’s jurisprudence.