1. Facts (Decision of 15 December 2016 –V R 14/16)

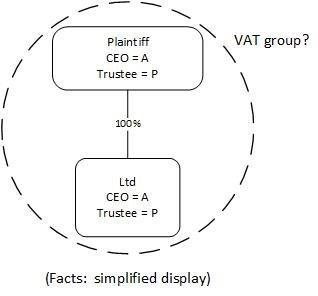

The Plaintiff was a limited company, which held 100% ownership of six companies, some directly and others through a subsidiary. A was one of the Plaintiff’s managing directors and also managing director of the six subsidiary companies. The Plaintiff and the tax office unanimously agreed that the conditions for the existence of a VAT group, between the Plaintiff and the six companies, had been met.

The District Court subsequently instituted insolvency proceedings against the Plaintiff and its subsidiaries. At the request of the Plaintiff, debtor-in-possession management, in accordance with sec. 270 para. 1 German Insolvency Code (GIC) was ordered. The right of administration and disposal remained with the respective debtor. A single trustee was appointed (P). The tax office assumed the continued existence of the VAT group after the opening of insolvency proceedings. It also imposed VAT on the Plaintiff for supplies made by the subsidiaries. Therefore, it accordingly set the VAT assessments of the subsidiaries at EUR 0.

2. Decision by the Federal Fiscal Court

In contrast to the tax office, the Federal Fiscal Court assumed that the opening of the insolvency proceedings at the controlling company resulted in the termination of the VAT group. The Court cited a systematic distinction between VAT and insolvency law. From a VAT perspective, the members of a VAT-group are a single company. The insolvency law, however, does not combine the insolvency proceedings of several affiliates. According to insolvency law, companies affiliated with the group are not held jointly liable, as they are not considered by insolvency law to form a group. Only VAT claims from sales activities of the controlling company, which arise after insolvency proceedings have commenced, are debts incumbent on the estate. However, this is not the case when VAT claims arising from sales activities of the controlled companyoccur after insolvency proceedings have commenced. The tax office would not be entitled to impose the VAT of the controlled companies as debts incumbent on the estateof the controlling company. Since the order of debtor-in-possession managementdoes not change anything in the separation of the insolvency proceedings of any of the affiliated companies, there is no further assessment.

In addition, the insolvency of the subsidiary companiesalso terminates the VAT-group. This follows in the case of the appointment of an insolvency administrator under sec. 80 para. 1 GIC. Where debtor-in-possession managementis ordered, the financial integration ends due to sec. 276a sentence 1 GIC. Accordingly, the supervisory board, the general meeting or the corresponding executive bodies of the VAT group no longer have any managerial influence. The result is the same irrespective of whether the trustee of the controlling and controlled company is the same. This results due to the insolvencyproceedings separationas well as the applicable sec. 276a sentence. 1 GIC.

3. Practical consequences

To date, the fiscal authorities (and some of the literature) have assumed that the VAT group continues to exist in the event of the insolvency of the controlling company (see Upper Tax Authority Frankfurt/Main of 25 November 2015). The Court opposes this view. The opening of insolvency proceedings at the controlling company serves to terminate the VAT group, irrespective of whether a case of self or third-party administration exists. If the fiscal authorities have already issued VAT as debts incumbent on the estate, which results from supplies of the alleged controlled company, the insolvency administrator may reclaim VAT (possibly including interest), if this is still possible under procedural law. The fact that the VAT group also terminates in the event of the insolvency of the controlled company corresponds, at least in the case of the third-party administration of the Federal Fiscal Court’s case law, to the former Bankruptcy Act. When a temporary insolvency administrator is appointed, the VAT group is terminated. It has not yet been clarified by a high-court decision how this issue will be treated in the case of temporary debtor-in-possession management.

Contrary to the decision of the Upper Tax Authority Frankfurt/Main, the VAT group is also terminated with the appointment of the same insolvency administrator for both the controlling and controlled company. The Federal Fiscal Court only had to decide on this in terms of an identical trustee, however, it also mentioned, in passing, the case of an identical insolvency administrator.

The termination of the VAT group means that the controlled company has to exercise all VAT duties on its own, even though no insolvency proceedings were opened regarding its assets. It should be noted that, despite the insolvency of one or both companies, persisting service relationships are basically taxable supplies.

Contact:

Dr. Michael Rust

Lawyer

Phone: +49 89 217501274

michael.rust@kmlz.de

As per: 16.05.2017